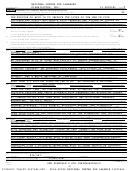

Form 990 - Return Of Organization Exempt From Income Tax - 2014 Page 8

ADVERTISEMENT

NATIONAL CENTER FOR LEARNING

DISABILITIES, INC.

13-2899381

8

Page

Form 990 (2014)

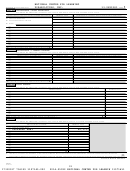

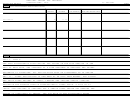

Part VII

(continued)

Section A. Officers, Directors, Trustees, Key Employees, and Highest Compensated Employees

(B)

(C)

(A)

(D)

(E)

(F)

Position

Average

Name and title

Reportable

Reportable

Estimated

(do not check more than one

hours per

compensation

compensation

amount of

box, unless person is both an

officer and a director/trustee)

week

from

from related

other

(list any

the

organizations

compensation

hours for

organization

(W-2/1099-MISC)

from the

related

(W-2/1099-MISC)

organization

organizations

and related

below

organizations

line)

1.00

(18) ALAN D. PESKY

X

0.

0.

0.

BOARD MEMBER

1.00

(19) CASSIA SCHIFTER

X

0.

0.

0.

BOARD MEMBER

1.00

(20) SALLY QUINN

X

0.

0.

0.

BOARD MEMBER

1.00

(21) ANDREA DAVIS PINKNEY

X

0.

0.

0.

BOARD MEMBER THROUGH 4/15

1.00

(22) STAN WATTLES

X

0.

0.

0.

BOARD MEMBER THROUGH 4/15

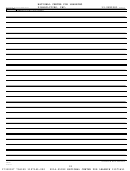

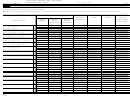

40.00

(23) JAMES WENDORF

X

229,258.

0.

36,435.

EXECUTIVE DIRECTOR

40.00

(24) ALAN BENDICH

X

125,354.

0.

35,791.

DIRECTOR FINANCE & OPERATI

40.00

(25) KEVIN HAGER

X

167,660.

0.

20,433.

CHIEF COMMUNICATIONS & ENG

40.00

(26) LINDSAY JONES

X

127,870.

0.

45,967.

DIRECTOR PUBLIC POLICY & ADVOCACY

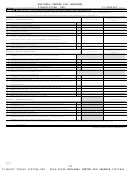

650,142.

0. 138,626.

1b

Sub-total

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ |

477,134.

0.

87,240.

c

Total from continuation sheets to Part VII, Section A

~~~~~~~~~~ |

1,127,276.

0. 225,866.

d

Total (add lines 1b and 1c)

•••••••••••••••••••••••• |

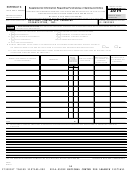

2

Total number of individuals (including but not limited to those listed above) who received more than $100,000 of reportable

8

compensation from the organization |

Yes

No

3

Did the organization list any

former

officer, director, or trustee, key employee, or highest compensated employee on

X

If "Yes," complete Schedule J for such individual

line 1a?

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

3

4

For any individual listed on line 1a, is the sum of reportable compensation and other compensation from the organization

X

If "Yes," complete Schedule J for such individual

and related organizations greater than $150,000?

~~~~~~~~~~~~~

4

5

Did any person listed on line 1a receive or accrue compensation from any unrelated organization or individual for services

X

If "Yes," complete Schedule J for such person

rendered to the organization?

••••••••••••••••••••••••

5

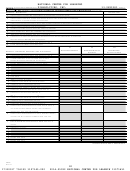

Section B. Independent Contractors

1

Complete this table for your five highest compensated independent contractors that received more than $100,000 of compensation from

the organization. Report compensation for the calendar year ending with or within the organization's tax year.

(A)

(B)

(C)

Name and business address

Description of services

Compensation

DIGITAL PULP, INC., 220 EAST 23RD STREET,

SUITE 900, NEW YORK, NY 10010

WEBSITE DEVELOPMENT

3,412,352.

PROPPER DALEY LLC, 6380 WILSHIRE BLVD,

15TH FLOOR, LOS ANGELES, CA 90048

CONSULTING SERVICES

317,082.

RTI RESEARCH, 1351 WASHINGTON BLVD., SUITE

900, STAMFORD, CT 06902-2448

CONSULTING SERVICES

220,256.

TENTHWAVE DIGITAL LLC, 35 PINELAWN ROAD

SUITE 207W, MELVILLE, NY 11747

WEBSITE DEVELOPMENT

138,300.

ALLEY DESIGN SOLUTIONS, INC.

6116 SW MCKINLEY AVE, DES MOINES, IA 50321 CONSULTING SERVICES

108,104.

2

Total number of independent contractors (including but not limited to those listed above) who received more than

5

$100,000 of compensation from the organization |

SEE PART VII, SECTION A CONTINUATION SHEETS

990

Form

(2014)

432008

11-07-14

8

17330517 756359 1107145.000

2014.05092 NATIONAL CENTER FOR LEARNIN 11071451

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49 50

50