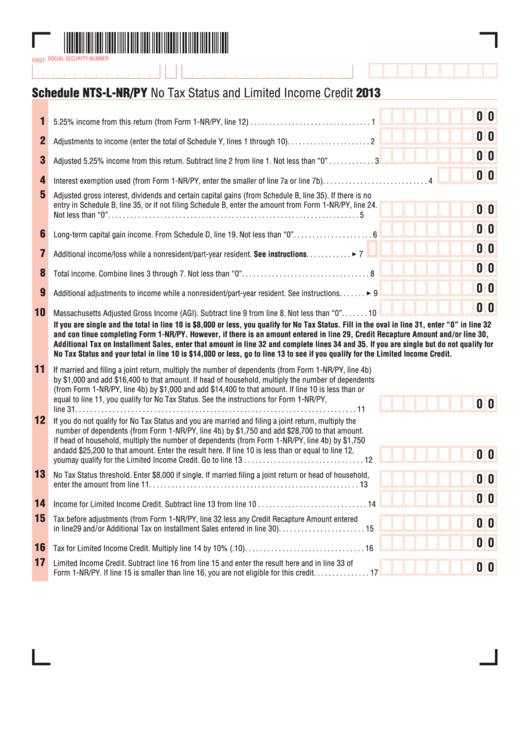

Schedule Nts-L-Nr/py - No Tax Status And Limited Income Credit - 2013

ADVERTISEMENT

SOCIAL SECURITY NUMBER

FIRST NAME

M.I.

LAST NAME

Schedule NTS-L-NR/PY No Tax Status and Limited Income Credit

2013

0 0

1

5.25% income from this return (from Form 1-NR/PY, line 12) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

0 0

2

Adjustments to income (enter the total of Schedule Y, lines 1 through 10) . . . . . . . . . . . . . . . . . . . . . . 2

0 0

3

Adjusted 5.25% income from this return. Subtract line 2 from line 1. Not less than “0” . . . . . . . . . . . . 3

0 0

4

Interest exemption used (from Form 1-NR/PY, enter the smaller of line 7a or line 7b) . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5

Adjusted gross interest, dividends and certain capital gains (from Schedule B, line 35). If there is no

entry in Schedule B, line 35, or if not filing Schedule B, enter the amount from Form 1-NR/PY, line 24.

0 0

Not less than “0” . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

0 0

6

Long-term capital gain income. From Schedule D, line 19. Not less than “0” . . . . . . . . . . . . . . . . . . . . . 6

0 0

7

Additional income/loss while a nonresident/part-year resident. See instructions . . . . . . . . . . . . 3 7

0 0

8

Total income. Combine lines 3 through 7. Not less than “0” . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

0 0

9

Additional adjustments to income while a nonresident/part-year resident. See instructions . . . . . . . 3 9

0 0

10

Massachusetts Adjusted Gross Income (AGI). Subtract line 9 from line 8. Not less than “0” . . . . . . . 10

If you are single and the total in line 10 is $8,000 or less, you qualify for No Tax Status. Fill in the oval in line 31, enter “0” in line 32

and con tinue completing Form 1-NR/PY. However, if there is an amount entered in line 29, Credit Recapture Amount and/or line 30,

Additional Tax on Installment Sales, enter that amount in line 32 and complete lines 34 and 35. If you are single but do not qualify for

No Tax Status and your total in line 10 is $14,000 or less, go to line 13 to see if you qualify for the Limited Income Credit.

11

If married and filing a joint return, multiply the number of dependents (from Form 1-NR/PY, line 4b)

by $1,000 and add $16,400 to that amount. If head of household, multiply the number of dependents

(from Form 1-NR/PY, line 4b) by $1,000 and add $14,400 to that amount. If line 10 is less than or

equal to line 11, you qualify for No Tax Status. See the instructions for Form 1-NR/PY,

0 0

line 31 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

12

If you do not qualify for No Tax Status and you are married and filing a joint return, multiply the

number of dependents (from Form 1-NR/PY, line 4b) by $1,750 and add $28,700 to that amount.

If head of household, multiply the number of dependents (from Form 1-NR/PY, line 4b) by $1,750

and add $25,200 to that amount. Enter the result here. If line 10 is less than or equal to line 12,

0 0

you may qualify for the Limited Income Credit. Go to line 13 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

13

No Tax Status threshold. Enter $8,000 if single. If married filing a joint return or head of household,

0 0

enter the amount from line 11 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

0 0

14

Income for Limited Income Credit. Subtract line 13 from line 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

15

Tax before adjustments (from Form 1-NR/PY, line 32 less any Credit Recapture Amount entered

0 0

in line 29 and/or Additional Tax on Installment Sales entered in line 30) . . . . . . . . . . . . . . . . . . . . . . . 15

0 0

16

Tax for Limited Income Credit. Multiply line 14 by 10% (.10) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

17

Limited Income Credit. Subtract line 16 from line 15 and enter the result here and in line 33 of

0 0

Form 1-NR/PY. If line 15 is smaller than line 16, you are not eligible for this credit . . . . . . . . . . . . . . . 17

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1