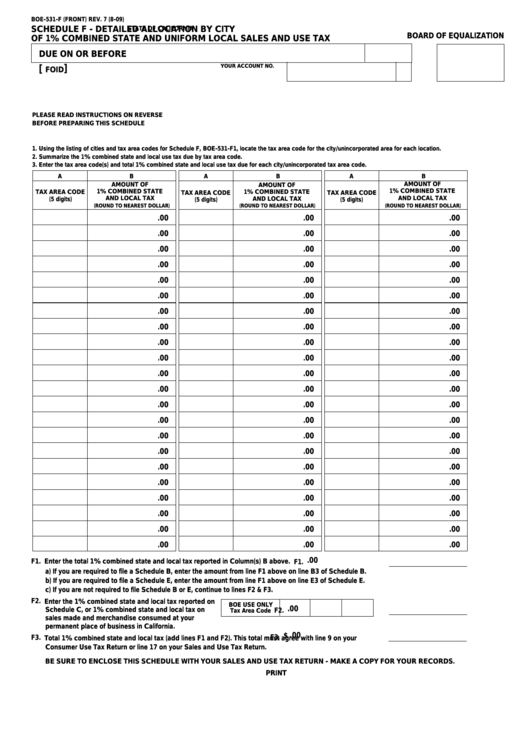

BOE-531-F (FRONT) REV. 7 (8-09)

SCHEDULE F - DETAILED ALLOCATION BY CITY

STATE OF CALIFORNIA

BOARD OF EQUALIZATION

OF 1% COMBINED STATE AND UNIFORM LOCAL SALES AND USE TAX

DUE ON OR BEFORE

]

YOUR ACCOUNT NO.

[

FOID

PLEASE READ INSTRUCTIONS ON REVERSE

BEFORE PREPARING THIS SCHEDULE

1. Using the listing of cities and tax area codes for Schedule F, BOE-531-F1, locate the tax area code for the city/unincorporated area for each location.

2. Summarize the 1% combined state and local use tax due by tax area code.

3. Enter the tax area code(s) and total 1% combined state and local use tax due for each city/unincorporated tax area code.

A

B

A

B

A

B

AMOUNT OF

AMOUNT OF

AMOUNT OF

1% COMBINED STATE

1% COMBINED STATE

TAX AREA CODE

1% COMBINED STATE

TAX AREA CODE

TAX AREA CODE

AND LOCAL TAX

AND LOCAL TAX

(5 digits)

AND LOCAL TAX

(5 digits)

(5 digits)

(ROUND TO NEAREST DOLLAR)

(ROUND TO NEAREST DOLLAR)

(ROUND TO NEAREST DOLLAR)

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

F1. Enter the total 1% combined state and local tax reported in Column(s) B above.

F1.

a) If you are required to file a Schedule B, enter the amount from line F1 above on line B3 of Schedule B.

b) If you are required to file a Schedule E, enter the amount from line F1 above on line E3 of Schedule E.

c) If you are not required to file Schedule B or E, continue to lines F2 & F3.

F2. Enter the 1% combined state and local tax reported on

BOE USE ONLY

.00

Schedule C, or 1% combined state and local tax on

F2.

Tax Area Code

sales made and merchandise consumed at your

permanent place of business in California.

.00

$

F3.

F3. Total 1% combined state and local tax (add lines F1 and F2). This total must agree with line 9 on your

Consumer Use Tax Return or line 17 on your Sales and Use Tax Return.

BE SURE TO ENCLOSE THIS SCHEDULE WITH YOUR SALES AND USE TAX RETURN - MAKE A COPY FOR YOUR RECORDS.

CLEAR

PRINT

1

1 2

2