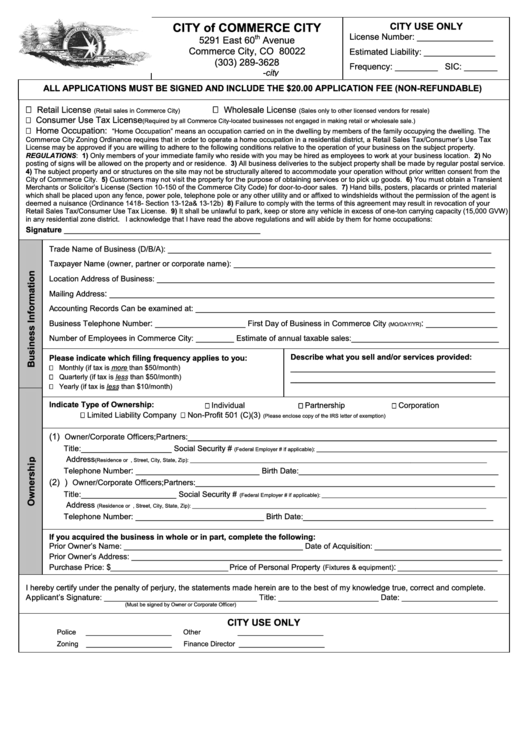

Retail Sales Tax/consumer'S Use Tax License - City Of Commerce City, Colorado

ADVERTISEMENT

CITY of COMMERCE CITY

CITY USE ONLY

License Number: ________________

th

5291 East 60

Avenue

Commerce City, CO 80022

Estimated Liability: _______________

(303) 289-3628

Frequency: _________ SIC: _______

ALL APPLICATIONS MUST BE SIGNED AND INCLUDE THE $20.00 APPLICATION FEE (NON-REFUNDABLE)

Retail License

Wholesale License

(Retail sales in Commerce City)

(Sales only to other licensed vendors for resale)

Consumer Use Tax License

(Required by all Commerce City-located businesses not engaged in making retail or wholesale sale.)

Home Occupation:

“Home Occupation” means an occupation carried on in the dwelling by members of the family occupying the dwelling. The

Commerce City Zoning Ordinance requires that in order to operate a home occupation in a residential district, a Retail Sales Tax/Consumer’s Use Tax

License may be approved if you are willing to adhere to the following conditions relative to the operation of your business on the subject property.

REGULATIONS: 1) Only members of your immediate family who reside with you may be hired as employees to work at your business location. 2) No

posting of signs will be allowed on the property and or residence. 3) All business deliveries to the subject property shall be made by regular postal service.

4) The subject property and or structures on the site may not be structurally altered to accommodate your operation without prior written consent from the

City of Commerce City. 5) Customers may not visit the property for the purpose of obtaining services or to pick up goods. 6) You must obtain a Transient

Merchants or Solicitor’s License (Section 10-150 of the Commerce City Code) for door-to-door sales. 7) Hand bills, posters, placards or printed material

which shall be placed upon any fence, power pole, telephone pole or any other utility and or affixed to windshields without the permission of the agent is

deemed a nuisance (Ordinance 1418- Section 13-12a& 13-12b) 8) Failure to comply with the terms of this agreement may result in revocation of your

Retail Sales Tax/Consumer Use Tax License. 9) It shall be unlawful to park, keep or store any vehicle in excess of one-ton carrying capacity (15,000 GVW)

in any residential zone district. I acknowledge that I have read the above regulations and will abide by them for home occupations:

Signature _____________________________________________

____________________________________________________________________

Trade Name of Business (D/B/A):

_______________________________________________________

Taxpayer Name (owner, partner or corporate name):

_______________________________________________________________________

Location Address of Business:

: _________________________________________________________________________________

Mailing Address

_______________________________________________________________

Accounting Records Can be examined at:

: ___________________

: _______________

Business Telephone Number

First Day of Business in Commerce City

(MO/DAY/YR)

________

_______________________________

Number of Employees in Commerce City:

Estimate of annual taxable sales:

Describe what you sell and/or services provided:

Please indicate which filing frequency applies to you:

_______________________________________

Monthly (if tax is more than $50/month)

_______________________________________

Quarterly (if tax is less than $50/month)

Yearly (if tax is less than $10/month)

Indicate Type of Ownership:

Individual

Partnership

Corporation

Limited Liability Company

Non-Profit 501 (C)(3)

(Please enclose copy of the IRS letter of exemption)

(1)

_________________________________________________________________

Owner/Corporate Officers;Partners:

___________________

Title:

Social Security #

(Federal Employer # if applicable): _________________________________________________________________

Address

(Residence or P.O. Box, Street, City, State, Zip): _____________________________________________________________________________________________________

: __________________________

__________________________________________

Telephone Number

Birth Date:

(2) )

_______________________________________________________________

Owner/Corporate Officers;Partners:

____________________

Title:

Social Security #

(Federal Employer # if applicable): _______________________________________________________________

Address

(Residence or P.O. Box, Street, City, State, Zip): ____________________________________________________________________________________________________

___________________________

________________________________________

Telephone Number:

Birth Date:

If you acquired the business in whole or in part, complete the following:

Prior Owner’s Name: _________________________________________ Date of Acquisition: _____________________________

Prior Owner’s Address: _____________________________________________________________________________________

: _____________________

Purchase Price: $___________________________ Price of Personal Property

(Fixtures & equipment)

I hereby certify under the penalty of perjury, the statements made herein are to the best of my knowledge true, correct and complete.

Applicant’s Signature: ___________________________________ Title: _______________________ Date: ______________________

(Must be signed by Owner or Corporate Officer)

CITY USE ONLY

Police

______________________

Other

______________________

Zoning

______________________

Finance Director ______________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1