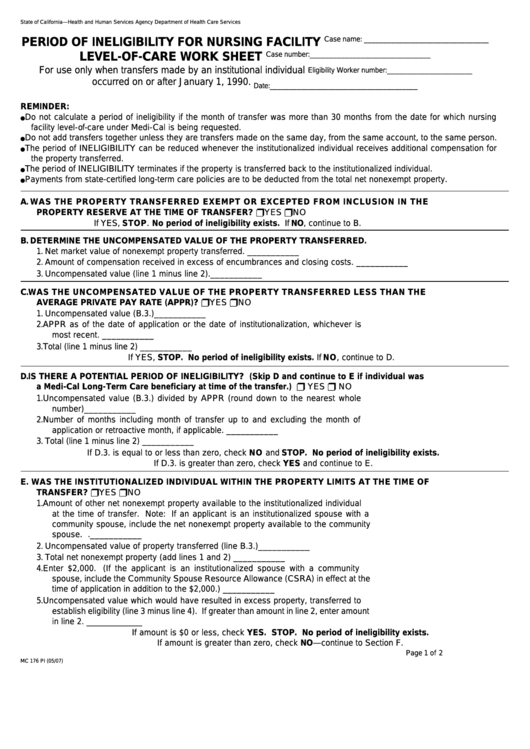

State of California—Health and Human Services Agency

Department of Health Care Services

Case name: ________________________________

PERIOD OF INELIGIBILITY FOR NURSING FACILITY

LEVEL-OF-CARE WORK SHEET

Case number:_______________________________

For use only when transfers made by an institutional individual

Eligibility Worker number:______________________

occurred on or after January 1, 1990.

Date: ______________________________________

REMINDER:

Do not calculate a period of ineligibility if the month of transfer was more than 30 months from the date for which nursing

●

facility level-of-care under Medi-Cal is being requested.

Do not add transfers together unless they are transfers made on the same day, from the same account, to the same person.

●

The period of INELIGIBILITY can be reduced whenever the institutionalized individual receives additional compensation for

●

the property transferred.

The period of INELIGIBILITY terminates if the property is transferred back to the institutionalized individual.

●

Payments from state-certified long-term care policies are to be deducted from the total net nonexempt property.

●

A. WAS THE PROPERTY TRANSFERRED EXEMPT OR EXCEPTED FROM INCLUSION IN THE

PROPERTY RESERVE AT THE TIME OF TRANSFER? ........................................................................... ❒ YES

❒ NO

If YES, STOP. No period of ineligibility exists. If NO, continue to B.

B. DETERMINE THE UNCOMPENSATED VALUE OF THE PROPERTY TRANSFERRED. ........................

1. Net market value of nonexempt property transferred. .................................................

___________

2. Amount of compensation received in excess of encumbrances and closing costs.

___________

3. Uncompensated value (line 1 minus line 2).................................................................

___________

C. WAS THE UNCOMPENSATED VALUE OF THE PROPERTY TRANSFERRED LESS THAN THE

AVERAGE PRIVATE PAY RATE (APPR)? ................................................................................................. ❒ YES

❒ NO

1. Uncompensated value (B.3.)........................................................................................

___________

2. APPR as of the date of application or the date of institutionalization, whichever is

most recent. .................................................................................................................

___________

3. Total (line 1 minus line 2) .............................................................................................

___________

If YES, STOP. No period of ineligibility exists. If NO, continue to D.

D. IS THERE A POTENTIAL PERIOD OF INELIGIBILITY? (Skip D and continue to E if individual was

a Medi-Cal Long-Term Care beneficiary at time of the transfer.) ......................................................... ❒ YES

❒ NO

1. Uncompensated value (B.3.) divided by APPR (round down to the nearest whole

number)........................................................................................................................

___________

2. Number of months including month of transfer up to and excluding the month of

application or retroactive month, if applicable. .............................................................

___________

3. Total (line 1 minus line 2) .............................................................................................

___________

If D.3. is equal to or less than zero, check NO and STOP. No period of ineligibility exists.

If D.3. is greater than zero, check YES and continue to E.

E. WAS THE INSTITUTIONALIZED INDIVIDUAL WITHIN THE PROPERTY LIMITS AT THE TIME OF

TRANSFER? ............................................................................................................................................... ❒ YES

❒ NO

1. Amount of other net nonexempt property available to the institutionalized individual

at the time of transfer. Note: If an applicant is an institutionalized spouse with a

community spouse, include the net nonexempt property available to the community

spouse. .......................................................................................................................

___________

2. Uncompensated value of property transferred (line B.3.)............................................

___________

3. Total net nonexempt property (add lines 1 and 2) .......................................................

___________

4. Enter $2,000. (If the applicant is an institutionalized spouse with a community

spouse, include the Community Spouse Resource Allowance (CSRA) in effect at the

time of application in addition to the $2,000.) ..............................................................

___________

5. Uncompensated value which would have resulted in excess property, transferred to

establish eligibility (line 3 minus line 4). If greater than amount in line 2, enter amount

in line 2. ...................................................................................................................... _____________

If amount is $0 or less, check YES. STOP. No period of ineligibility exists.

If amount is greater than zero, check NO—continue to Section F.

Page 1 of 2

MC 176 PI (05/07)

1

1 2

2