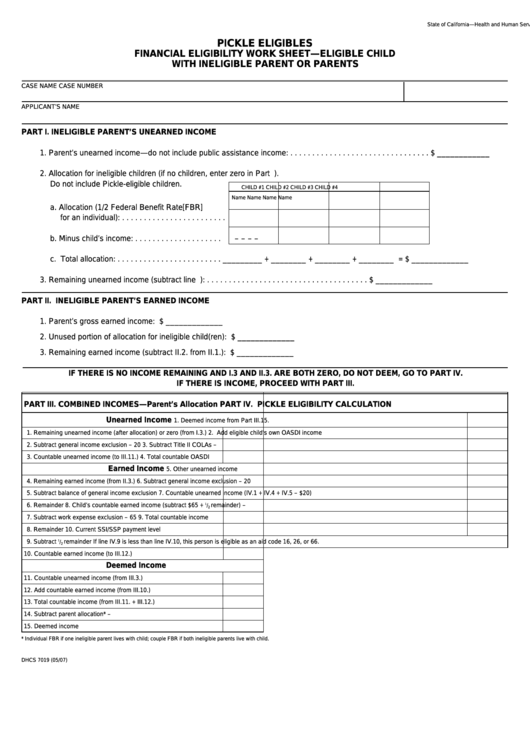

Form Dhcs 7019 - Pickle Eligibles Financial Eligibility Work Sheet Eligible Child With Ineligible Parent Or Parents - Health And Human Services Agency

ADVERTISEMENT

State of California—Health and Human Services Agency

Department of Health Care Services

PICKLE ELIGIBLES

FINANCIAL ELIGIBILITY WORK SHEET—ELIGIBLE CHILD

WITH INELIGIBLE PARENT OR PARENTS

CASE NAME

CASE NUMBER

APPLICANT’S NAME

PART I. INELIGIBLE PARENT’S UNEARNED INCOME

1. Parent’s unearned income—do not include public assistance income: . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ ____________

2. Allocation for ineligible children (if no children, enter zero in Part I.2.c.).

Do not include Pickle-eligible children.

CHILD #1

CHILD #2

CHILD #3

CHILD #4

Name

Name

Name

Name

a. Allocation (1/2 Federal Benefit Rate[FBR]

for an individual): . . . . . . . . . . . . . . . . . . . . . . . .

b. Minus child’s income: . . . . . . . . . . . . . . . . . . . .

–

–

–

–

c. Total allocation: . . . . . . . . . . . . . . . . . . . . . . . .

_________

+ ________

+ ________

+ ________ = $ _____________

3. Remaining unearned income (subtract line I.2.c. from line I.1.): . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ _____________

PART II. INELIGIBLE PARENT’S EARNED INCOME

1. Parent’s gross earned income: ............................................................................................................................... $ _____________

2. Unused portion of allocation for ineligible child(ren): .............................................................................................. $ _____________

3. Remaining earned income (subtract II.2. from II.1.): .............................................................................................. $ _____________

IF THERE IS NO INCOME REMAINING AND I.3 AND II.3. ARE BOTH ZERO, DO NOT DEEM, GO TO PART IV.

IF THERE IS INCOME, PROCEED WITH PART III.

PART III. COMBINED INCOMES—Parent’s Allocation

PART IV. PICKLE ELIGIBILITY CALCULATION

Unearned Income

1. Deemed income from Part III.15.

1. Remaining unearned income (after allocation) or zero (from I.3.)

2. Add eligible child’s own OASDI income

2. Subtract general income exclusion

–

20

3. Subtract Title II COLAs

–

3. Countable unearned income (to III.11.)

4. Total countable OASDI

Earned Income

5. Other unearned income

4. Remaining earned income (from II.3.)

6. Subtract general income exclusion

–

20

5. Subtract balance of general income exclusion

7. Countable unearned income (IV.1 + IV.4 + IV.5 – $20)

6. Remainder

8. Child’s countable earned income (subtract $65 +

remainder)

–

1

/

2

7. Subtract work expense exclusion

–

65

9. Total countable income

8. Remainder

10. Current SSI/SSP payment level

9. Subtract

1

remainder

If line IV.9 is less than line IV.10, this person is eligible as an aid code 16, 26, or 66.

/

2

10. Countable earned income (to III.12.)

Deemed Income

11. Countable unearned income (from III.3.)

12. Add countable earned income (from III.10.)

13. Total countable income (from III.11. + III.12.)

14. Subtract parent allocation*

–

15. Deemed income

* Individual FBR if one ineligible parent lives with child; couple FBR if both ineligible parents live with child.

DHCS 7019 (05/07)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1