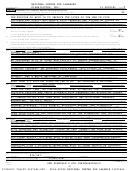

Form 990 - Return Of Organization Exempt From Income Tax - 2014 Page 13

ADVERTISEMENT

NATIONAL CENTER FOR LEARNING

DISABILITIES, INC.

13-2899381

12

Form 990 (2014)

Page

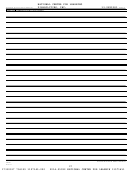

Part XI Reconciliation of Net Assets

X

Check if Schedule O contains a response or note to any line in this Part XI

•••••••••••••••••••••••••••

7,463,877.

1

Total revenue (must equal Part VIII, column (A), line 12)

~~~~~~~~~~~~~~~~~~~~~~~~~~

1

8,416,383.

2

Total expenses (must equal Part IX, column (A), line 25)

~~~~~~~~~~~~~~~~~~~~~~~~~~

2

-952,506.

3

Revenue less expenses. Subtract line 2 from line 1

~~~~~~~~~~~~~~~~~~~~~~~~~~~~

3

2,235,962.

4

Net assets or fund balances at beginning of year (must equal Part X, line 33, column (A))

~~~~~~~~~~

4

5

Net unrealized gains (losses) on investments

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

5

6

Donated services and use of facilities

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

6

7

Investment expenses

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

7

8

Prior period adjustments

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

8

-14,492.

9

Other changes in net assets or fund balances (explain in Schedule O)

~~~~~~~~~~~~~~~~~~~

9

10

Net assets or fund balances at end of year. Combine lines 3 through 9 (must equal Part X, line 33,

1,268,964.

column (B))

•••••••••••••••••••••••••••••••••••••••••••••••

10

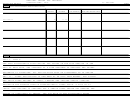

Part XII Financial Statements and Reporting

X

Check if Schedule O contains a response or note to any line in this Part XII •••••••••••••••••••••••••••

Yes

No

X

1

Accounting method used to prepare the Form 990:

Cash

Accrual

Other

If the organization changed its method of accounting from a prior year or checked "Other," explain in Schedule O.

X

2

a

Were the organization's financial statements compiled or reviewed by an independent accountant? ~~~~~~~~~~~~

2a

If "Yes," check a box below to indicate whether the financial statements for the year were compiled or reviewed on a

separate basis, consolidated basis, or both:

Separate basis

Consolidated basis

Both consolidated and separate basis

X

b

Were the organization's financial statements audited by an independent accountant? ~~~~~~~~~~~~~~~~~~~

2b

If "Yes," check a box below to indicate whether the financial statements for the year were audited on a separate basis,

consolidated basis, or both:

X

Separate basis

Consolidated basis

Both consolidated and separate basis

c

If "Yes" to line 2a or 2b, does the organization have a committee that assumes responsibility for oversight of the audit,

X

review, or compilation of its financial statements and selection of an independent accountant?~~~~~~~~~~~~~~~

2c

If the organization changed either its oversight process or selection process during the tax year, explain in Schedule O.

3

a

As a result of a federal award, was the organization required to undergo an audit or audits as set forth in the Single Audit

X

Act and OMB Circular A-133? ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

3a

b

If "Yes," did the organization undergo the required audit or audits? If the organization did not undergo the required audit

or audits, explain why in Schedule O and describe any steps taken to undergo such audits ••••••••••••••••

3b

990

Form

(2014)

432012

11-07-14

13

17330517 756359 1107145.000

2014.05092 NATIONAL CENTER FOR LEARNIN 11071451

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49 50

50