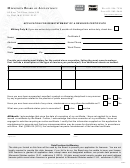

5.

A) Provide the names of all owners, managers, directors and officers of the firm who

or

reside in

practice in Minnesota.

Attach list, if necessary.

Be sure to complete a

Non-CPA Owner of Firm Statement

(page 5) and enclose the $45.00 fee for each individual listed below

who is not a CPA.

Name

CPA Certificate #

State of

Practicing in

Residence

Minnesota?

(if applicable)

Yes

No

Yes

No

Yes

No

Yes

No

Yes

No

Yes

No

non-CPA

in

total, what percentage of:

B) The

owners in the list above hold,

Voting interest in the firm?

%

Financial interest in the firm?

%

Firm Permit Renewal

6.

Designation Affidavit for

Read all statements and sign the affidavit below.

If a statement does not apply to your firm, mark “N/A” on the line next to that statement.

1. All employees who hold a certificate or have been granted practice privileges under

Minnesota Statutes §326A.14 (2016) and who are responsible for supervising attest

or compilation services or who sign or authorize someone to sign an accountant’s

report on financial statements on behalf of the firm have met the competency

requirements set forth in professional standards for such services.

2. All attest and compilation services rendered by the firm in this state are under the

charge of a person holding a valid certificate with an active status or a person who

has been granted practice privileges under Minnesota Statutes §326A.14 (2016).

3. The firm has an audit documentation retention and destruction policy that complies

with Minnesota Rules 1105.7800.F (2015).

4. The firm has verified that all non-CPA owners have completed a Non-CPA Owner of

Firm Statement and registered with the Board.

5. The firm has verified that two-thirds of all CPA owners, managers, directors and

officers of the firm who have their principal place of business located in Minnesota

have an active certificate for 2017.

Affidavit: I swear or affirm that I have read the foregoing renewal application

and that the statements are true and complete.

Printed Name of Certificate Holder/Owner

Signature of Certificate Holder/Owner

Name of Firm

Date

CPA Sole Proprietor Firm Permit Renewal Form—Page 2 of 5

1

1 2

2 3

3 4

4 5

5 6

6