Arizona Form 140es - Individual Estimated Income Tax Payment - 2014

ADVERTISEMENT

2014 Individual Estimated

Arizona Form

Income Tax Payment

140ES

You must round each estimated payment to whole dollars

Phone Numbers

(no cents).

Use Tax Table X or Y (in the 2013 tax instruction booklet)

For information or help, call one of the numbers listed:

to help estimate this year's tax liability. Figure this tax on

Phoenix

(602) 255-3381

your total annual income.

From area codes 520 and 928, toll-free

(800) 352-4090

Tax forms, instructions, and other tax information

Required Payments

If you need tax forms, instructions, and other tax

Arizona requires certain individuals to make estimated

information, go to the department’s Internet home page at

income tax payments.

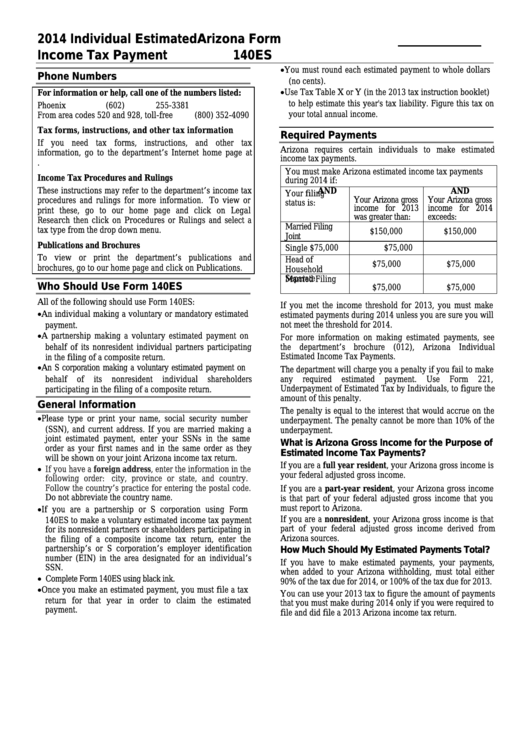

You must make Arizona estimated income tax payments

Income Tax Procedures and Rulings

during 2014 if:

These instructions may refer to the department’s income tax

AND

AND

Your filing

Your Arizona gross

Your Arizona gross

procedures and rulings for more information. To view or

status is:

income for 2013

income for 2014

print these, go to our home page and click on Legal

was greater than:

exceeds:

Research then click on Procedures or Rulings and select a

Married Filing

tax type from the drop down menu.

$150,000

$150,000

Joint

Publications and Brochures

Single

$75,000

$75,000

To view or print the department’s publications and

Head of

$75,000

$75,000

brochures, go to our home page and click on Publications.

Household

Married Filing

Who Should Use Form 140ES

$75,000

$75,000

Separate

All of the following should use Form 140ES:

If you met the income threshold for 2013, you must make

An individual making a voluntary or mandatory estimated

estimated payments during 2014 unless you are sure you will

not meet the threshold for 2014.

payment.

A partnership making a voluntary estimated payment on

For more information on making estimated payments, see

behalf of its nonresident individual partners participating

the department’s brochure (012), Arizona Individual

Estimated Income Tax Payments.

in the filing of a composite return.

An S corporation making a voluntary estimated payment on

The department will charge you a penalty if you fail to make

behalf

of

its

nonresident

individual

shareholders

any

required

estimated

payment.

Use

Form

221,

Underpayment of Estimated Tax by Individuals, to figure the

participating in the filing of a composite return.

amount of this penalty.

General Information

The penalty is equal to the interest that would accrue on the

Please type or print your name, social security number

underpayment. The penalty cannot be more than 10% of the

(SSN), and current address. If you are married making a

underpayment.

joint estimated payment, enter your SSNs in the same

What is Arizona Gross Income for the Purpose of

order as your first names and in the same order as they

Estimated Income Tax Payments?

will be shown on your joint Arizona income tax return.

If you are a full year resident, your Arizona gross income is

If you have a foreign address, enter the information in the

your federal adjusted gross income.

following order:

city, province or state, and country.

Follow the country’s practice for entering the postal code.

If you are a part-year resident, your Arizona gross income

Do not abbreviate the country name.

is that part of your federal adjusted gross income that you

If you are a partnership or S corporation using Form

must report to Arizona.

If you are a nonresident, your Arizona gross income is that

140ES to make a voluntary estimated income tax payment

part of your federal adjusted gross income derived from

for its nonresident partners or shareholders participating in

Arizona sources.

the filing of a composite income tax return, enter the

partnership’s or S corporation’s employer identification

How Much Should My Estimated Payments Total?

number (EIN) in the area designated for an individual’s

If you have to make estimated payments, your payments,

SSN.

when added to your Arizona withholding, must total either

Complete Form 140ES using black ink.

90% of the tax due for 2014, or 100% of the tax due for 2013.

Once you make an estimated payment, you must file a tax

You can use your 2013 tax to figure the amount of payments

return for that year in order to claim the estimated

that you must make during 2014 only if you were required to

payment.

file and did file a 2013 Arizona income tax return.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3