Instructions For Completing The Cacfp Meal Benefit Income Eligibility Form - Arizona Department Of Education - 2018

ADVERTISEMENT

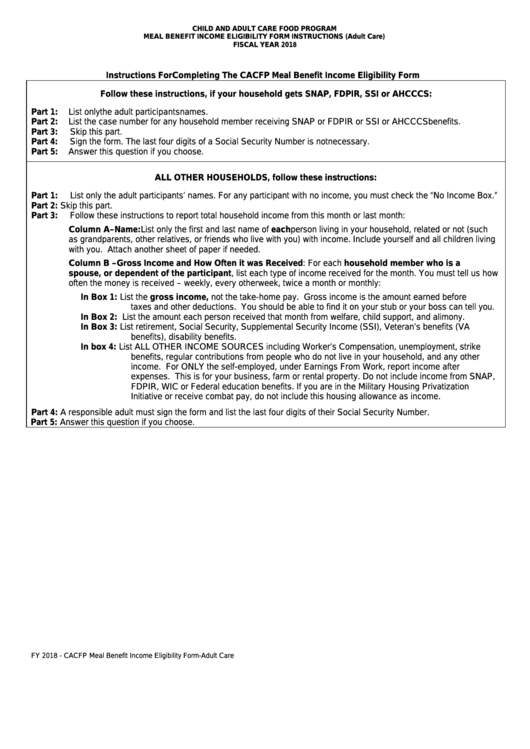

CHILD AND ADULT CARE FOOD PROGRAM

MEAL BENEFIT INCOME ELIGIBILITY FORM INSTRUCTIONS (Adult Care)

FISCAL YEAR 2018

Instructions For Completing The CACFP Meal Benefit Income Eligibility Form

Follow these instructions, if your household gets SNAP, FDPIR, SSI or AHCCCS:

Part 1:

List only the adult participants names.

Part 2:

List the case number for any household member receiving SNAP or FDPIR or SSI or AHCCCS benefits.

Part 3:

Skip this part.

Part 4:

Sign the form. The last four digits of a Social Security Number is not necessary.

Part 5:

Answer this question if you choose.

ALL OTHER HOUSEHOLDS, follow these instructions:

Part 1:

List only the adult participants’ names. For any participant with no income, you must check the “No Income Box.”

Part 2:

Skip this part.

Part 3:

Follow these instructions to report total household income from this month or last month:

Column A–Name: List only the first and last name of each person living in your household, related or not (such

as grandparents, other relatives, or friends who live with you) with income. Include yourself and all children living

with you. Attach another sheet of paper if needed.

Column B – Gross Income and How Often it was Received: For each household member who is a

spouse, or dependent of the participant, list each type of income received for the month. You must tell us how

often the money is received – weekly, every other week, twice a month or monthly:

In Box 1:

List the gross income, not the take-home pay. Gross income is the amount earned before

taxes and other deductions. You should be able to find it on your stub or your boss can tell you.

In Box 2:

List the amount each person received that month from welfare, child support, and alimony.

In Box 3:

List retirement, Social Security, Supplemental Security Income (SSI), Veteran’s benefits (VA

benefits), disability benefits.

In box 4:

List ALL OTHER INCOME SOURCES including Worker’s Compensation, unemployment, strike

benefits, regular contributions from people who do not live in your household, and any other

income. For ONLY the self-employed, under Earnings From Work, report income after

expenses. This is for your business, farm or rental property. Do not include income from SNAP,

FDPIR, WIC or Federal education benefits. If you are in the Military Housing Privatization

Initiative or receive combat pay, do not include this housing allowance as income.

Part 4: A responsible adult must sign the form and list the last four digits of their Social Security Number.

Part 5: Answer this question if you choose.

FY 2018 - CACFP Meal Benefit Income Eligibility Form-Adult Care

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1