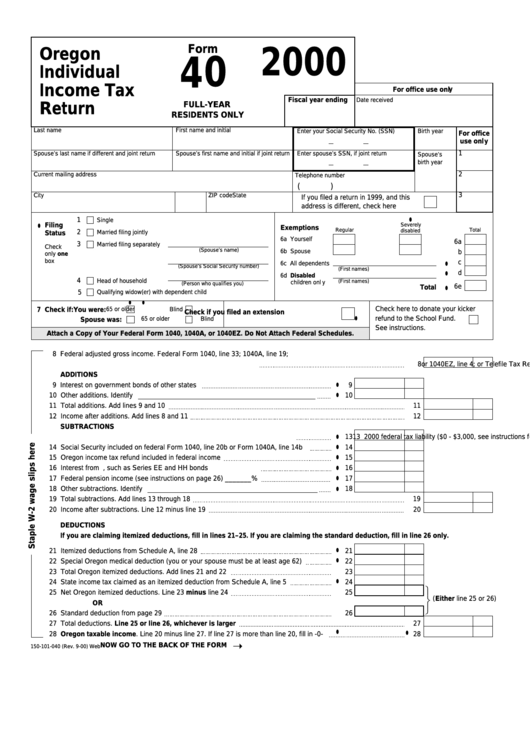

Form 40 - Oregon Individual Income Tax Return - 2000

ADVERTISEMENT

Form

Oregon

2000

4

0

Individual

Income Tax

For office use only

Fiscal year ending

Date received

FULL-YEAR

Return

RESIDENTS ONLY

Last name

First name and initial

Enter your Social Security No. (SSN)

Birth year

For office

use only

1

Spouse’s last name if different and joint return

Spouse’s first name and initial if joint return

Enter spouse’s SSN, if joint return

Spouse’s

birth year

2

Current mailing address

Telephone number

(

)

3

City

State

ZIP code

If you filed a return in 1999, and this

address is different, check here

•

1

Single

•

Filing

Severely

Exemptions

Regular

Total

disabled

2

Status

Married filing jointly

6a Yourself

6a

3

Married filing separately

Check

(Spouse’s name)

6b Spouse

b

only one

box

c

•

6c All dependents

(Spouse’s Social Security number)

(First names)

•

d

6d Disabled

4

Head of household

(First names)

children only

(Person who qualifies you)

6e

•

Total

Qualifying widow(er) with dependent child

5

•

•

Check here to donate your kicker

65 or older

Blind

7 Check if: You were:

Check if you filed an extension

•

refund to the School Fund.

65 or older

Blind

Spouse was:

See instructions.

Attach a Copy of Your Federal Form 1040, 1040A, or 1040EZ. Do Not Attach Federal Schedules.

8 Federal adjusted gross income. Federal Form 1040, line 33; 1040A, line 19;

or 1040EZ, line 4; or Telefile Tax Record, line I. See instructions

8

ADDITIONS

•

9 Interest on government bonds of other states

9

•

10 Other additions. Identify

10

11 Total additions. Add lines 9 and 10

11

12 Income after additions. Add lines 8 and 11

12

SUBTRACTIONS

•

13 2000 federal tax liability ($0 - $3,000, see instructions for the correct amount)

13

•

14 Social Security included on federal Form 1040, line 20b or Form 1040A, line 14b

14

•

15 Oregon income tax refund included in federal income

15

•

16 Interest from U.S. government, such as Series EE and HH bonds

16

•

17 Federal pension income (see instructions on page 26) _______%

17

•

18 Other subtractions. Identify

18

19 Total subtractions. Add lines 13 through 18

19

20 Income after subtractions. Line 12 minus line 19

20

DEDUCTIONS

If you are claiming itemized deductions, fill in lines 21–25. If you are claiming the standard deduction, fill in line 26 only.

•

21 Itemized deductions from Schedule A, line 28

21

•

22 Special Oregon medical deduction (you or your spouse must be at least age 62)

22

23 Total Oregon itemized deductions. Add lines 21 and 22

23

•

24 State income tax claimed as an itemized deduction from Schedule A, line 5

24

25 Net Oregon itemized deductions. Line 23 minus line 24

25

(Either line 25 or 26)

OR

26 Standard deduction from page 29

26

27 Total deductions. Line 25 or line 26, whichever is larger

27

•

•

28 Oregon taxable income. Line 20 minus line 27. If line 27 is more than line 20, fill in -0-

28

NOW GO TO THE BACK OF THE FORM

150-101-040 (Rev. 9-00) Web

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2