Form Sc Sch.tc-37 - Whole Effluent Toxicity Testing

ADVERTISEMENT

STATE OF SOUTH CAROLINA

1350

1350

SC SCH.TC-37

DEPARTMENT OF REVENUE

WHOLE EFFLUENT

(Rev. 10/10/07)

TOXICITY TESTING

3428

20

Attach to your Income Tax Return

Names As Shown On Tax Return

Fed. EI No.

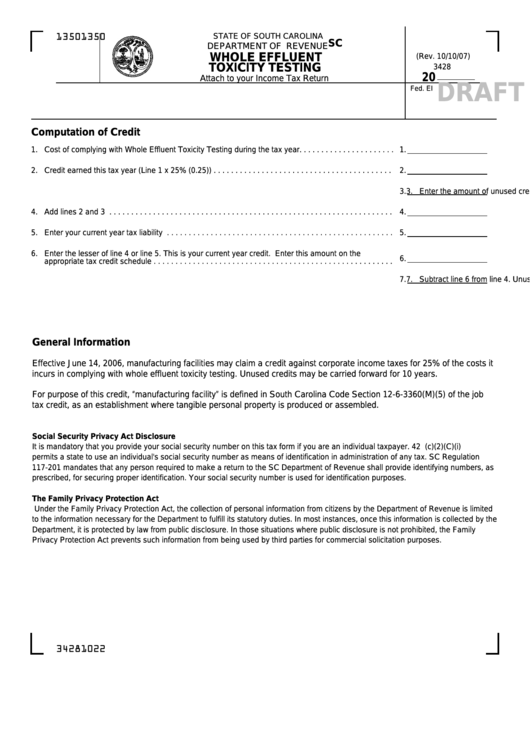

Computation of Credit

1. Cost of complying with Whole Effluent Toxicity Testing during the tax year. . . . . . . . . . . . . . . . . . . . . .

1.

2. Credit earned this tax year (Line 1 x 25% (0.25)) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2.

3. Enter the amount of unused credit carried forward from previous tax years . . . . . . . . . . . . . . . . . . . . .

3.

4. Add lines 2 and 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4.

5. Enter your current year tax liability . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5.

6. Enter the lesser of line 4 or line 5. This is your current year credit. Enter this amount on the

6.

appropriate tax credit schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7. Subtract line 6 from line 4. Unused credits may be carried forward for up to 10 years. . . . . . . . . . . . . .

7.

General Information

Effective June 14, 2006, manufacturing facilities may claim a credit against corporate income taxes for 25% of the costs it

incurs in complying with whole effluent toxicity testing. Unused credits may be carried forward for 10 years.

For purpose of this credit, “manufacturing facility” is defined in South Carolina Code Section 12-6-3360(M)(5) of the job

tax credit, as an establishment where tangible personal property is produced or assembled.

Social Security Privacy Act Disclosure

It is mandatory that you provide your social security number on this tax form if you are an individual taxpayer. 42 U.S.C 405(c)(2)(C)(i)

permits a state to use an individual's social security number as means of identification in administration of any tax. SC Regulation

117-201 mandates that any person required to make a return to the SC Department of Revenue shall provide identifying numbers, as

prescribed, for securing proper identification. Your social security number is used for identification purposes.

The Family Privacy Protection Act

Under the Family Privacy Protection Act, the collection of personal information from citizens by the Department of Revenue is limited

to the information necessary for the Department to fulfill its statutory duties. In most instances, once this information is collected by the

Department, it is protected by law from public disclosure. In those situations where public disclosure is not prohibited, the Family

Privacy Protection Act prevents such information from being used by third parties for commercial solicitation purposes.

34281022

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1