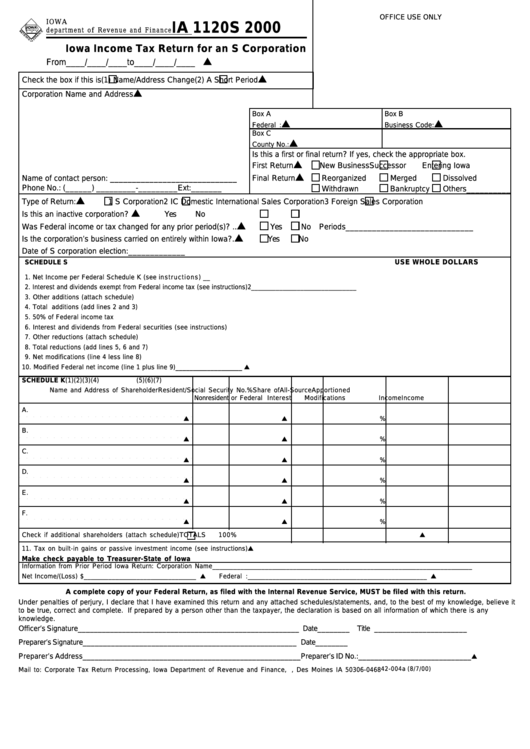

Form Ia 1120s - Iowa Income Tax Return For An S Corporation - 2000

ADVERTISEMENT

OFFICE USE ONLY

IOWA

IA 1120S 2000

d e p a r t m e n t o f R e ve n u e a n d F i n a n c e

Iowa Income Tax Return for an S Corporation

s

From____/____/____to____/____/____

s

Check the box if this is

(1) Name/Address Change

(2) A Short Period

s

Corporation Name and Address

Box A

Box B

s

s

Federal T.I.N.:

Business Code:

Box C

s

County No.:

Is this a first or final return? If yes, check the appropriate box.

s

First Return

New Business

Successor

Entering Iowa

s

Final Return

Reorganized

Merged

Dissolved

Name of contact person: _____________________________

Phone No.: ( ______ ) _________ - _________ Ext: _______

Withdrawn

Bankruptcy

Others__________

s

Type of Return:

1 S Corporation

2 IC Domestic International Sales Corporation

3 Foreign Sales Corporation

s

Is this an inactive corporation? .................................................

Yes

No

s

Was Federal income or tax changed for any prior period(s)? ..

Yes

No Periods_____________________________

s

Is the corporation’s business carried on entirely within Iowa? .

Yes

No

Date of S corporation election: _____________

USE WHOLE DOLLARS

SCHEDULE S

1. Net Income per Fe deral Schedule K (see i nstru c t ions) ..................................................................................................... 1 ___________________________

2. Interest and dividends exempt from Federal income tax (see instructions) 2 ______________________________

3. Other additions (attach schedule) ............................................................... 3 ______________________________

4. Total additions (add lines 2 and 3) .......................................................................................................................................... 4 ___________________________

5. 50% of Federal income tax .......................................................................... 5 ______________________________

6. Interest and dividends from F eder al securities (see instructions) ........... 6 ______________________________

7. Other reductions (attach schedule) ............................................................. 7 ______________________________

8. Total reductions (add lines 5, 6 and 7) ..................................................................................................................................... 8 ___________________________

9. Net modifications (line 4 less line 8) ........................................................................................................................................ 9 ___________________________

10. Modified Federal net income (line 1 plus line 9) ..................................................................................................................... 10 ___________________________ s

SCHEDULE K

(1)

(2)

(3)

(4)

(5)

(6)

(7)

Name and Address of Shareholder

Resident/ Social Security No.

%

Share of

All-Source

Apportioned

Nonresident or Federal I.D. No. Interest

Modifications

Income

Income

A.

s

s

s

%

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

B.

s

s

s

%

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

C.

s

s

s

%

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

D.

s

s

s

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

%

E.

s

s

s

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

%

F.

s

s

s

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

%

s

Check if additional shareholders (attach schedule)

TOTALS

100%

11. Tax on built-in gains or passive investment income (see instructions) ............................................................................. 11 ___________________________ s

Make check payable to Treasurer-State of Iowa

Information from Prior Period Iowa Return: Corporation Name __________________________________________________________________________

Net Income/(Loss) $ ________________________________ s

Federal T.I.N.: ___________________________________________________ s

A complete copy of your Federal Return, as filed with the Internal Revenue Service, MUST be filed with this return.

Under penalties of perjury, I declare that I have examined this return and any attached schedules/statements, and, to the best of my knowledge, believe it

to be true, correct and complete. If prepared by a person other than the taxpayer, the declaration is based on all information of which there is any

knowledge.

Officer’s Signature _______________________________________________________

Date ________ Title _______________________

Preparer’s Signature _____________________________________________________

Date ________

s

Preparer’s Address ______________________________________________________ Preparer’s ID No.: ____________________________

42-004a (8/7/00)

Mail to: Corporate Tax Return Processing, Iowa Department of Revenue and Finance, P.O. Box 10468, Des Moines IA 50306-0468

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1