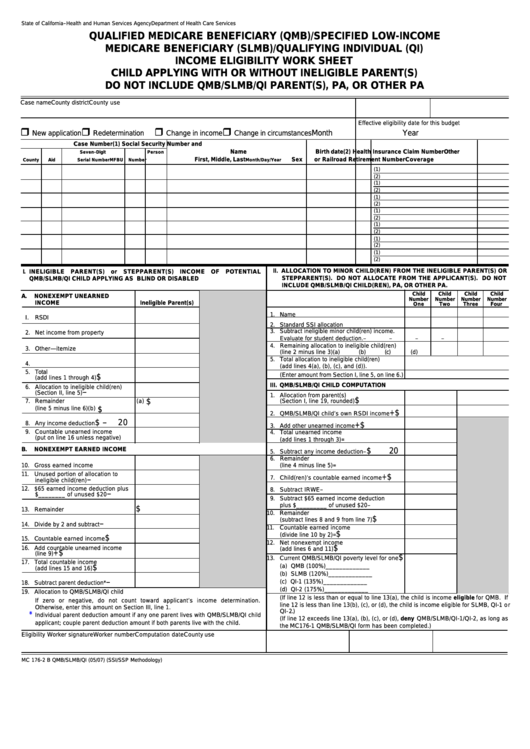

Form Mc 176-2 B - Qualified Medicare Beneficiary (Qmb)/specified Low-Income Medicare Beneficiary (Slmb)/qualifying Individual (Qi) Income Eligibility Work Sheet Child Applying With Or Without Ineligible Parent(S)

ADVERTISEMENT

State of California–Health and Human Services Agency

Department of Health Care Services

QUALIFIED MEDICARE BENEFICIARY (QMB)/SPECIFIED LOW-INCOME

MEDICARE BENEFICIARY (SLMB)/QUALIFYING INDIVIDUAL (QI)

INCOME ELIGIBILITY WORK SHEET

CHILD APPLYING WITH OR WITHOUT INELIGIBLE PARENT(S)

DO NOT INCLUDE QMB/SLMB/QI PARENT(S), PA, OR OTHER PA

Case name

County district

County use

Effective eligibility date for this budget

r

r

r

r

Month

Year

New application

Redetermination

Change in income

Change in circumstances

Case Number

(1) Social Security Number and

Name

Birth date

(2) Health Insurance Claim Number

Other

Seven-Digit

Person

First, Middle, Last

Sex

or Railroad Retirement Number

Coverage

County

Aid

Serial Number

MFBU

Number

Month/Day/Year

(1)

(2)

(1)

(2)

(1)

(2)

(1)

(2)

(1)

(2)

(1)

(2)

(1)

(2)

II. ALLOCATION TO MINOR CHILD(REN) FROM THE INELIGIBLE PARENT(S) OR

I. INELIGIBLE

PARENT(S)

or

STEPPARENT(S)

INCOME

OF

POTENTIAL

STEPPARENT(S). DO NOT ALLOCATE FROM THE APPLICANT(S). DO NOT

QMB/SLMB/QI CHILD APPLYING AS BLIND OR DISABLED

INCLUDE QMB/SLMB/QI CHILD(REN), PA, OR OTHER PA.

Child

Child

Child

Child

A.

NONEXEMPT UNEARNED

Number

Number

Number

Number

INCOME

Ineligible Parent(s)

One

Two

Three

Four

1. Name

I.

RSDI

2. Standard SSI allocation

3. Subtract ineligible minor child(ren) income.

2. Net income from property

Evaluate for student deduction.

–

–

–

–

4. Remaining allocation to ineligible child(ren)

3. Other—itemize

(line 2 minus line 3)

(a)

(b)

(c)

(d)

5. Total allocation to ineligible child(ren)

4.

(add lines 4(a), (b), (c), and (d)).

5. Total

(Enter amount from Section I, line 5, on line 6.)

$

(add lines 1 through 4)

III. QMB/SLMB/QI CHILD COMPUTATION

6. Allocation to ineligible child(ren)

–

(Section II, line 5)

1. Allocation from parent(s)

$

$

7. Remainder

(a)

(Section I, line 19, rounded)

(line 5 minus line 6)

(b)

$

+$

2. QMB/SLMB/QI child’s own RSDI income

$ –

20

8. Any income deduction

+$

3. Add other unearned income

9. Countable unearned income

4. Total unearned income

(put on line 16 unless negative)

(add lines 1 through 3)

=

B.

NONEXEMPT EARNED INCOME

$

20

5. Subtract any income deduction

–

6. Remainder

10. Gross earned income

(line 4 minus line 5)

=

11. Unused portion of allocation to

+$

7. Child(ren)’s countable earned income

–

ineligible child(ren)

12. $65 earned income deduction plus

8. Subtract IRWE

–

–

$________ of unused $20

9. Subtract $65 earned income deduction

plus $_________ of unused $20

–

$

13. Remainder

10. Remainder

$

(subtract lines 8 and 9 from line 7)

–

14. Divide by 2 and subtract

11. Countable earned income

$

(divide line 10 by 2)

=

$

15. Countable earned income

12. Net nonexempt income

$

16. Add countable unearned income

(add lines 6 and 11)

+$

(line 9)

$

13. Current QMB/SLMB/QI poverty level for one

17. Total countable income

(a) QMB (100%)

_____________

$

(add lines 15 and 16)

(b) SLMB (120%)

_____________

–

(c) QI-1 (135%)

_____________

18. Subtract parent deduction*

(d) QI-2 (175%)

_____________

19. Allocation to QMB/SLMB/QI child

(If line 12 is less than or equal to line 13(a), the child is income eligible for QMB. If

If zero or negative, do not count toward applicant’s income determination.

line 12 is less than line 13(b), (c), or (d), the child is income eligible for SLMB, QI-1 o r

Otherwise, enter this amount on Section III, line 1.

QI- 2.)

*

Individual parent deduction amount if any one parent lives with QMB/SLMB/QI child

(If line 12 exceeds line 13(a), (b), (c), or (d), deny QMB/SLMB/QI - 1/QI-2, as long as

applicant; couple parent deduction amount if both parents live with the child.

the MC 176-1 QMB/SLMB/QI form has been completed.)

Eligibility Worker signature

Worker number

Computation date

County use

MC 176-2 B QMB/SLMB/QI (05/07) (SSI/SSP Methodology)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4