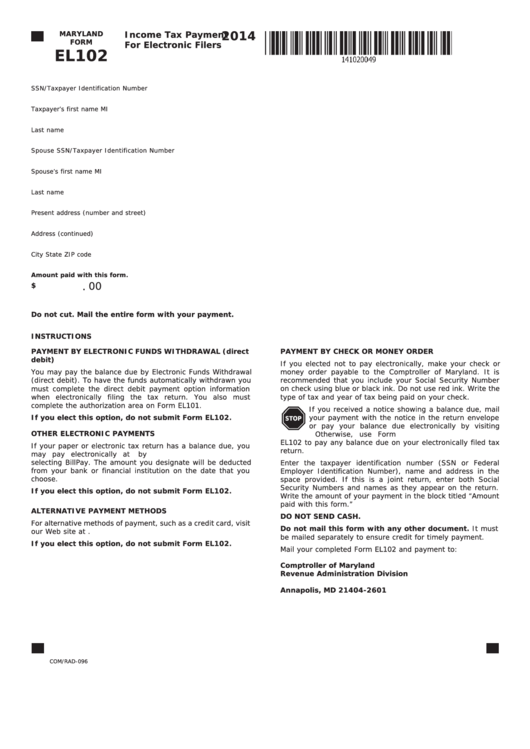

2014

Income Tax Payment

MARYLAND

FORM

For Electronic Filers

EL102

SSN/Taxpayer Identification Number

Taxpayer’s first name

MI

Last name

Spouse SSN/Taxpayer Identification Number

Spouse’s first name

MI

Last name

Present address (number and street)

Address (continued)

City

State ZIP code

Amount paid with this form.

00

$

.

Do not cut. Mail the entire form with your payment.

INSTRUCTIONS

PAYMENT BY ELECTRONIC FUNDS WITHDRAWAL (direct

PAYMENT BY CHECK OR MONEY ORDER

debit)

If you elected not to pay electronically, make your check or

You may pay the balance due by Electronic Funds Withdrawal

money order payable to the Comptroller of Maryland. It is

(direct debit). To have the funds automatically withdrawn you

recommended that you include your Social Security Number

must complete the direct debit payment option information

on check using blue or black ink. Do not use red ink. Write the

when electronically filing the tax return. You also must

type of tax and year of tax being paid on your check.

complete the authorization area on Form EL101.

If you received a notice showing a balance due, mail

If you elect this option, do not submit Form EL102.

your payment with the notice in the return envelope

STOP

or pay your balance due electronically by visiting

OTHER ELECTRONIC PAYMENTS

Otherwise, use Form

EL102 to pay any balance due on your electronically filed tax

If your paper or electronic tax return has a balance due, you

return.

may pay electronically at by

selecting BillPay. The amount you designate will be deducted

Enter the taxpayer identification number (SSN or Federal

from your bank or financial institution on the date that you

Employer Identification Number), name and address in the

choose.

space provided. If this is a joint return, enter both Social

Security Numbers and names as they appear on the return.

If you elect this option, do not submit Form EL102.

Write the amount of your payment in the block titled “Amount

paid with this form.”

ALTERNATIVE PAYMENT METHODS

DO NOT SEND CASH.

For alternative methods of payment, such as a credit card, visit

Do not mail this form with any other document. It must

our Web site at

be mailed separately to ensure credit for timely payment.

If you elect this option, do not submit Form EL102.

Mail your completed Form EL102 and payment to:

Comptroller of Maryland

Revenue Administration Division

P.O. Box 2601

Annapolis, MD 21404-2601

COM/RAD-096

1

1