State of Georgia Department of Revenue

KEEP THESE INSTRUCTIONS AND WORKSHEET WITH YOUR RECORDS

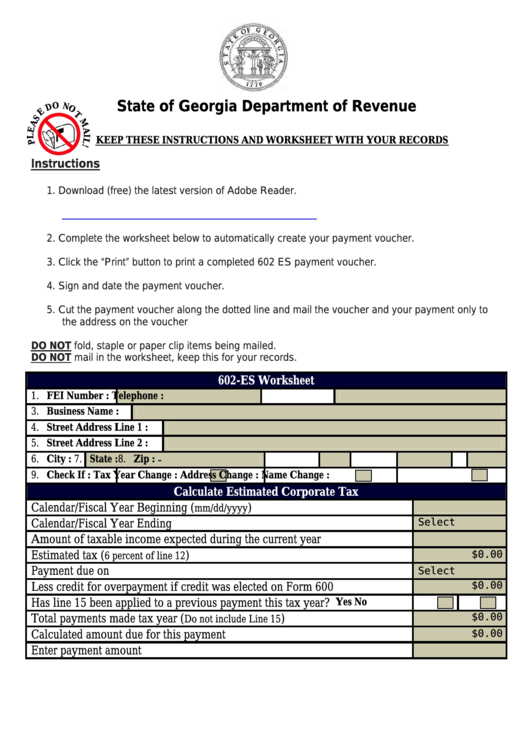

Instructions

1. Download (free) the latest version of Adobe Reader.

2. Complete the worksheet below to automatically create your payment voucher.

3. Click the “Print” button to print a completed 602 ES payment voucher.

4. Sign and date the payment voucher.

5. Cut the payment voucher along the dotted line and mail the voucher and your payment only to

the address on the voucher

DO NOT fold, staple or paper clip items being mailed.

DO NOT mail in the worksheet, keep this for your records.

602-ES Worksheet

1. FEI Number :

Telephone :

3. Business Name :

4. Street Address Line 1 :

5. Street Address Line 2 :

6. City :

7. State :

8. Zip :

-

9. Check If :

Tax Year Change :

Address Change :

Name Change :

Calculate Estimated Corporate Tax

Calendar/Fiscal Year Beginning (

) ....................................................

mm/dd/yyyy

Calendar/Fiscal Year Ending ..............................................................................

Select

Amount of taxable income expected during the current year .............................

Estimated tax (

) .........................................................................

$0.00

6 percent of line 12

Payment due on ...................................................................................................

Select

$0.00

Less credit for overpayment if credit was elected on Form 600 .........................

Has line 15 been applied to a previous payment this tax year? ...........................

Yes

No

$0.00

Total payments made tax year (

) .........................................

Do not include Line 15

Calculated amount due for this payment .............................................................

$0.00

Enter payment amount .........................................................................................

Print

Clear

1

1 2

2