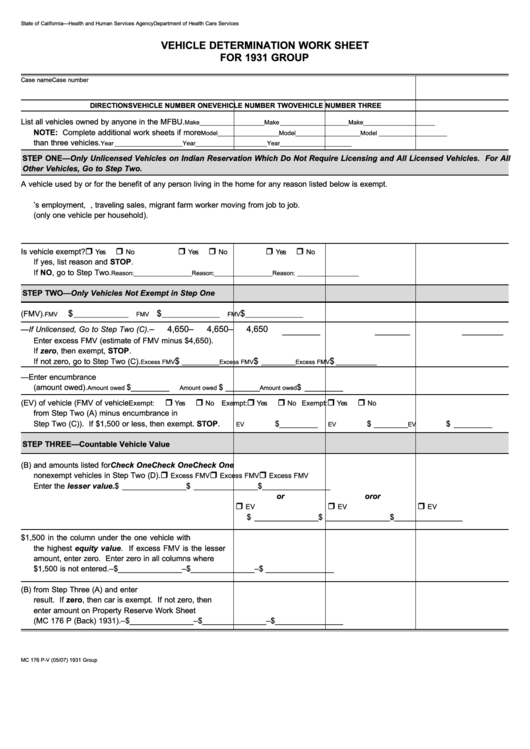

State of California—Health and Human Services Agency

Department of Health Care Services

VEHICLE DETERMINATION WORK SHEET

FOR 1931 GROUP

Case name

Case number

DIRECTIONS

VEHICLE NUMBER ONE

VEHICLE NUMBER TWO

VEHICLE NUMBER THREE

List all vehicles owned by anyone in the MFBU.

Make ___________________

Make ____________________

Make_____________________

NOTE: Complete additional work sheets if more

Model __________________

Model ___________________

Model ____________________

than three vehicles.

Year ____________________

Year_____________________

Year _____________________

STEP ONE—Only Unlicensed Vehicles on Indian Reservation Which Do Not Require Licensing and All Licensed Vehicles. For All

Other Vehicles, Go to Step Two.

A vehicle used by or for the benefit of any person living in the home for any reason listed below is exempt.

1. On the job or for income producing purposes even if only on a seasonal basis or temporarily unemployed.

2. Long distance travel essential to individual’s employment, e.g., traveling sales, migrant farm worker moving from job to job.

3. Home (only one vehicle per household).

4. Transportation of incapacitated or disabled individual living in the home.

5. Transportation of primary fuel/water for the home.

Is vehicle exempt?

Yes

No

Yes

No

Yes

No

If yes, list reason and STOP.

If NO, go to Step Two.

Reason: _________________

Reason: _________________

Reason: __________________

STEP TWO—Only Vehicles Not Exempt in Step One

$

$

$

A. Enter estimate of Fair Market Value (FMV).

FMV

________________

FMV

_________________

FMV

_________________

–

4,650

–

4,650

–

4,650

B. Licensed Only—If Unlicensed, Go to Step Two (C).

___________

_________

____________

Enter excess FMV (estimate of FMV minus $4,650).

If zero, then exempt, STOP.

$

$

$

If not zero, go to Step Two (C).

Excess FMV

___________

Excess FMV

__________

Excess FMV

____________

C. All Remaining Vehicles—Enter encumbrance

(amount owed).

$ _________

$ ________

$ _________

Amount owed

Amount owed

Amount owed

D. Determine equity value (EV) of vehicle (FMV of vehicle

Exempt:

Yes

No

Exempt:

Yes

No Exempt:

Yes

No

from Step Two (A) minus encumbrance in

Step Two (C)). If $1,500 or less, then exempt. STOP.

$ _________

$ ________

$ _________

EV

EV

EV

STEP THREE—Countable Vehicle Value

A. Compare Step Two (B) and amounts listed for

Check One

Check One

Check One

nonexempt vehicles in Step Two (D).

Excess FMV

Excess FMV

Excess FMV

Enter the lesser value.

$ _______________

$ _______________

$ ________________

or

or

or

EV

EV

EV

$ _______________

$ _______________

$ ________________

B. Enter $1,500 in the column under the one vehicle with

the highest equity value. If excess FMV is the lesser

amount, enter zero. Enter zero in all columns where

$1,500 is not entered.

– $ _______________

– $ _______________

– $ ________________

C. Subtract Step Three (B) from Step Three (A) and enter

result. If zero, then car is exempt. If not zero, then

enter amount on Property Reserve Work Sheet

(MC 176 P (Back) 1931).

– $ _______________

– $ _______________

– $ ________________

MC 176 P-V (05/07) 1931 Group

1

1