Form Mc 175-3i.1 - Sneede V. Kizer Net Nonexempt Income Determination-Continuation Sheet

ADVERTISEMENT

State of California—Health and Human Services Agency

Department of Health Care Services

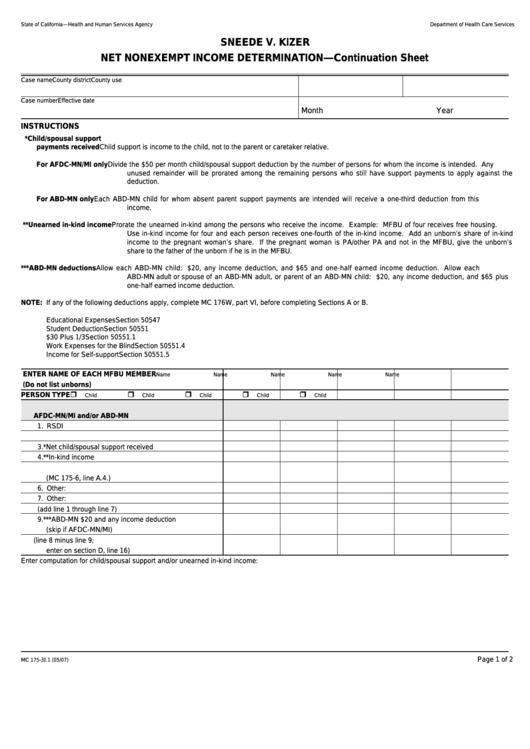

SNEEDE V. KIZER

NET NONEXEMPT INCOME DETERMINATION—Continuation Sheet

Case name

County district

County use

Case number

Effective date

Month

Year

INSTRUCTIONS

*

Child/spousal support

payments received

Child support is income to the child, not to the parent or caretaker relative.

For AFDC-MN/MI only

Divide the $50 per month child/spousal support deduction by the number of persons for whom the income is intended. Any

unused remainder will be prorated among the remaining persons who still have support payments to apply against the

deduction.

For ABD-MN only

Each ABD-MN child for whom absent parent support payments are intended will receive a one-third deduction from this

income.

**

Unearned in-kind income

Prorate the unearned in-kind among the persons who receive the income. Example: MFBU of four receives free housing.

Use in-kind income for four and each person receives one-fourth of the in-kind income. Add an unborn’s share of in-kind

income to the pregnant woman’s share. If the pregnant woman is PA/other PA and not in the MFBU, give the unborn’s

share to the father of the unborn if he is in the MFBU.

***

ABD-MN deductions

Allow each ABD-MN child: $20, any income deduction, and $65 and one-half earned income deduction. Allow each

ABD-MN adult or spouse of an ABD-MN adult, or parent of an ABD-MN child: $20, any income deduction, and $65 plus

one-half earned income deduction.

NOTE: If any of the following deductions apply, complete MC 176W, part VI, before completing Sections A or B.

Educational Expenses

Section 50547

Student Deduction

Section 50551

$30 Plus 1/3

Section 50551.1

Work Expenses for the Blind

Section 50551.4

Income for Self-support

Section 50551.5

ENTER NAME OF EACH MFBU MEMBER

Name

Name

Name

Name

Name

(Do not list unborns)

PERSON TYPE

Child

Child

Child

Child

Child

A. NONEXEMPT UNEARNED INCOME

AFDC-MN/MI and/or ABD-MN

1. RSDI

2. Net income from property

3. *Net child/spousal support received

4. **In-kind income

5. Income available from PA or other PA

(MC 175-6, line A.4.)

6. Other:

7. Other:

8. Total (add line 1 through line 7)

9. ***ABD-MN $20 and any income deduction

(skip if AFDC-MN/MI)

10. Countable unearned income (line 8 minus line 9;

enter on section D, line 16)

Enter computation for child/spousal support and/or unearned in-kind income:

Page 1 of 2

MC 175-3I.1 (05/07)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2

![Form Mc 175-5 - Sneede V. Kizer Federal Poverty Level (fpl) Programs For Pregnant Women And Infants (income Disregard, 200 Percent[%]), Children Ages 1 Through 5 (133 Percent [%]), And Children Ages 6 Through 18 (100 Percent [%]) Form Mc 175-5 - Sneede V. Kizer Federal Poverty Level (fpl) Programs For Pregnant Women And Infants (income Disregard, 200 Percent[%]), Children Ages 1 Through 5 (133 Percent [%]), And Children Ages 6 Through 18 (100 Percent [%])](https://data.formsbank.com/pdf_docs_html/364/3645/364599/page_1_thumb.png)