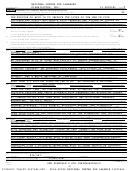

Form 990 - Return Of Organization Exempt From Income Tax - 2014 Page 32

ADVERTISEMENT

NATIONAL CENTER FOR LEARNING

DISABILITIES, INC.

13-2899381

4

Schedule D (Form 990) 2014

Page

Part XI

Reconciliation of Revenue per Audited Financial Statements With Revenue per Return.

Complete if the organization answered "Yes" to Form 990, Part IV, line 12a.

7,860,740.

1

Total revenue, gains, and other support per audited financial statements

~~~~~~~~~~~~~~~~~~~

1

2

Amounts included on line 1 but not on Form 990, Part VIII, line 12:

a

Net unrealized gains (losses) on investments

~~~~~~~~~~~~~~~~~~

2a

396,863.

b

Donated services and use of facilities

~~~~~~~~~~~~~~~~~~~~~~

2b

c

Recoveries of prior year grants

~~~~~~~~~~~~~~~~~~~~~~~~~

2c

d

Other (Describe in Part XIII.)

~~~~~~~~~~~~~~~~~~~~~~~~~~

2d

396,863.

e

Add lines

2a

through

2d

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

2e

7,463,877.

3

Subtract line

2e

from line

1

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

3

4

Amounts included on Form 990, Part VIII, line 12, but not on line 1:

a

Investment expenses not included on Form 990, Part VIII, line 7b

~~~~~~~~

4a

b

Other (Describe in Part XIII.)

~~~~~~~~~~~~~~~~~~~~~~~~~~

4b

0.

c

Add lines

4a

and

4b

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

4c

7,463,877.

(This must equal Form 990, Part I, line 12.)

5

Total revenue. Add lines

3

and

4c.

•••••••••••••••••

5

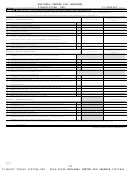

Part XII Reconciliation of Expenses per Audited Financial Statements With Expenses per Return.

Complete if the organization answered "Yes" to Form 990, Part IV, line 12a.

8,827,738.

1

Total expenses and losses per audited financial statements

~~~~~~~~~~~~~~~~~~~~~~~~~~

1

2

Amounts included on line 1 but not on Form 990, Part IX, line 25:

396,863.

a

Donated services and use of facilities

~~~~~~~~~~~~~~~~~~~~~~

2a

b

Prior year adjustments

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

2b

c

Other losses

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

2c

14,492.

~~~~~~~~~~~~~~~~~~~~~~~~~~

d

Other (Describe in Part XIII.)

2d

411,355.

e

Add lines

2a

through

2d

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

2e

8,416,383.

3

Subtract line

2e

from line

1

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

3

4

Amounts included on Form 990, Part IX, line 25, but not on line 1:

a

Investment expenses not included on Form 990, Part VIII, line 7b

~~~~~~~~

4a

b

Other (Describe in Part XIII.)

~~~~~~~~~~~~~~~~~~~~~~~~~~

4b

0.

c

Add lines

4a

and

4b

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

4c

8,416,383.

(This must equal Form 990, Part I, line 18.)

••••••••••••••••

5

Total expenses. Add lines

3

and

4c.

5

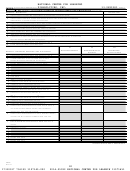

Part XIII Supplemental Information.

Provide the descriptions required for Part II, lines 3, 5, and 9; Part III, lines 1a and 4; Part IV, lines 1b and 2b; Part V, line 4; Part X, line 2; Part XI,

lines 2d and 4b; and Part XII, lines 2d and 4b. Also complete this part to provide any additional information.

PART X, LINE 2:

NCLD RECOGNIZES THE EFFECT OF INCOME TAX POSITIONS ONLY IF THOSE POSITIONS

ARE MORE LIKELY THAN NOT OF BEING SUSTAINED.

MANAGEMENT HAS DETERMINED

THAT NCLD HAD NO UNCERTAIN TAX POSITIONS THAT WOULD REQUIRE FINANCIAL

STATEMENT RECOGNITION OR DISCLOSURE.

NCLD IS NO LONGER SUBJECT TO

EXAMINATION BY THE APPLICABLE TAXING JURISDICTIONS FOR PERIODS PRIOR TO

2012.

PART XII, LINE 2D - OTHER ADJUSTMENTS:

LOSSES ON UNCOLLECTIBLE PLEDGES

14,492.

432054

Schedule D (Form 990) 2014

10-01-14

32

17330517 756359 1107145.000

2014.05092 NATIONAL CENTER FOR LEARNIN 11071451

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49 50

50