Form Ct-32-S - New York Bank S Corporation Franchise Tax Return - 2013

ADVERTISEMENT

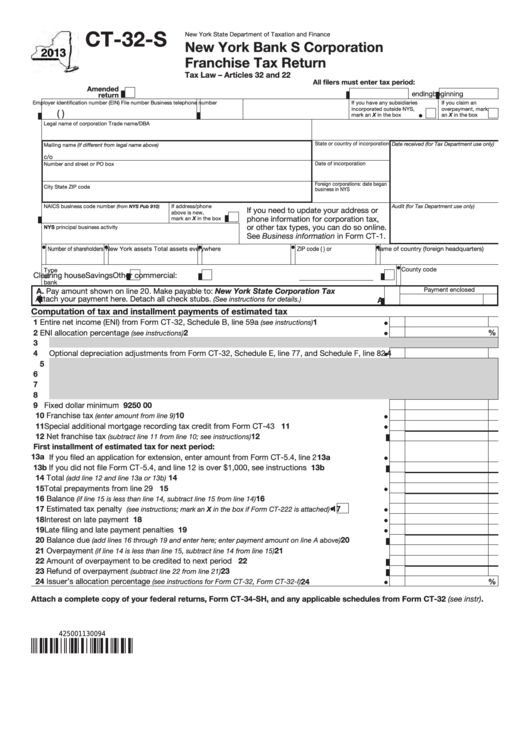

CT-32-S

New York State Department of Taxation and Finance

New York Bank S Corporation

Franchise Tax Return

Tax Law – Articles 32 and 22

All filers must enter tax period:

Amended

beginning

ending

return

Employer identification number (EIN)

File number

Business telephone number

If you have any subsidiaries

If you claim an

incorporated outside NYS,

overpayment, mark

(

)

mark an X in the box

an X in the box

Legal name of corporation

Trade name/DBA

State or country of incorporation

Date received (for Tax Department use only)

Mailing name (if different from legal name above)

c/o

Date of incorporation

Number and street or PO box

Foreign corporations: date began

City

State

ZIP code

business in NYS

NAICS business code number

If address/phone

Audit (for Tax Department use only)

(from NYS Pub 910)

If you need to update your address or

above is new,

phone information for corporation tax,

mark an X in the box

or other tax types, you can do so online.

NYS principal business activity

See Business information in Form CT-1.

Number of shareholders

New York assets

Total assets everywhere

ZIP code (U.S. headquarters) or

Name of country (foreign headquarters)

County code

Type

of

Clearing house

Savings

Other commercial:

bank

Payment enclosed

A. Pay amount shown on line 20. Make payable to: New York State Corporation Tax

Attach your payment here. Detach all check stubs.

(See instructions for details.)

A

Computation of tax and installment payments of estimated tax

1 Entire net income (ENI) from Form CT-32, Schedule B, line 59a

............................

1

(see instructions)

2 ENI allocation percentage

......................................................................................

2

%

(see instructions)

3

4 Optional depreciation adjustments from Form CT-32, Schedule E, line 77, and Schedule F, line 82

4

5

6

7

8

9 Fixed dollar minimum .........................................................................................................................

9

250 00

10 Franchise tax

10

..............................................................................................

(enter amount from line 9)

11 Special additional mortgage recording tax credit from Form CT-43 ................................................

11

12 Net franchise tax

...........................................................

12

(subtract line 11 from line 10; see instructions)

First installment of estimated tax for next period:

13a If you filed an application for extension, enter amount from Form CT-5.4, line 2 ..............................

13a

13b If you did not file Form CT-5.4, and line 12 is over $1,000, see instructions ...................................

13b

14 Total

14

....................................................................................................

(add line 12 and line 13a or 13b)

15 Total prepayments from line 29 ........................................................................................................

15

16 Balance

...........................................................

16

(if line 15 is less than line 14, subtract line 15 from line 14)

17 Estimated tax penalty

17

..............

(see instructions; mark an X in the box if Form CT-222 is attached)

18 Interest on late payment ..................................................................................................................

18

19 Late filing and late payment penalties .............................................................................................

19

20 Balance due

..................

20

(add lines 16 through 19 and enter here; enter payment amount on line A above)

21 Overpayment

21

..................................................

(if line 14 is less than line 15, subtract line 14 from line 15)

22 Amount of overpayment to be credited to next period ...................................................................

22

23 Refund of overpayment

.........................................................................

23

(subtract line 22 from line 21)

24 Issuer’s allocation percentage

.....................................

24

%

(see instructions for Form CT-32, Form CT-32-I)

Attach a complete copy of your federal returns, Form CT-34-SH, and any applicable schedules from Form CT-32 (see instr).

425001130094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2