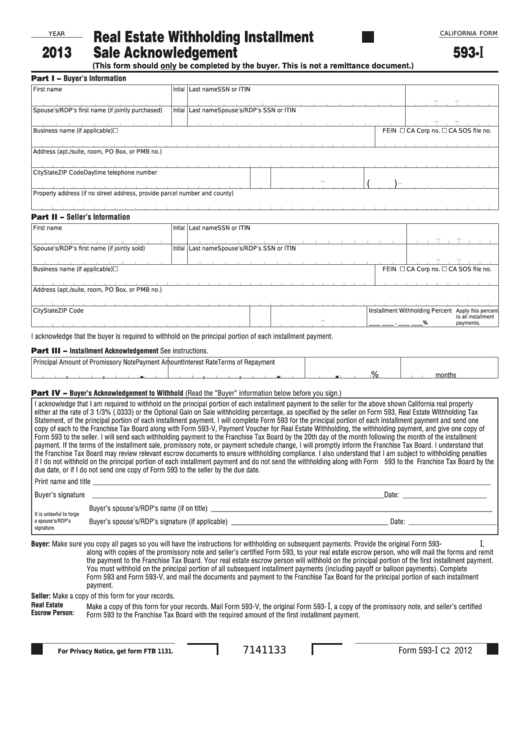

Real Estate Withholding Installment

YEAR

CALIFORNIA FORM

2013

Sale Acknowledgement

593-I

(This form should only be completed by the buyer. This is not a remittance document.)

Part I – Buyer’s Information

First name

Initial Last name

SSN or ITIN

- -

Spouse‘s/RDP‘s first name (if jointly purchased)

Initial Last name

Spouse’s/RDP’s SSN or ITIN

- -

FEIN

CA Corp no. CA SOS file no.

Business name (if applicable)

Address (apt./suite, room, PO Box, or PMB no.)

City

State ZIP Code

Daytime telephone number

-

-

(

)

Property address (if no street address, provide parcel number and county)

Part II – Seller’s Information

First name

Initial Last name

SSN or ITIN

- -

Spouse‘s/RDP‘s first name (if jointly sold)

Initial Last name

Spouse’s/RDP’s SSN or ITIN

- -

FEIN

CA Corp no. CA SOS file no.

Business name (if applicable)

Address (apt./suite, room, PO Box, or PMB no.)

City

State

ZIP Code

Installment Withholding Percent

Apply this percent

-

to all installment

____ ____ . ____ ____%

payments.

I acknowledge that the buyer is required to withhold on the principal portion of each installment payment.

Part III –

Installment Acknowledgement See instructions.

Principal Amount of Promissory Note

Payment Amount

Interest Rate

Terms of Repayment

.

.

.

,

,

,

,

months

%

Part IV –

Buyer’s Acknowledgement to Withhold (Read the “Buyer” information below before you sign.)

I acknowledge that I am required to withhold on the principal portion of each installment payment to the seller for the above shown California real property

either at the rate of 3 1/3% (.0333) or the Optional Gain on Sale withholding percentage, as specified by the seller on Form 593, Real Estate Withholding Tax

Statement, of the principal portion of each installment payment. I will complete Form 593 for the principal portion of each installment payment and send one

copy of each to the Franchise Tax Board along with Form 593-V, Payment Voucher for Real Estate Withholding, the withholding payment, and give one copy of

Form 593 to the seller. I will send each withholding payment to the Franchise Tax Board by the 20th day of the month following the month of the installment

payment. If the terms of the installment sale, promissory note, or payment schedule change, I will promptly inform the Franchise Tax Board. I understand that

the Franchise Tax Board may review relevant escrow documents to ensure withholding compliance. I also understand that I am subject to withholding penalties

if I do not withhold on the principal portion of each installment payment and do not send the withholding along with Form 593 to the Franchise Tax Board by the

due date, or if I do not send one copy of Form 593 to the seller by the due date.

Print name and title _____________________________________________________________________________________________________________

Buyer’s signature

________________________________________________________________________________ Date: _______________________

Buyer’s spouse’s/RDP’s name (if on title) _____________________________________________________________________________

It is unlawful to forge

Buyer’s spouse’s/RDP’s signature (if applicable) ___________________________________________ Date:

a spouse’s/RDP’s

_________________________

signature.

Buyer:

Make sure you copy all pages so you will have the instructions for withholding on subsequent payments. Provide the original Form 593-

I

,

along with copies of the promissory note and seller’s certified Form 593, to your real estate escrow person, who will mail the forms and remit

the payment to the Franchise Tax Board. Your real estate escrow person will withhold on the principal portion of the first installment payment.

You must withhold on the principal portion of all subsequent installment payments (including payoff or balloon payments). Complete

Form 593 and Form 593-V, and mail the documents and payment to the Franchise Tax Board for the principal portion of each installment

payment.

Seller:

Make a copy of this form for your records.

Real Estate

I

Make a copy of this form for your records. Mail Form 593-V, the original Form 593-

, a copy of the promissory note, and seller’s certified

Escrow Person:

Form 593 to the Franchise Tax Board with the required amount of the first installment payment.

Form 593-

2012

7141133

I

C2

For Privacy Notice, get form FTB 1131.

1

1 2

2 3

3