Form Mc 176 Ep - Exempt Payment Form

ADVERTISEMENT

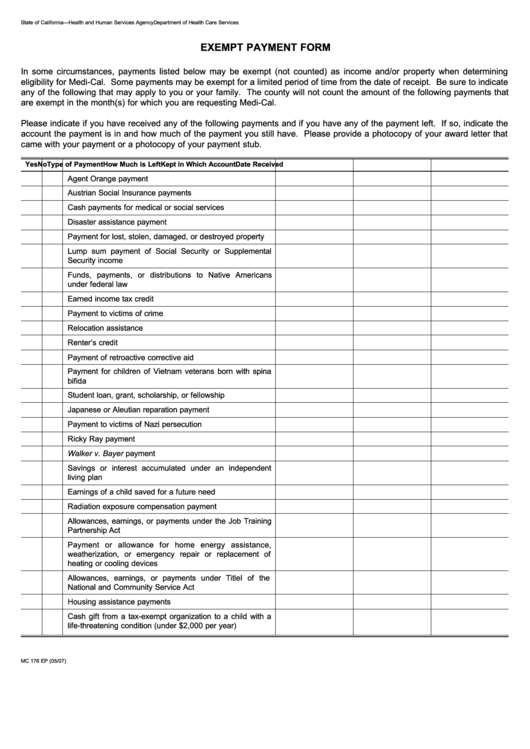

State of California—Health and Human Services Agency

Department of Health Care Services

EXEMPT PAYMENT FORM

In some circumstances, payments listed below may be exempt (not counted) as income and/or property when determining

eligibility for Medi-Cal. Some payments may be exempt for a limited period of time from the date of receipt. Be sure to indicate

any of the following that may apply to you or your family. The county will not count the amount of the following payments that

are exempt in the month(s) for which you are requesting Medi-Cal.

Please indicate if you have received any of the following payments and if you have any of the payment left. If so, indicate the

account the payment is in and how much of the payment you still have. Please provide a photocopy of your award letter that

came with your payment or a photocopy of your payment stub.

Yes

No

Type of Payment

How Much is Left

Kept in Which Account

Date Received

Agent Orange payment

Austrian Social Insurance payments

Cash payments for medical or social services

Disaster assistance payment

Payment for lost, stolen, damaged, or destroyed property

Lump sum payment of Social Security or Supplemental

Security income

Funds, payments, or distributions to Native Americans

under federal law

Earned income tax credit

Payment to victims of crime

Relocation assistance

Renter’s credit

Payment of retroactive corrective aid

Payment for children of Vietnam veterans born with spina

bifida

Student loan, grant, scholarship, or fellowship

Japanese or Aleutian reparation payment

Payment to victims of Nazi persecution

Ricky Ray payment

Walker v. Bayer payment

Savings or interest accumulated under an independent

living plan

Earnings of a child saved for a future need

Radiation exposure compensation payment

Allowances, earnings, or payments under the Job Training

Partnership Act

Payment or allowance for home energy assistance,

weatherization, or emergency repair or replacement of

heating or cooling devices

Allowances, earnings, or payments under Title I of the

National and Community Service Act

Housing assistance payments

Cash gift from a tax-exempt organization to a child with a

life-threatening condition (under $2,000 per year)

MC 176 EP (05/07)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1