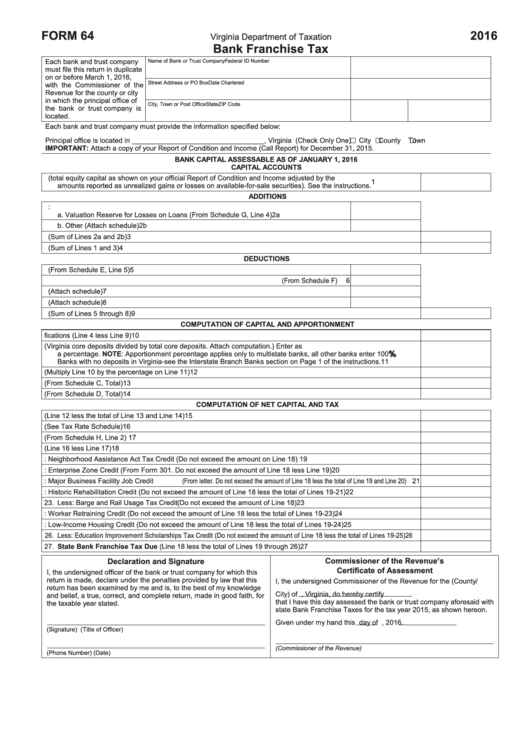

FORM 64

2016

Virginia Department of Taxation

Bank Franchise Tax

Each bank and trust company

Name of Bank or Trust Company

Federal ID Number

must file this return in duplicate

on or before March 1, 2016,

Street Address or PO Box

Date Chartered

with the Commissioner of the

Revenue for the county or city

in which the principal office of

City, Town or Post Office

State

ZIP Code

the bank or trust company is

located.

Each bank and trust company must provide the information specified below:

Principal office is located in __________________________________, Virginia (Check Only One)

City

County

Town

IMPORTANT: Attach a copy of your Report of Condition and Income (Call Report) for December 31, 2015.

BANK CAPITAl ASSESSABlE AS OF JANuARY 1, 2016

CAPITAl ACCOuNTS

1. Equity Capital (total equity capital as shown on your official Report of Condition and Income adjusted by the

1

amounts reported as unrealized gains or losses on available-for-sale securities). See the instructions.

ADDITIONS

2. Unallowable Portions of Valuation Reserves:

a. Valuation Reserve for Losses on Loans (From Schedule G, Line 4)

2a

b. Other (Attach schedule)

2b

3. Total Additions (Sum of Lines 2a and 2b)

3

4. Total (Sum of Lines 1 and 3)

4

DEDuCTIONS

5. Pro-rata Share of United States Obligations (From Schedule E, Line 5)

5

6. Retained Earnings and Surplus of Subsidiaries Included in Gross Capital (From Schedule F)

6

7. Deduction for Goodwill (Attach schedule)

7

8. Other (Attach schedule)

8

9. Total Deductions Before Apportionment (Sum of Lines 5 through 8)

9

COMPuTATION OF CAPITAl AND APPORTIONMENT

10. Capital Before Virginia Modifications (Line 4 less Line 9)

10

11. Apportionment Percentage (Virginia core deposits divided by total core deposits. Attach computation.) Enter as

%

a percentage. NOTE: Apportionment percentage applies only to multistate banks, all other banks enter 100%.

Banks with no deposits in Virginia-see the Interstate Branch Banks section on Page 1 of the instructions.

11

12. Capital Attributable to Virginia (Multiply Line 10 by the percentage on Line 11)

12

13. Virginia Real Estate Taxed by Virginia Locality (From Schedule C, Total)

13

14. Tangible Personal Property Otherwise Taxed by Virginia Localites (From Schedule D, Total)

14

COMPuTATION OF NET CAPITAl AND TAX

15. Net Taxable Capital (Line 12 less the total of Line 13 and Line 14)

15

16. Total Franchise Tax (See Tax Rate Schedule)

16

17. Credit for Bank Franchise Tax Due to Localities (From Schedule H, Line 2)

17

18. Tentative State Bank Franchise Tax Due (Line 16 less Line 17)

18

19. Less: Neighborhood Assistance Act Tax Credit (Do not exceed the amount on Line 18)

19

20. Less: Enterprise Zone Credit (From Form 301. Do not exceed the amount of Line 18 less Line 19)

20

21. Less: Major Business Facility Job Credit (From letter. Do not exceed the amount of Line 18 less the total of Line 19 and Line 20)

21

22. Less: Historic Rehabilitation Credit (Do not exceed the amount of Line 18 less the total of Lines 19-21)

22

23. Less: Barge and Rail Usage Tax Credit (Do not exceed the amount of Line 18)

23

24. Less: Worker Retraining Credit (Do not exceed the amount of Line 18 less the total of Lines 19-23)

24

25. Less: Low-Income Housing Credit (Do not exceed the amount of Line 18 less the total of Lines 19-24)

25

2 6. Less: Education Improvement Scholarships Tax Credit (Do not exceed the amount of Line 18 less the total of Lines 19-25)

2 6

27. State Bank Franchise Tax Due (Line 18 less the total of Lines 19 through 26)

27

Commissioner of the Revenue’s

Declaration and Signature

Certificate of Assessment

I, the undersigned officer of the bank or trust company for which this

return is made, declare under the penalties provided by law that this

I, the undersigned Commissioner of the Revenue for the (County/

return has been examined by me and is, to the best of my knowledge

City) of

, Virginia, do hereby certify

and belief, a true, correct, and complete return, made in good faith, for

that I have this day assessed the bank or trust company aforesaid with

the taxable year stated.

state Bank Franchise Taxes for the tax year 2015, as shown hereon.

Given under my hand this

day of

, 2016.

(Signature)

(Title of Officer)

(Commissioner of the Revenue)

(Phone Number)

(Date)

1

1