Form Nyc-3l -General Corporation Tax Return - 2017

ADVERTISEMENT

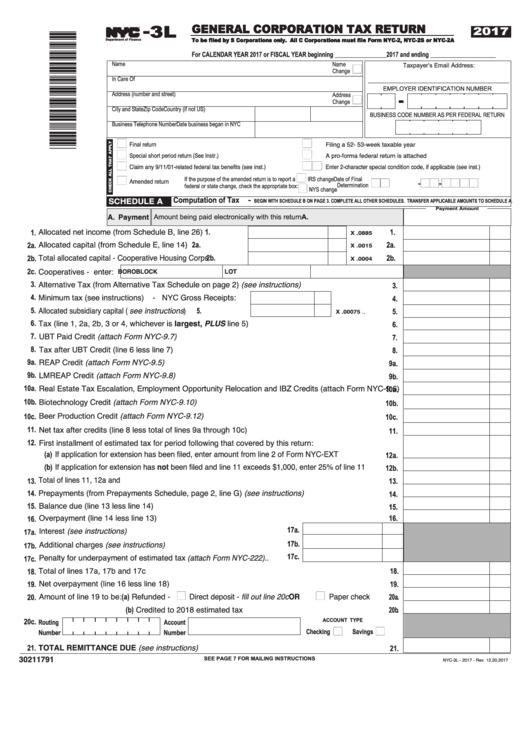

- 3L

G EN ERAL CO RPORATION TAX RETURN

2017

TM

To be filed by S Corporations only. All C Corporations must file Form NYC-2, NYC-2S or NYC-2A

Department of Finance

For CALENDAR YEAR 2017 or FISCAL YEAR beginning _______________ 2017 and ending ___________________

Name

Name

n

Taxpayer’s Email Address:

Change

In Care Of

__________________________________________

EMPLOYER IDENTIFICATION NUMBER

Address (number and street)

Address

n

Change

City and State

Zip Code

Country (if not US)

BUSINESS CODE NUMBER AS PER FEDERAL RETURN

Business Telephone Number

Date business began in NYC

n

n

Filing a 52- 53-week taxable year

Final return

n

n

Special short period return (See Instr.)

A pro-forma federal return is attached

n

nn

Claim any 9/11/01-related federal tax benefits (see inst.)

Enter 2‑character special condition code, if applicable (see inst.)

n

n

nn-nn-nnnn

If the purpose of the amended return is to report a

IRS change

Date of Final

Amended return

n

Determination

federal or state change, check the appropriate box:

NYS change

Computation of Tax -

SCHEDULE A

BEGIN WITH SCHEDULE B ON PAGE 3. COMPLETE ALL OTHER SCHEDULES. TRANSFER APPLICABLE AMOUNTS TO SCHEDULE A.

Payment Amount

A. Payment

A.

Amount being paid electronically with this return

Allocated net income (from Schedule B, line 26) ...........

1.

1.

1.

X .0885

Allocated capital (from Schedule E, line 14) .................. 2a.

2a.

2a.

X .0015

Total allocated capital - Cooperative Housing Corps. ........ 2b.

2b.

2b.

X .0004

2c.

Cooperatives - enter:

BORO

BLOCK

LOT

3.

Alternative Tax (from Alternative Tax Schedule on page 2) (see instructions)

3.

...................................

4.

Minimum tax (see instructions)

- NYC Gross Receipts:

..............

4.

5.

Allocated subsidiary capital (see instructions) ......................

5.

5.

X .00075 ..

Tax (line 1, 2a, 2b, 3 or 4, whichever is largest, PLUS line 5) ......................................................

6.

6.

7.

UBT Paid Credit (attach Form NYC-9.7) .......................................................................................

7.

8.

Tax after UBT Credit (line 6 less line 7).........................................................................................

8.

9a.

REAP Credit (attach Form NYC-9.5).............................................................................................

9a.

9b.

LMREAP Credit (attach Form NYC-9.8)........................................................................................

9b.

10a.

Real Estate Tax Escalation, Employment Opportunity Relocation and IBZ Credits (attach Form NYC-9.6)

10a.

10b.

Biotechnology Credit (attach Form NYC-9.10)..............................................................................

10b.

Beer Production Credit (attach Form NYC-9.12) ..........................................................................

10c.

10c.

11.

Net tax after credits (line 8 less total of lines 9a through 10c) ......................................................

11.

12.

First installment of estimated tax for period following that covered by this return:

(a) If application for extension has been filed, enter amount from line 2 of Form NYC-EXT ............

12a.

(b) If application for extension has not been filed and line 11 exceeds $1,000, enter 25% of line 11

12b.

Total of lines 11, 12a and 12b ...................................................................................................................

13.

13.

Prepayments (from Prepayments Schedule, page 2, line G) (see instructions) ...........................

14.

14.

Balance due (line 13 less line 14) .................................................................................................

15.

15.

Overpayment (line 14 less line 13)................................................................................................

16.

16.

17a.

Interest (see instructions) .................................................................

17a.

17b.

Additional charges (see instructions) ................................................

17b.

17c.

Penalty for underpayment of estimated tax (attach Form NYC-222)..

17c.

Total of lines 17a, 17b and 17c .....................................................................................................

18.

18.

Net overpayment (line 16 less line 18) .........................................................................................

19.

19.

n

n

Direct deposit - fill out line 20c

OR

Amount of line 19 to be: (a) Refunded -

Paper check

20a.

20.

(b) Credited to 2018 estimated tax ........................................................

20b.

20c.

Routing

Account

ACCOUNT TYPE

n

n

Checking

Savings

Number

Number

TOTAL REMITTANCE DUE (see instructions) .............................................................................

21.

21.

30211791

S E E PA G E 7 F O R M A I L I N G I N S T R U C T I O N S

NYC-3L - 2017 - Rev. 12.20.2017

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7