*173911*

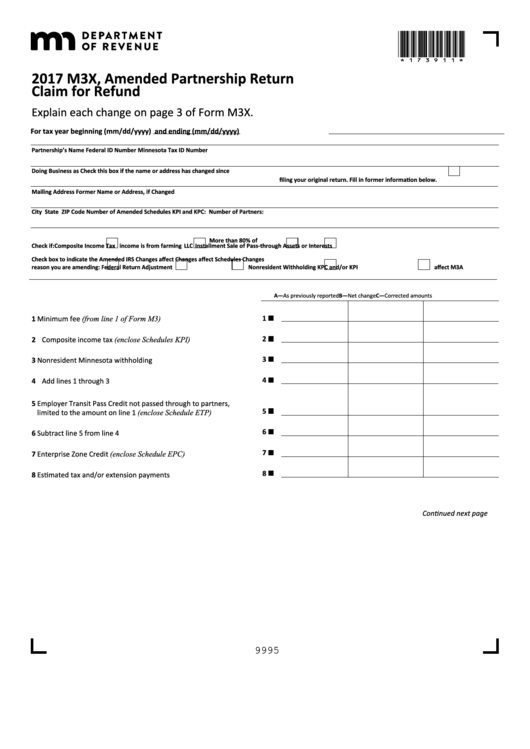

2017 M3X, Amended Partnership Return

Claim for Refund

Explain each change on page 3 of Form M3X .

For tax year beginning (mm/dd/yyyy)

and ending (mm/dd/yyyy)

Partnership’s Name

Federal ID Number

Minnesota Tax ID Number

Doing Business as

Check this box if the name or address has changed since

filing your original return. Fill in former information below.

Mailing Address

Former Name or Address, if Changed

City

State

ZIP Code

Number of Amended Schedules KPI and KPC:

Number of Partners:

More than 80% of

Check if:

Composite Income Tax

income is from farming

LLC

Installment Sale of Pass-through Assets or Interests

Check box to indicate the

Amended

IRS

Changes affect

Changes affect Schedules

Changes

reason you are amending:

Federal Return

Adjustment

Nonresident Withholding

KPC and/or KPI

affect M3A

A—As previously reported

B—Net change

C—Corrected amounts

1 Minimum fee (from line 1 of Form M3) . . . . . . . . . . . . . . . . . . . . . . . . .

1

2

2 Composite income tax (enclose Schedules KPI) . . . . . . . . . . . . . . . . . .

3

3 Nonresident Minnesota withholding . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

4 Add lines 1 through 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5 Employer Transit Pass Credit not passed through to partners,

5

limited to the amount on line 1 (enclose Schedule ETP) . . . . . . . . . . .

6

6 Subtract line 5 from line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

7 Enterprise Zone Credit (enclose Schedule EPC) . . . . . . . . . . . . . . . . . .

8

8 Estimated tax and/or extension payments . . . . . . . . . . . . . . . . . . . . . . .

Continued next page

9995

1

1 2

2 3

3 4

4