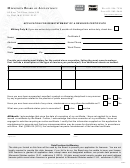

2017 FIRM PEER REVIEW STATEMENT

1.

Did or will your firm do one or more of the following?

2016

2017

Audits of Financial Statements

Yes

No

Yes

No

Reviews of Financial Statements

Yes

No

Yes

No

Compilations of Financial Statements

Yes

No

Yes

No

Examinations of Prospective Financial Information

Yes

No

Yes

No

If you answered “Yes” to any of the above, complete questions 2-5.

If you answered “No” to all of the above, sign the following affidavit, then skip to the next page.

I swear or affirm that during the past year my firm did not perform compilation services. The firm does not plan to do so

in the coming year and if the firm does engage in such practice, I will immediately notify the Minnesota State Board of

Accountancy (Board). I, therefore, request on behalf of the firm exemption from the peer review requirements of the

Board. I further certify that this information is correct and understand that my deliberate misrepresentation may result in

the suspension and/or revocation of my registration and the firm’s permit.

Printed Name

Signature

Name of Firm

Date

2.

Are you currently participating in a peer review program?

Yes

No

3.

Indicate the Report Acceptance Body (RAB) you are/will be working with:

AICPA

MAPA

MNCPA

Other (specify):

4.

What 12-month period will be reviewed during your next required peer review?

/

to

/

(Beginning Month)

(Beginning Year)

(Ending Month)

(Ending Year)

Note:

You must submit peer review reports no later than 15 months after the end of the year under review or within 30 days of

receipt of the Report Acceptance Body letter, whichever is earlier.

5.

Affidavit:

I certify that the information provided above is complete and accurate.

Printed Name

Signature

Name of Firm

Date

CPA Sole Proprietor Firm Permit Renewal Form—Page 3 of 5

1

1 2

2 3

3 4

4 5

5 6

6