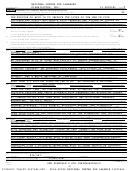

Form 990 - Return Of Organization Exempt From Income Tax - 2014 Page 3

ADVERTISEMENT

NATIONAL CENTER FOR LEARNING

DISABILITIES, INC.

13-2899381

3

Form 990 (2014)

Page

Part IV Checklist of Required Schedules

Yes

No

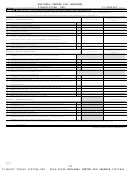

1

Is the organization described in section 501(c)(3) or 4947(a)(1) (other than a private foundation)?

X

If "Yes," complete Schedule A

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

1

X

Schedule B, Schedule of Contributors

2

Is the organization required to complete

?

~~~~~~~~~~~~~~~~~~~~~~

2

3

Did the organization engage in direct or indirect political campaign activities on behalf of or in opposition to candidates for

X

If "Yes," complete Schedule C, Part I

public office?

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

3

4

Section 501(c)(3) organizations.

Did the organization engage in lobbying activities, or have a section 501(h) election in effect

X

If "Yes," complete Schedule C, Part II

during the tax year?

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

4

5

Is the organization a section 501(c)(4), 501(c)(5), or 501(c)(6) organization that receives membership dues, assessments, or

X

If "Yes," complete Schedule C, Part III

similar amounts as defined in Revenue Procedure 98-19?

~~~~~~~~~~~~~~

5

6

Did the organization maintain any donor advised funds or any similar funds or accounts for which donors have the right to

X

If "Yes," complete Schedule D, Part I

provide advice on the distribution or investment of amounts in such funds or accounts?

6

7

Did the organization receive or hold a conservation easement, including easements to preserve open space,

X

If "Yes," complete Schedule D, Part II

the environment, historic land areas, or historic structures?

~~~~~~~~~~~~~~

7

If "Yes," complete

8

Did the organization maintain collections of works of art, historical treasures, or other similar assets?

X

Schedule D, Part III

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

8

9

Did the organization report an amount in Part X, line 21, for escrow or custodial account liability; serve as a custodian for

amounts not listed in Part X; or provide credit counseling, debt management, credit repair, or debt negotiation services?

X

If "Yes," complete Schedule D, Part IV

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

9

10

Did the organization, directly or through a related organization, hold assets in temporarily restricted endowments, permanent

X

If "Yes," complete Schedule D, Part V

endowments, or quasi-endowments?

~~~~~~~~~~~~~~~~~~~~~~~~

10

11

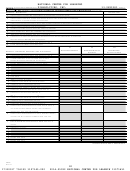

If the organization's answer to any of the following questions is "Yes," then complete Schedule D, Parts VI, VII, VIII, IX, or X

as applicable.

If "Yes," complete Schedule D,

a

Did the organization report an amount for land, buildings, and equipment in Part X, line 10?

X

Part VI

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

11a

b

Did the organization report an amount for investments - other securities in Part X, line 12 that is 5% or more of its total

X

If "Yes," complete Schedule D, Part VII

assets reported in Part X, line 16?

~~~~~~~~~~~~~~~~~~~~~~~~~

11b

c

Did the organization report an amount for investments - program related in Part X, line 13 that is 5% or more of its total

X

If "Yes," complete Schedule D, Part VIII

assets reported in Part X, line 16?

~~~~~~~~~~~~~~~~~~~~~~~~~

11c

d

Did the organization report an amount for other assets in Part X, line 15 that is 5% or more of its total assets reported in

X

If "Yes," complete Schedule D, Part IX

Part X, line 16?

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

11d

X

If "Yes," complete Schedule D, Part X

e

Did the organization report an amount for other liabilities in Part X, line 25?

~~~~~~

11e

f

Did the organization's separate or consolidated financial statements for the tax year include a footnote that addresses

X

If "Yes," complete Schedule D, Part X

the organization's liability for uncertain tax positions under FIN 48 (ASC 740)?

~~~~

11f

If "Yes," complete

12

a

Did the organization obtain separate, independent audited financial statements for the tax year?

X

Schedule D, Parts XI and XII

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

12a

b

Was the organization included in consolidated, independent audited financial statements for the tax year?

X

If "Yes," and if the organization answered "No" to line 12a, then completing Schedule D, Parts XI and XII is optional

~~~~~

12b

X

If "Yes," complete Schedule E

Is the organization a school described in section 170(b)(1)(A)(ii)?

13

~~~~~~~~~~~~~~

13

X

14

a

Did the organization maintain an office, employees, or agents outside of the United States?

~~~~~~~~~~~~~~~~

14a

b

Did the organization have aggregate revenues or expenses of more than $10,000 from grantmaking, fundraising, business,

investment, and program service activities outside the United States, or aggregate foreign investments valued at $100,000

X

If "Yes," complete Schedule F, Parts I and IV

or more?

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

14b

Did the organization report on Part IX, column (A), line 3, more than $5,000 of grants or other assistance to or for any

15

X

If "Yes," complete Schedule F, Parts II and IV

foreign organization?

~~~~~~~~~~~~~~~~~~~~~~~~~~~~

15

Did the organization report on Part IX, column (A), line 3, more than $5,000 of aggregate grants or other assistance to

16

X

If "Yes," complete Schedule F, Parts III and IV

or for foreign individuals?

~~~~~~~~~~~~~~~~~~~~~~~~~~

16

17

Did the organization report a total of more than $15,000 of expenses for professional fundraising services on Part IX,

X

If "Yes," complete Schedule G, Part I

column (A), lines 6 and 11e?

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

17

18

Did the organization report more than $15,000 total of fundraising event gross income and contributions on Part VIII, lines

X

If "Yes," complete Schedule G, Part II

1c and 8a?

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

18

If "Yes,"

19

Did the organization report more than $15,000 of gross income from gaming activities on Part VIII, line 9a?

X

complete Schedule G, Part III

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

19

X

If "Yes," complete Schedule H

20

a

Did the organization operate one or more hospital facilities?

~~~~~~~~~~~~~~~~

20a

b

If "Yes" to line 20a, did the organization attach a copy of its audited financial statements to this return? ••••••••••

20b

990

Form

(2014)

432003

11-07-14

3

17330517 756359 1107145.000

2014.05092 NATIONAL CENTER FOR LEARNIN 11071451

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49 50

50