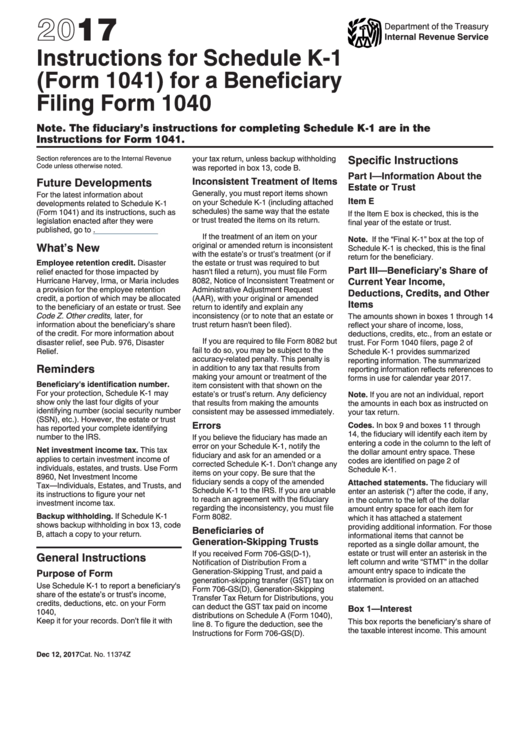

Instructions For Schedule K-1 (Form 1041) For A Beneficiary Filing Form 1040 - 2017

ADVERTISEMENT

2017

Department of the Treasury

Internal Revenue Service

Instructions for Schedule K-1

(Form 1041) for a Beneficiary

Filing Form 1040

Note. The fiduciary’s instructions for completing Schedule K-1 are in the

Instructions for Form 1041.

Specific Instructions

your tax return, unless backup withholding

Section references are to the Internal Revenue

Code unless otherwise noted.

was reported in box 13, code B.

Part I—Information About the

Future Developments

Inconsistent Treatment of Items

Estate or Trust

Generally, you must report items shown

For the latest information about

Item E

on your Schedule K-1 (including attached

developments related to Schedule K-1

schedules) the same way that the estate

(Form 1041) and its instructions, such as

If the Item E box is checked, this is the

or trust treated the items on its return.

legislation enacted after they were

final year of the estate or trust.

published, go to IRS.gov/Form1041.

If the treatment of an item on your

Note. If the “Final K-1” box at the top of

What’s New

original or amended return is inconsistent

Schedule K-1 is checked, this is the final

with the estate’s or trust’s treatment (or if

return for the beneficiary.

Employee retention credit. Disaster

the estate or trust was required to but

Part III—Beneficiary’s Share of

relief enacted for those impacted by

hasn't filed a return), you must file Form

Hurricane Harvey, Irma, or Maria includes

8082, Notice of Inconsistent Treatment or

Current Year Income,

a provision for the employee retention

Administrative Adjustment Request

Deductions, Credits, and Other

credit, a portion of which may be allocated

(AAR), with your original or amended

Items

to the beneficiary of an estate or trust. See

return to identify and explain any

Code Z. Other credits, later, for

inconsistency (or to note that an estate or

The amounts shown in boxes 1 through 14

trust return hasn't been filed).

information about the beneficiary’s share

reflect your share of income, loss,

of the credit. For more information about

deductions, credits, etc., from an estate or

If you are required to file Form 8082 but

disaster relief, see Pub. 976, Disaster

trust. For Form 1040 filers, page 2 of

fail to do so, you may be subject to the

Relief.

Schedule K-1 provides summarized

accuracy-related penalty. This penalty is

reporting information. The summarized

Reminders

in addition to any tax that results from

reporting information reflects references to

making your amount or treatment of the

forms in use for calendar year 2017.

Beneficiary's identification number.

item consistent with that shown on the

For your protection, Schedule K-1 may

estate’s or trust’s return. Any deficiency

Note. If you are not an individual, report

show only the last four digits of your

that results from making the amounts

the amounts in each box as instructed on

identifying number (social security number

consistent may be assessed immediately.

your tax return.

(SSN), etc.). However, the estate or trust

Errors

Codes. In box 9 and boxes 11 through

has reported your complete identifying

14, the fiduciary will identify each item by

number to the IRS.

If you believe the fiduciary has made an

entering a code in the column to the left of

error on your Schedule K-1, notify the

Net investment income tax. This tax

the dollar amount entry space. These

fiduciary and ask for an amended or a

applies to certain investment income of

codes are identified on page 2 of

corrected Schedule K-1. Don’t change any

individuals, estates, and trusts. Use Form

Schedule K-1.

items on your copy. Be sure that the

8960, Net Investment Income

fiduciary sends a copy of the amended

Attached statements. The fiduciary will

Tax—Individuals, Estates, and Trusts, and

Schedule K-1 to the IRS. If you are unable

enter an asterisk (*) after the code, if any,

its instructions to figure your net

to reach an agreement with the fiduciary

in the column to the left of the dollar

investment income tax.

regarding the inconsistency, you must file

amount entry space for each item for

Backup withholding. If Schedule K-1

Form 8082.

which it has attached a statement

shows backup withholding in box 13, code

providing additional information. For those

Beneficiaries of

B, attach a copy to your return.

informational items that cannot be

Generation-Skipping Trusts

reported as a single dollar amount, the

estate or trust will enter an asterisk in the

If you received Form 706-GS(D-1),

General Instructions

left column and write “STMT” in the dollar

Notification of Distribution From a

amount entry space to indicate the

Generation-Skipping Trust, and paid a

Purpose of Form

information is provided on an attached

generation-skipping transfer (GST) tax on

Use Schedule K-1 to report a beneficiary's

statement.

Form 706-GS(D), Generation-Skipping

share of the estate’s or trust’s income,

Transfer Tax Return for Distributions, you

credits, deductions, etc. on your Form

can deduct the GST tax paid on income

Box 1—Interest

1040, U.S. Individual Income Tax Return.

distributions on Schedule A (Form 1040),

Keep it for your records. Don’t file it with

This box reports the beneficiary’s share of

line 8. To figure the deduction, see the

the taxable interest income. This amount

Instructions for Form 706-GS(D).

Dec 12, 2017

Cat. No. 11374Z

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3