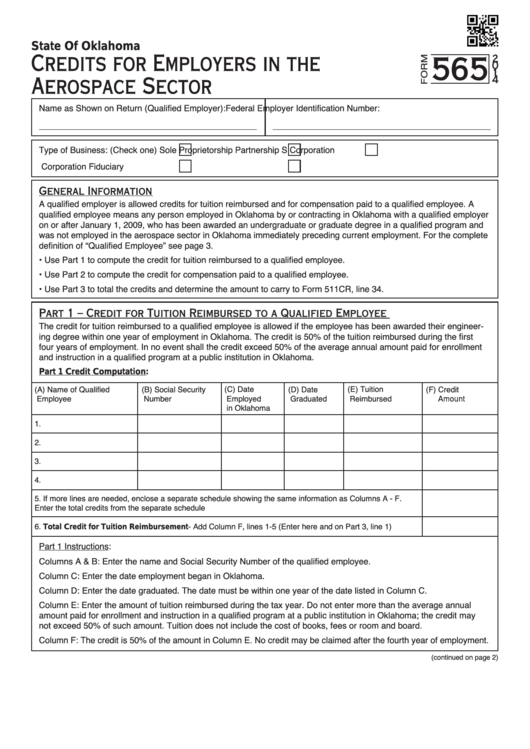

State Of Oklahoma

Credits for Employers in the

565

2

0

1

Aerospace Sector

4

Name as Shown on Return (Qualified Employer):

Federal Employer Identification Number:

Type of Business: (Check one)

Sole Proprietorship

Partnership

S Corporation

Corporation

Fiduciary

General Information

A qualified employer is allowed credits for tuition reimbursed and for compensation paid to a qualified employee. A

qualified employee means any person employed in Oklahoma by or contracting in Oklahoma with a qualified employer

on or after January 1, 2009, who has been awarded an undergraduate or graduate degree in a qualified program and

was not employed in the aerospace sector in Oklahoma immediately preceding current employment. For the complete

definition of “Qualified Employee” see page 3.

• Use Part 1 to compute the credit for tuition reimbursed to a qualified employee.

• Use Part 2 to compute the credit for compensation paid to a qualified employee.

• Use Part 3 to total the credits and determine the amount to carry to Form 511CR, line 34.

Part 1 – Credit for Tuition Reimbursed to a Qualified Employee

The credit for tuition reimbursed to a qualified employee is allowed if the employee has been awarded their engineer-

ing degree within one year of employment in Oklahoma. The credit is 50% of the tuition reimbursed during the first

four years of employment. In no event shall the credit exceed 50% of the average annual amount paid for enrollment

and instruction in a qualified program at a public institution in Oklahoma.

Part 1 Credit Computation:

(A) Name of Qualified

(B) Social Security

(C) Date

(D) Date

(E) Tuition

(F) Credit

Employee

Number

Employed

Graduated

Reimbursed

Amount

in Oklahoma

1.

2.

3.

4.

5.

If more lines are needed, enclose a separate schedule showing the same information as Columns A - F.

Enter the total credits from the separate schedule here....................................................................................

6.

Total Credit for Tuition Reimbursement - Add Column F, lines 1-5 (Enter here and on Part 3, line 1) .........

Part 1 Instructions:

Columns A & B: Enter the name and Social Security Number of the qualified employee.

Column C: Enter the date employment began in Oklahoma.

Column D: Enter the date graduated. The date must be within one year of the date listed in Column C.

Column E: Enter the amount of tuition reimbursed during the tax year. Do not enter more than the average annual

amount paid for enrollment and instruction in a qualified program at a public institution in Oklahoma; the credit may

not exceed 50% of such amount. Tuition does not include the cost of books, fees or room and board.

Column F: The credit is 50% of the amount in Column E. No credit may be claimed after the fourth year of employment.

(continued on page 2)

1

1 2

2 3

3