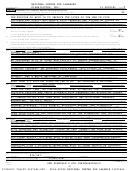

Form 990 - Return Of Organization Exempt From Income Tax - 2014 Page 35

ADVERTISEMENT

NATIONAL CENTER FOR LEARNING

DISABILITIES, INC.

13-2899381

Schedule G (Form 990 or 990-EZ) 2014

Page

2

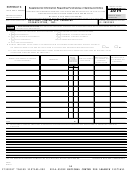

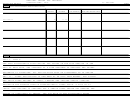

Part II

Fundraising Events.

Complete if the organization answered "Yes" to Form 990, Part IV, line 18, or reported more than $15,000

of fundraising event contributions and gross income on Form 990-EZ, lines 1 and 6b. List events with gross receipts greater than $5,000.

(a)

Event #1

(b)

Event #2

(c)

Other events

(d)

Total events

ANNUAL

NONE

(add col.

(a)

through

BENEFIT

col.

(c)

)

(event type)

(event type)

(total number)

2,407,875.

2,407,875.

1

Gross receipts

~~~~~~~~~~~~~~

2,252,848.

2,252,848.

2

Less: Contributions

~~~~~~~~~~~

155,027.

155,027.

Gross income (line 1 minus line 2) ••••

3

4

Cash prizes

~~~~~~~~~~~~~~~

5

Noncash prizes

~~~~~~~~~~~~~

15,469.

15,469.

Rent/facility costs ~~~~~~~~~~~~

6

86,800.

86,800.

7

Food and beverages

~~~~~~~~~~

8

Entertainment

~~~~~~~~~~~~~~

52,758.

52,758.

9

Other direct expenses ~~~~~~~~~~

155,027.

10

Direct expense summary. Add lines 4 through 9 in column (d)

~~~~~~~~~~~~~~~~~~~~~~~~ |

0.

11

Net income summary. Subtract line 10 from line 3, column (d)

•••••••••••••••••••••••• |

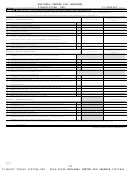

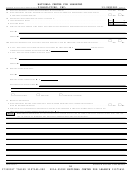

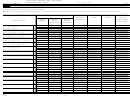

Part III

Gaming.

Complete if the organization answered "Yes" to Form 990, Part IV, line 19, or reported more than

$15,000 on Form 990-EZ, line 6a.

Pull tabs/instant

(b)

(d)

Total gaming (add

(a)

Bingo

(c)

Other gaming

bingo/progressive bingo

col.

(a)

through col.

(c)

)

1

Gross revenue ••••••••••••••

2

Cash prizes

~~~~~~~~~~~~~~~

Noncash prizes

3

~~~~~~~~~~~~~

Rent/facility costs

4

~~~~~~~~~~~~

5

Other direct expenses

••••••••••

Yes

%

Yes

%

Yes

%

6

Volunteer labor ~~~~~~~~~~~~~

No

No

No

7

Direct expense summary. Add lines 2 through 5 in column (d)

~~~~~~~~~~~~~~~~~~~~~~~~ |

••••••••••••••••••••• |

8

Net gaming income summary. Subtract line 7 from line 1, column (d)

Enter the state(s) in which the organization conducts gaming activities:

9

a

Is the organization licensed to conduct gaming activities in each of these states?

~~~~~~~~~~~~~~~~~~~~

Yes

No

b

If "No," explain:

10

a

Were any of the organization's gaming licenses revoked, suspended or terminated during the tax year?

~~~~~~~~~

Yes

No

b

If "Yes," explain:

Schedule G (Form 990 or 990-EZ) 2014

432082 08-28-14

35

17330517 756359 1107145.000

2014.05092 NATIONAL CENTER FOR LEARNIN 11071451

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49 50

50