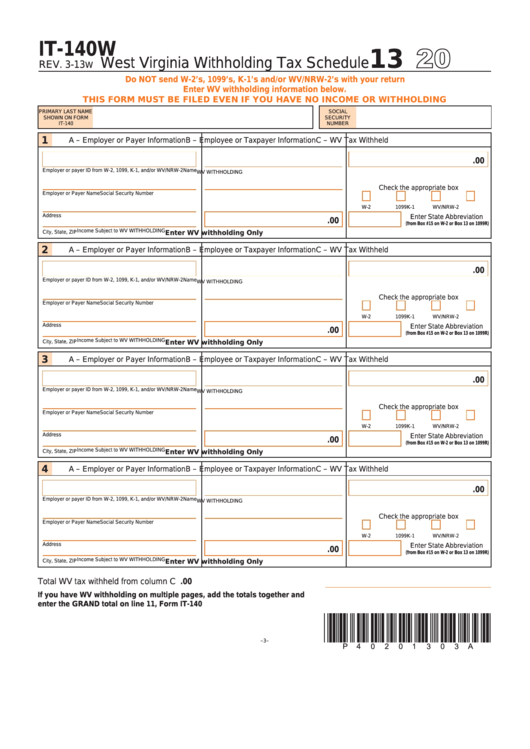

13

IT-140W

West Virginia Withholding Tax Schedule

REV. 3-13

W

Do NoT send W-2’s, 1099’s, K-1’s and/or WV/NRW-2’s with your return

Enter WV withholding information below.

This fOrm musT be fileD even if yOu have nO incOme Or wiThhOlDing

PRIMaRY LaST NaME

SOCIaL

SHOWN ON FORM

SECuRITY

IT-140

NuMbER

1

a – Employer or Payer Information

b – Employee or Taxpayer Information

C – WV Tax Withheld

.00

Employer or payer ID from W-2, 1099, k-1, and/or WV/NRW-2

Name

WV WITHHOLDINg

Check the appropriate box

Employer or Payer Name

Social Security Number

W-2

1099

k-1

WV/NRW-2

address

Enter State abbreviation

.00

(from Box #15 on W-2 or Box 13 on 1099R)

enter wv withholding Only

Income Subject to WV WITHHOLDINg

City, State, ZIP

2

a – Employer or Payer Information

b – Employee or Taxpayer Information

C – WV Tax Withheld

.00

Employer or payer ID from W-2, 1099, k-1, and/or WV/NRW-2

Name

WV WITHHOLDINg

Check the appropriate box

Employer or Payer Name

Social Security Number

W-2

1099

k-1

WV/NRW-2

address

Enter State abbreviation

.00

(from Box #15 on W-2 or Box 13 on 1099R)

enter wv withholding Only

Income Subject to WV WITHHOLDINg

City, State, ZIP

3

a – Employer or Payer Information

b – Employee or Taxpayer Information

C – WV Tax Withheld

.00

Employer or payer ID from W-2, 1099, k-1, and/or WV/NRW-2

Name

WV WITHHOLDINg

Check the appropriate box

Employer or Payer Name

Social Security Number

W-2

1099

k-1

WV/NRW-2

address

Enter State abbreviation

.00

(from Box #15 on W-2 or Box 13 on 1099R)

enter wv withholding Only

Income Subject to WV WITHHOLDINg

City, State, ZIP

4

a – Employer or Payer Information

b – Employee or Taxpayer Information

C – WV Tax Withheld

.00

Employer or payer ID from W-2, 1099, k-1, and/or WV/NRW-2

Name

WV WITHHOLDINg

Check the appropriate box

Employer or Payer Name

Social Security Number

W-2

1099

k-1

WV/NRW-2

address

Enter State abbreviation

.00

(from Box #15 on W-2 or Box 13 on 1099R)

enter wv withholding Only

Income Subject to WV WITHHOLDINg

City, State, ZIP

Total WV tax withheld from column C above....................................................

.00

If you have WV withholding on multiple pages, add the totals together and

enter the GRaND total on line 11, Form IT-140

*p40201303a*

–3–

1

1