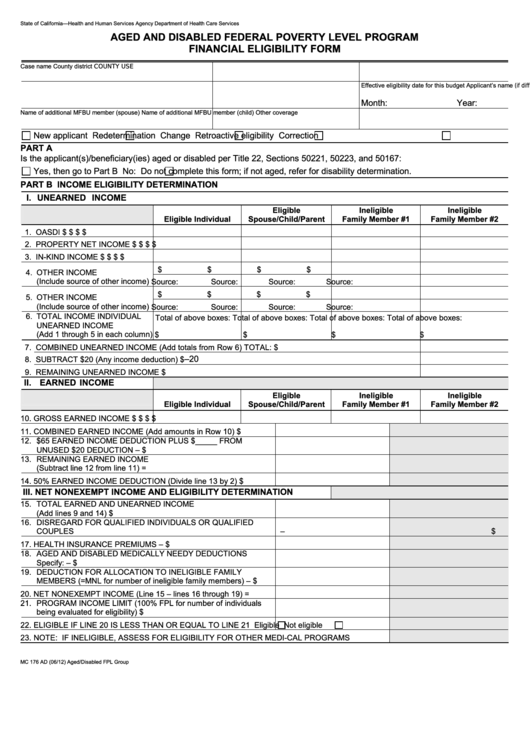

Form Mc 176 Ad - Aged And Disabled Federal Poverty Level Program Financial Eligibility Form

ADVERTISEMENT

State of California—Health and Human Services Agency

Department of Health Care Services

AGED AND DISABLED FEDERAL POVERTY LEVEL PROGRAM

FINANCIAL ELIGIBILITY FORM

Case name

County district

COUNTY USE

Applicant’s name (if different from above)

Case number

Effective eligibility date for this budget

Month:

Year:

Name of additional MFBU member (spouse)

Name of additional MFBU member (child)

Other coverage

New applicant

Redetermination

Change

Retroactive eligibility

Correction

PART A

Is the applicant(s)/beneficiary(ies) aged or disabled per Title 22, Sections 50221, 50223, and 50167:

Yes, then go to Part B

No: Do not complete this form; if not aged, refer for disability determination.

PART B INCOME ELIGIBILITY DETERMINATION

I.

UNEARNED INCOME

Eligible

Ineligible

Ineligible

Eligible Individual

Spouse/Child/Parent

Family Member #1

Family Member #2

1. OASDI

$

$

$

$

2. PROPERTY NET INCOME

$

$

$

$

3. IN-KIND INCOME

$

$

$

$

$

$

$

$

4. OTHER INCOME

(Include source of other income) Source:

Source:

Source:

Source:

$

$

$

$

5. OTHER INCOME

(Include source of other income) Source:

Source:

Source:

Source:

6. TOTAL INCOME INDIVIDUAL

Total of above boxes:

Total of above boxes:

Total of above boxes:

Total of above boxes:

UNEARNED INCOME

(Add 1 through 5 in each column) $

$

$

$

7. COMBINED UNEARNED INCOME (Add totals from Row 6)

TOTAL:

$

–20

8. SUBTRACT $20 (Any income deduction)

$

9. REMAINING UNEARNED INCOME

$

II. EARNED INCOME

Eligible

Ineligible

Ineligible

Eligible Individual

Spouse/Child/Parent

Family Member #1

Family Member #2

10. GROSS EARNED INCOME

$

$

$

$

11. COMBINED EARNED INCOME (Add amounts in Row 10)

$

12. $65 EARNED INCOME DEDUCTION PLUS $_____ FROM

UNUSED $20 DEDUCTION

– $

13. REMAINING EARNED INCOME

(Subtract line 12 from line 11)

=

14. 50% EARNED INCOME DEDUCTION (Divide line 13 by 2)

$

III.

NET NONEXEMPT INCOME AND ELIGIBILITY DETERMINATION

15. TOTAL EARNED AND UNEARNED INCOME

(Add lines 9 and 14)

$

16. DISREGARD FOR QUALIFIED INDIVIDUALS OR QUALIFIED

COUPLES

– $

17. HEALTH INSURANCE PREMIUMS

– $

18. AGED AND DISABLED MEDICALLY NEEDY DEDUCTIONS

Specify:

– $

19. DEDUCTION FOR ALLOCATION TO INELIGIBLE FAMILY

MEMBERS (=MNL for number of ineligible family members)

– $

20. NET NONEXEMPT INCOME (Line 15 – lines 16 through 19)

=

21. PROGRAM INCOME LIMIT (100% FPL for number of individuals

being evaluated for eligibility)

$

22. ELIGIBLE IF LINE 20 IS LESS THAN OR EQUAL TO LINE 21

Eligible

Not eligible

23. NOTE: IF INELIGIBLE, ASSESS FOR ELIGIBILITY FOR OTHER MEDI-CAL PROGRAMS

MC 176 AD (06/12) Aged/Disabled FPL Group

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1![Form Mc 175-5 - Sneede V. Kizer Federal Poverty Level (fpl) Programs For Pregnant Women And Infants (income Disregard, 200 Percent[%]), Children Ages 1 Through 5 (133 Percent [%]), And Children Ages 6 Through 18 (100 Percent [%]) Form Mc 175-5 - Sneede V. Kizer Federal Poverty Level (fpl) Programs For Pregnant Women And Infants (income Disregard, 200 Percent[%]), Children Ages 1 Through 5 (133 Percent [%]), And Children Ages 6 Through 18 (100 Percent [%])](https://data.formsbank.com/pdf_docs_html/364/3645/364599/page_1_thumb.png)