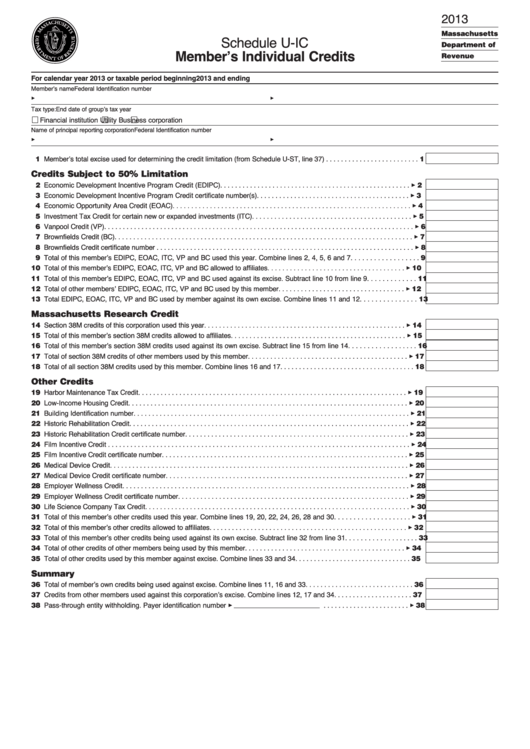

2013

Massachusetts

Schedule U-IC

Department of

Member’s Individual Credits

Revenue

For calendar year 2013 or taxable period beginning

2013 and ending

Member’s name

Federal Identification number

3

3

Tax type:

End date of group’s tax year

Financial institution

Utility

Business corporation

Name of principal reporting corporation

Federal Identification number

3

3

1 Member’s total excise used for determining the credit limitation (from Schedule U-ST, line 37) . . . . . . . . . . . . . . . . . . . . . . . . . 1

Credits Subject to 50% Limitation

2 Economic Development Incentive Program Credit (EDIPC) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 2

3 Economic Development Incentive Program Credit certificate number(s) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 3

4 Economic Opportunity Area Credit (EOAC) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 4

5 Investment Tax Credit for certain new or expanded investments (ITC) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 5

6 Vanpool Credit (VP) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 6

7 Brownfields Credit (BC) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 7

8 Brownfields Credit certificate number . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 8

9 Total of this member’s EDIPC, EOAC, ITC, VP and BC used this year. Combine lines 2, 4, 5, 6 and 7 . . . . . . . . . . . . . . . . . . 9

10 Total of this member’s EDIPC, EOAC, ITC, VP and BC allowed to affiliates . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 10

11 Total of this member’s EDIPC, EOAC, ITC, VP and BC used against its excise. Subtract line 10 from line 9. . . . . . . . . . . . . 11

12 Total of other members’ EDIPC, EOAC, ITC, VP and BC used by this member . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 12

13 Total EDIPC, EOAC, ITC, VP and BC used by member against its own excise. Combine lines 11 and 12 . . . . . . . . . . . . . . . 13

Massachusetts Research Credit

14 Section 38M credits of this corporation used this year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 14

15 Total of this member’s section 38M credits allowed to affiliates . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 15

16 Total of this member’s section 38M credits used against its own excise. Subtract line 15 from line 14 . . . . . . . . . . . . . . . . . . 16

17 Total of section 38M credits of other members used by this member . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 17

18 Total of all section 38M credits used by this member. Combine lines 16 and 17. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

Other Credits

19 Harbor Maintenance Tax Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 19

20 Low-Income Housing Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 20

21 Building Identification number. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 21

22 Historic Rehabilitation Credit. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 22

23 Historic Rehabilitation Credit certificate number. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 23

24 Film Incentive Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 24

25 Film Incentive Credit certificate number . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 25

26 Medical Device Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 26

27 Medical Device Credit certificate number . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 27

28 Employer Wellness Credit. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 28

29 Employer Wellness Credit certificate number. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 29

30 Life Science Company Tax Credit. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 30

31 Total of this member’s other credits used this year. Combine lines 19, 20, 22, 24, 26, 28 and 30 . . . . . . . . . . . . . . . . . . . . 3 31

32 Total of this member’s other credits allowed to affiliates . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 32

33 Total of this member’s other credits being used against its own excise. Subtract line 32 from line 31 . . . . . . . . . . . . . . . . . . . 33

34 Total of other credits of other members being used by this member . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 34

35 Total of other credits used by this member against excise. Combine lines 33 and 34 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 35

Summary

36 Total of member’s own credits being used against excise. Combine lines 11, 16 and 33 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 36

37 Credits from other members used against this corporation’s excise. Combine lines 12, 17 and 34 . . . . . . . . . . . . . . . . . . . . . 37

38 Pass-through entity withholding. Payer identification number 3

. . . . . . . . . . . . . . . . . . . . . . . 3 38

1

1