Form 990 - Return Of Organization Exempt From Income Tax - 2014 Page 28

ADVERTISEMENT

NATIONAL CENTER FOR LEARNING

DISABILITIES, INC.

13-2899381

Schedule C (Form 990 or 990-EZ) 2014

Page

3

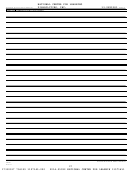

Part II-B

Complete if the organization is exempt under section 501(c)(3) and has NOT filed Form 5768

(election under section 501(h)).

(a)

(b)

For each "Yes," response to lines 1a through 1i below, provide in Part IV a detailed description

of the lobbying activity.

Yes

No

Amount

1

During the year, did the filing organization attempt to influence foreign, national, state or

local legislation, including any attempt to influence public opinion on a legislative matter

or referendum, through the use of:

a

Volunteers?

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

b

Paid staff or management (include compensation in expenses reported on lines 1c through 1i)?

~

c

Media advertisements?

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

d

Mailings to members, legislators, or the public?

~~~~~~~~~~~~~~~~~~~~~~~~~

e

Publications, or published or broadcast statements?

~~~~~~~~~~~~~~~~~~~~~~

f

Grants to other organizations for lobbying purposes?

~~~~~~~~~~~~~~~~~~~~~~

g

Direct contact with legislators, their staffs, government officials, or a legislative body?

~~~~~~

Rallies, demonstrations, seminars, conventions, speeches, lectures, or any similar means?

h

~~~~

i

Other activities?

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

j

Total. Add lines 1c through 1i

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

2

a

Did the activities in line 1 cause the organization to be not described in section 501(c)(3)?

~~~~

b

If "Yes," enter the amount of any tax incurred under section 4912

~~~~~~~~~~~~~~~~

c

If "Yes," enter the amount of any tax incurred by organization managers under section 4912

~~~

d

If the filing organization incurred a section 4912 tax, did it file Form 4720 for this year?

••••••

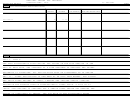

Part III-A Complete if the organization is exempt under section 501(c)(4), section 501(c)(5), or section

501(c)(6).

Yes

No

1

Were substantially all (90% or more) dues received nondeductible by members?

~~~~~~~~~~~~~~~~~

1

2

Did the organization make only in-house lobbying expenditures of $2,000 or less?

~~~~~~~~~~~~~~~~

2

3

Did the organization agree to carry over lobbying and political expenditures from the prior year?

•••••••••

3

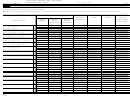

Part III-B Complete if the organization is exempt under section 501(c)(4), section 501(c)(5), or section

501(c)(6) and if either (a) BOTH Part III-A, lines 1 and 2, are answered "No," OR (b) Part III-A, line 3, is

answered "Yes."

1

Dues, assessments and similar amounts from members

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

1

2

Section 162(e) nondeductible lobbying and political expenditures

(do not include amounts of political

expenses for which the section 527(f) tax was paid).

a

Current year

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

2a

b

Carryover from last year

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

2b

c

Total

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

2c

3

Aggregate amount reported in section 6033(e)(1)(A) notices of nondeductible section 162(e) dues

~~~~~~~~

3

4

If notices were sent and the amount on line 2c exceeds the amount on line 3, what portion of the excess

does the organization agree to carryover to the reasonable estimate of nondeductible lobbying and political

expenditure next year?

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

4

Taxable amount of lobbying and political expenditures (see instructions) •••••••••••••••••••••

5

5

Part IV

Supplemental Information

Provide the descriptions required for Part I-A, line 1; Part I-B, line 4; Part I-C, line 5; Part II-A (affiliated group list); Part II-A, lines 1 and 2 (see

instructions); and Part II-B, line 1. Also, complete this part for any additional information.

Schedule C (Form 990 or 990-EZ) 2014

432043

10-21-14

28

17330517 756359 1107145.000

2014.05092 NATIONAL CENTER FOR LEARNIN 11071451

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49 50

50