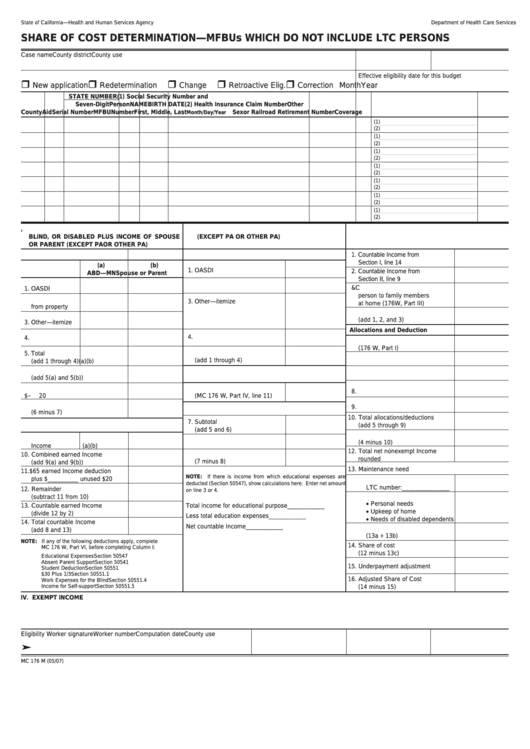

Form Mc 176 M - Share Of Cost Determination-Mfbus Which Do Not Include Ltc Persons

ADVERTISEMENT

State of California—Health and Human Services Agency

Department of Health Care Services

SHARE OF COST DETERMINATION—MFBUs WHICH DO NOT INCLUDE LTC PERSONS

Case name

County district

County use

Effective eligibility date for this budget

New application

Redetermination

Change

Retroactive Elig.

Correction Month

Year

STATE NUMBER

(1) Social Security Number and

Seven-Digit

Person

NAME

BIRTH DATE

(2) Health Insurance Claim Number

Other

County

Aid

Serial Number

MFBU Number

First, Middle, Last

Sex

or Railroad Retirement Number

Coverage

Month/Day/Year

(1)

(2)

(1)

(2)

(1)

(2)

(1)

(2)

(1)

(2)

(1)

(2)

(1)

(2)

I. INCOME OF MFBU MEMBERS APPLYING AS AGED,

II. INCOME OF MFBU MEMBERS NOT LISTED IN I.

III. SHARE OF COST COMPUTATION

BLIND, OR DISABLED PLUS INCOME OF SPOUSE

(EXCEPT PA OR OTHER PA)

OR PARENT (EXCEPT PA OR OTHER PA)

A. Nonexempt Unearned Income

A. Nonexempt Unearned Income

1. Countable Income from

Section I, line 14

(a)

(b)

1. OASDI

2. Countable Income from

ABD—MN

Spouse or Parent

Section II, line 9

2. Net income from property

3. Income allocated from LTC/B&C

1. OASDI

person to family members

2. Net income

3. Other—itemize

at home (176W, Part III)

from property

4. Combined countable Income

(add 1, 2, and 3)

3. Other—itemize

Allocations and Deduction

4.

4.

5. Allocation to excluded children

(176 W, Part I)

5. Total unearned Income

5. Total

(add 1 through 4)

6. Income to determine PA Eligibility

(add 1 through 4) (a)

(b)

6. Combined unearned Income

B. Nonexempt Earned Income

7. Health Insurance

(add 5(a) and 5(b))

7. Any Income deduction

6. Total net earned Income

8.

$

–

20

(MC 176 W, Part IV, line 11)

8. Countable unearned income

9.

C. Total Countable Income

(6 minus 7)

10. Total allocations/deductions

7. Subtotal

(add 5 through 9)

B. Nonexempt Earned Income

(add 5 and 6)

11. Total net nonexempt Income

9. Gross Earned

8. Child support/alimony paid

(4 minus 10)

Income

(a)

(b)

12. Total net nonexempt Income

9. Total countable Income

10. Combined earned Income

rounded

(7 minus 8)

(add 9(a) and 9(b))

13. Maintenance need

11. $65 earned Income deduction

NOTE: If there is income from which educational expenses are

plus $_________ unused $20

a. MFBU members not in

deducted (Section 50547), show calculations here. Enter net amount

LTC number:______________

12. Remainder

on line 3 or 4.

b. MFBU members in LTC

(subtract 11 from 10)

• Personal needs

13. Countable earned Income

Total income for educational purpose

___________

• Upkeep of home

(divide 12 by 2)

Less total education expenses

___________

• Needs of disabled dependents

14. Total countable Income

Net countable Income

___________

c. Total maintenance need

(add 8 and 13)

(13a + 13b)

NOTE: If any of the following deductions apply, complete

14. Share of cost

MC 176 W, Part VI, before completing Column I:

(12 minus 13c)

Educational Expenses

Section 50547

Absent Parent Support

Section 50541

15. Underpayment adjustment

Student Deduction

Section 50551

$30 Plus 1/3

Section 50551.1

16. Adjusted Share of Cost

Work Expenses for the Blind

Section 50551.4

Income for Self-support

Section 50551.5

(14 minus 15)

IV. EXEMPT INCOME

Eligibility Worker signature

Worker number

Computation date

County use

MC 176 M (05/07)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1