Form Mc 176 Qdwi - Qualified Disabled Working Individual (Qdwi) Income Eligibility Work Sheet Couple Or Applicant With An Ineligible Spouse, With Or Without Child(Ren)

ADVERTISEMENT

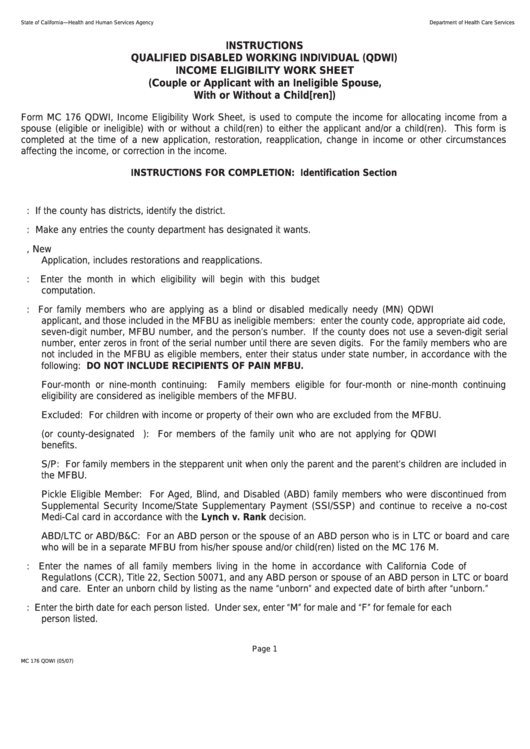

State of California—Health and Human Services Agency

Department of Health Care Services

INSTRUCTIONS

QUALIFIED DISABLED WORKING INDIVIDUAL (QDWI)

INCOME ELIGIBILITY WORK SHEET

(Couple or Applicant with an Ineligible Spouse,

With or Without a Child[ren])

Form MC 176 QDWI, Income Eligibility Work Sheet, is used to compute the income for allocating income from a

spouse (eligible or ineligible) with or without a child(ren) to either the applicant and/or a child(ren). This form is

completed at the time of a new application, restoration, reapplication, change in income or other circumstances

affecting the income, or correction in the income.

INSTRUCTIONS FOR COMPLETION: Identification Section

1. Enter case name.

2. County district: If the county has districts, identify the district.

3. County use: Make any entries the county department has designated it wants.

4. Check the appropriate box which gives information concerning the reason for the computation. The box, New

Application, includes restorations and reapplications.

5. Effective eligibility date for this budget:

Enter the month in which eligibility will begin with this budget

computation.

6. State number: For family members who are applying as a blind or disabled medically needy (MN) QDWI

applicant, and those included in the MFBU as ineligible members: enter the county code, appropriate aid code,

seven-digit number, MFBU number, and the person’s number. If the county does not use a seven-digit serial

number, enter zeros in front of the serial number until there are seven digits. For the family members who are

not included in the MFBU as eligible members, enter their status under state number, in accordance with the

following: DO NOT INCLUDE RECIPIENTS OF PA IN MFBU.

Four-month or nine-month continuing:

Family members eligible for four-month or nine-month continuing

eligibility are considered as ineligible members of the MFBU.

Excluded: For children with income or property of their own who are excluded from the MFBU.

I.E. (or county-designated I.E. aid code): For members of the family unit who are not applying for QDWI

benefits.

S/P: For family members in the stepparent unit when only the parent and the parent’s children are included in

the MFBU.

Pickle Eligible Member: For Aged, Blind, and Disabled (ABD) family members who were discontinued from

Supplemental Security Income/State Supplementary Payment (SSI/SSP) and continue to receive a no-cost

Medi-Cal card in accordance with the Lynch v. Rank decision.

ABD/LTC or ABD/B&C: For an ABD person or the spouse of an ABD person who is in LTC or board and care

who will be in a separate MFBU from his/her spouse and/or child(ren) listed on the MC 176 M.

7. Name: Enter the names of all family members living in the home in accordance with California Code of

RegulatIons (CCR), Title 22, Section 50071, and any ABD person or spouse of an ABD person in LTC or board

and care. Enter an unborn child by listing as the name “unborn” and expected date of birth after “unborn.”

8. Birth date: Enter the birth date for each person listed. Under sex, enter “M” for male and “F” for female for each

person listed.

Page 1

MC 176 QDWI (05/07)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4