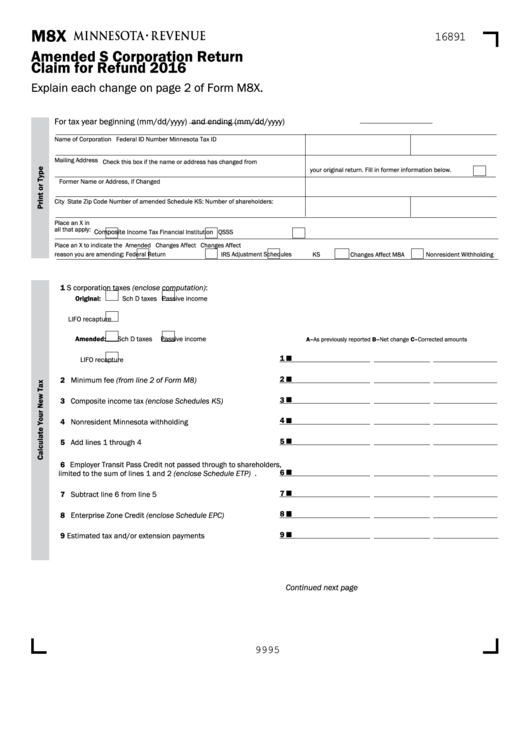

M8X

16891

Amended S Corporation Return

Claim for Refund 2016

Explain each change on page 2 of Form M8X .

For tax year beginning (mm/dd/yyyy)

and ending (mm/dd/yyyy)

Name of Corporation

Federal ID Number

Minnesota Tax ID

Mailing Address

Check this box if the name or address has changed from

your original return . Fill in former information below .

Former Name or Address, if Changed

City

State

Zip Code

Number of amended Schedule KS:

Number of shareholders:

Place an X in

all that apply:

Composite

Income Tax

Financial Institution

QSSS

Place an X to indicate the

Amended

Changes Affect

Changes Affect

reason you are amending:

Federal Return

IRS Adjustment

Schedules KS

Changes Affect M8A

Nonresident Withholding

1 S corporation taxes (enclose computation):

Original:

Sch D taxes

Passive income

LIFO recapture

Amended:

Sch D taxes

Passive income

A–As previously reported

B–Net change

C–Corrected amounts

1

LIFO recapture . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

2 Minimum fee (from line 2 of Form M8) . . . . . . . . . . . . . . . . . .

3

3 Composite income tax (enclose Schedules KS) . . . . . . . . . . . .

4

4 Nonresident Minnesota withholding . . . . . . . . . . . . . . . . . . . . .

5

5 Add lines 1 through 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6 Employer Transit Pass Credit not passed through to shareholders,

6

limited to the sum of lines 1 and 2 (enclose Schedule ETP) .

7

7 Subtract line 6 from line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

8 Enterprise Zone Credit (enclose Schedule EPC) . . . . . . . . . . .

9

9 Estimated tax and/or extension payments . . . . . . . . . . . . . . .

Continued next page

9995

1

1 2

2 3

3 4

4