Form Rec - Reconciliation - 2017

Download a blank fillable Form Rec - Reconciliation - 2017 in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form Rec - Reconciliation - 2017 with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

*174611*

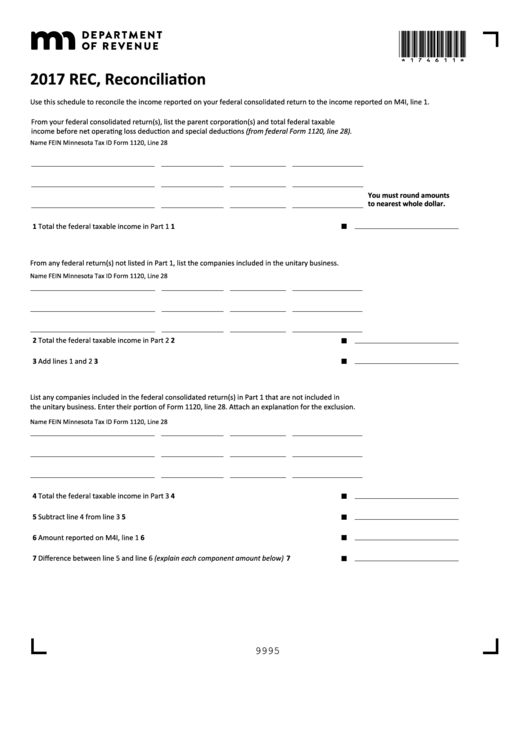

2017 REC, Reconciliation

Use this schedule to reconcile the income reported on your federal consolidated return to the income reported on M4I, line 1.

From your federal consolidated return(s), list the parent corporation(s) and total federal taxable

income before net operating loss deduction and special deductions (from federal Form 1120, line 28).

Name

FEIN

Minnesota Tax ID

Form 1120, Line 28

You must round amounts

to nearest whole dollar.

1 Total the federal taxable income in Part 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

From any federal return(s) not listed in Part 1, list the companies included in the unitary business.

Name

FEIN

Minnesota Tax ID

Form 1120, Line 28

2 Total the federal taxable income in Part 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Add lines 1 and 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

List any companies included in the federal consolidated return(s) in Part 1 that are not included in

the unitary business. Enter their portion of Form 1120, line 28. Attach an explanation for the exclusion.

Name

FEIN

Minnesota Tax ID

Form 1120, Line 28

4 Total the federal taxable income in Part 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5 Subtract line 4 from line 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6 Amount reported on M4I, line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

7 Difference between line 5 and line 6 (explain each component amount below) . . . . . . . . . . . 7

9995

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1