Form Mc 176 P - Property Reserve Work Sheet

ADVERTISEMENT

State of California—Health and Human Services Agency

Department of Health Care Services

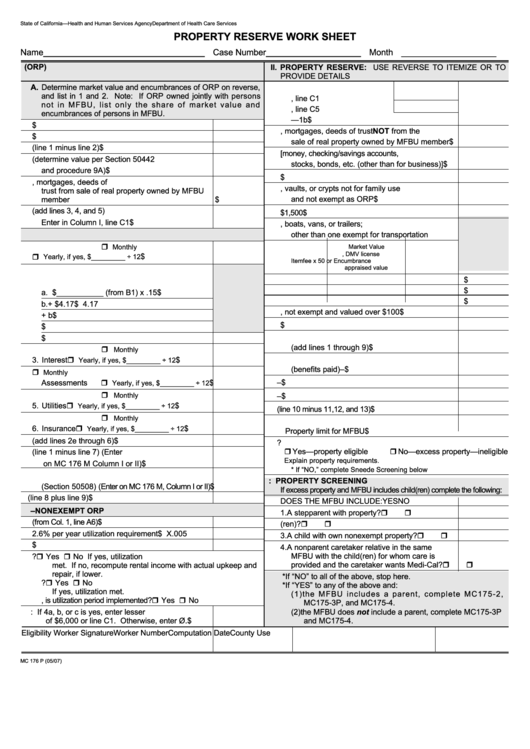

PROPERTY RESERVE WORK SHEET

Name__________________________________ Case Number ____________________ Month ____________________

I. NONEXEMPT OTHER REAL PROPERTY (ORP)

II. PROPERTY RESERVE: USE REVERSE TO ITEMIZE OR TO

PROVIDE DETAILS

A. Determine market value and encumbrances of ORP on reverse,

1. Excess value ORP

and list in 1 and 2. Note: If ORP owned jointly with persons

a. Enter from Col. I, line C1

not in MFBU, list only the share of market value and

b. Enter from Col. I, line C5

encumbrances of persons in MFBU.

c. Line 1a—1b

$

1. Market Value per Section 50412

$

2. Notes, mortgages, deeds of trust NOT from the

2. Encumbrances per Section 50413

$

sale of real property owned by MFBU member

$

3. Net Market Value (line 1 minus line 2)

$

3. Liquid assets [money, checking/savings accounts,

4. Life Estate (determine value per Section 50442

stocks, bonds, etc. (other than for business)]

$

and procedure 9A)

$

4. CSV of nonexempt life insurance

$

5. Net Market Value of notes, mortgages, deeds of

5. Burial plots, vaults, or crypts not for family use

trust from sale of real property owned by MFBU

member

$

and not exempt as ORP

$

6. Total net ORP (add lines 3, 4, and 5)

6. Value of designated burial funds in excess of $1,500 $

Enter in Column I, line C1

$

7. Nonbusiness vehicles, boats, vans, or trailers;

B. INCOME FROM NONEXEMPT ORP

other than one exempt for transportation

Monthly

Market Value

e.g., DMV license

1. Rental Income

$

Yearly, if yes, $_________ ÷ 12

Item

fee x 50 or

Encumbrance

appraised value

2. Upkeep and Repair

$

$

a. $___________ (from B1) x .15 $

$

b. + $4.17

$ 4.17

8. Jewelry, not exempt and valued over $100

$

c. Line a + b

$

9. Other countable property

$

d. Actual upkeep and repair

$

10. Subtotal property reserve

e. Greater of line 2c or 2d

$

(add lines 1 through 9)

$

Monthly

11. Long-term care insurance exemption

3. Interest

$

Yearly, if yes, $_________ ÷ 12

(benefits paid)

–$

4. Taxes and

Monthly

Assessments

$

12. Community spouse resource allowance

–$

Yearly, if yes, $_________ ÷ 12

Monthly

13. Amount equal to Japanese Reparation Payment –$

5. Utilities

$

Yearly, if yes, $_________ ÷ 12

14. Total property reserve (line 10 minus 11,12, and 13)

$

Monthly

15. Number of persons in MFBU ________

6. Insurance

$

Yearly, if yes, $_________ ÷ 12

Property limit for MFBU

$

7. Total expenses (add lines 2e through 6)

$

16. Is line 15 greater than or equal to line 14?

Yes—property eligible

No—excess property—ineligible

8. Net rental income (line 1 minus line 7) (Enter

Explain property requirements.

on MC 176 M Column I or II)

$

* If “NO,” complete Sneede Screening below

9. Income from ORP other than rental income

III. SNEEDE: PROPERTY SCREENING

(Section 50508) (Enter on MC 176 M, Column I or II) $

If excess property and MFBU includes child(ren) complete the following:

10. Total income from ORP (line 8 plus line 9)

$

DOES THE MFBU INCLUDE:

YES

NO

C. UTILIZATION–NONEXEMPT ORP

1. A stepparent with property?

1. Total Net Market Value of ORP (from Col. 1, line A6) $

2. An unmarried couple with mutual child(ren)?

2. 6% per year utilization requirement

$ X.005

3. A child with own nonexempt property?

3. Income needed $

4. A nonparent caretaker relative in the same

MFBU with the child(ren) for whom care is

4. a. Is B10 greater than C3?

Yes

No If yes, utilization

provided and the caretaker wants Medi-Cal?

met. If no, recompute rental income with actual upkeep and

repair, if lower.

* If “NO” to all of the above, stop here.

b. Is B10 now greater than or equal to C3?

Yes

No

* If “YES” to any of the above and:

If yes, utilization met.

(1) the MFBU includes a parent, complete MC175-2,

c. If still no, is utilization period implemented?

Yes

No

MC175-3P, and MC175-4.

(2) the MFBU does not include a parent, complete MC175-3P

5.

Exemption: If 4a, b, or c is yes, enter lesser

of $6,000 or line C1. Otherwise, enter Ø.

$

and MC175-4.

Eligibility Worker Signature

Worker Number

Computation Date

County Use

MC 176 P (05/07)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2