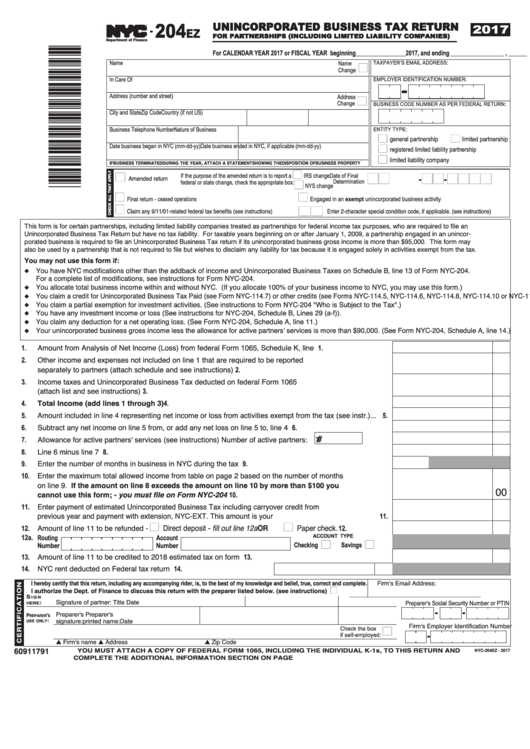

Form Nyc-204ez - Unincorporated Business Tax Return For Partnerships (Including Limited Liability Companies) - 2017

ADVERTISEMENT

204

UNINCORPORATED BUSINESS TAX RETURN

2017

-

EZ

TM

FOR PARTNERSHIPS (INCLUDING LIMITED LIABILITY COMPANIES)

Department of Finance

For CALENDAR YEAR 2017 or FISCAL YEAR beginning ________________2017, and ending _________________ , ______

Name

n

Name

TAXPAYER’S EMAIL ADDRESS:

Change

In Care Of

EMPLOYER IDENTIFICATION NUMBER:

Address (number and street)

Address

n

Change

BUSINESS CODE NUMBER AS PER FEDERAL RETURN:

City and State

Zip Code

Country (if not US)

Business Telephone Number

Nature of Business

ENTITY TYPE:

n

n

general partnership

limited partnership

n

Date business began in NYC (mm-dd-yy)

Date business ended in NYC, if applicable (mm-dd-yy)

registered limited liability partnership

n

limited liability company

,

IF BUSINESS TERMINATED DURING THE YEAR

ATTACH A STATEMENT SHOWING THE DISPOSITION OF BUSINESS PROPERTY

n

nn-nn-nnnn

n

If the purpose of the amended return is to report a

IRS change

Date of Final

Amended return

n

Determination

federal or state change, check the appropriate box:

NYS change

n

n

Final return - ceased operations

Engaged in an exempt unincorporated business activity

n

nn

Claim any 9/11/01-related federal tax benefits (see instructions)

Enter 2‑character special condition code, if applicable. (see instructions)

This form is for certain partnerships, including limited liability companies treated as partnerships for federal income tax purposes, who are required to file an

Unincorporated Business Tax Return but have no tax liability. For taxable years beginning on or after January 1, 2009, a partnership engaged in an unincor-

porated business is required to file an Unincorporated Business Tax return if its unincorporated business gross income is more than $95,000. This form may

also be used by a partnership that is not required to file but wishes to disclaim any liability for tax because it is engaged solely in activities exempt from the tax.

You may not use this form if:

You have NYC modifications other than the addback of income and Unincorporated Business Taxes on Schedule B, line 13 of Form NYC-204.

u

For a complete list of modifications, see instructions for Form NYC-204.

You allocate total business income within and without NYC. (If you allocate 100% of your business income to NYC, you may use this form.)

u

You claim a credit for Unincorporated Business Tax Paid (see Form NYC-114.7) or other credits (see Forms NYC-114.5, NYC-114.6, NYC-114.8, NYC-114.10 or NYC-114.12).

u

You claim a partial exemption for investment activities. (See instructions to Form NYC-204 "Who is Subject to the Tax".)

u

You have any investment income or loss (See instructions for NYC-204, Schedule B, Lines 29 (a-f)).

u

You claim any deduction for a net operating loss. (See Form NYC-204, Schedule A, line 11.)

u

Your unincorporated business gross income less the allowance for active partners' services is more than $90,000. (See Form NYC-204, Schedule A, line 14.)

u

1.

Amount from Analysis of Net Income (Loss) from federal Form 1065, Schedule K, line 1............................ 1.

2.

Other income and expenses not included on line 1 that are required to be reported

separately to partners (attach schedule and see instructions) ...................................................................... 2.

3.

Income taxes and Unincorporated Business Tax deducted on federal Form 1065

(attach list and see instructions).................................................................................................................... 3.

Total Income (add lines 1 through 3) ......................................................................................................... 4.

4.

5.

Amount included in line 4 representing net income or loss from activities exempt from the tax (see instr.) ... 5.

6.

Subtract any net income on line 5 from, or add any net loss on line 5 to, line 4 amount .............................. 6.

#

Allowance for active partners' services (see instructions) Number of active partners:

........................... 7.

7.

8.

Line 6 minus line 7 ........................................................................................................................................ 8.

9.

Enter the number of months in business in NYC during the tax year............................................................ 9.

Enter the maximum total allowed income from table on page 2 based on the number of months

10.

on line 9. If the amount on line 8 exceeds the amount on line 10 by more than $100 you

00

cannot use this form; - you must file on Form NYC-204 ....................................................................... 10.

Enter payment of estimated Unincorporated Business Tax including carryover credit from

11.

previous year and payment with extension, NYC-EXT. This amount is your overpayment............................. 11.

n

Direct deposit - fill out line 12a OR

n

Paper check

12.

Amount of line 11 to be refunded -

................... 12.

12a.

Routing

Account

ACCOUNT TYPE

n

n

Checking

Savings

Number

Number

Amount of line 11 to be credited to 2018 estimated tax on form NYC-5UB................................................. 13.

13.

14.

NYC rent deducted on Federal tax return .......................................... 14.

I hereby certify that this return, including any accompanying rider, is, to the best of my knowledge and belief, true, correct and complete.

Firm's Email Address:

I authorize the Dept. of Finance to discuss this return with the preparer listed below. (see instructions) .........YES

n

_____________________________________________

S

I G N

Signature of partner:

Title

Date

Preparer's Social Security Number or PTIN

:

HERE

Preparer's

Preparer's

P

'

REPARER

S

:

signature:

printed name:

Date

USE ONLY

Firm's Employer Identification Number

n

Check the box

if self-employed:

s Firm's name

s Address

s Zip Code

60911791

YOU MUST ATTACH A COPY OF FEDERAL FORM 1065, INCLUDING THE INDIVIDUAL K-1s, TO THIS RETURN AND

NYC-204EZ - 2017

COMPLETE THE ADDITIONAL INFORMATION SECTION ON PAGE 2. SEE PAGE2 FOR MAILING INSTRUCTIONS.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2