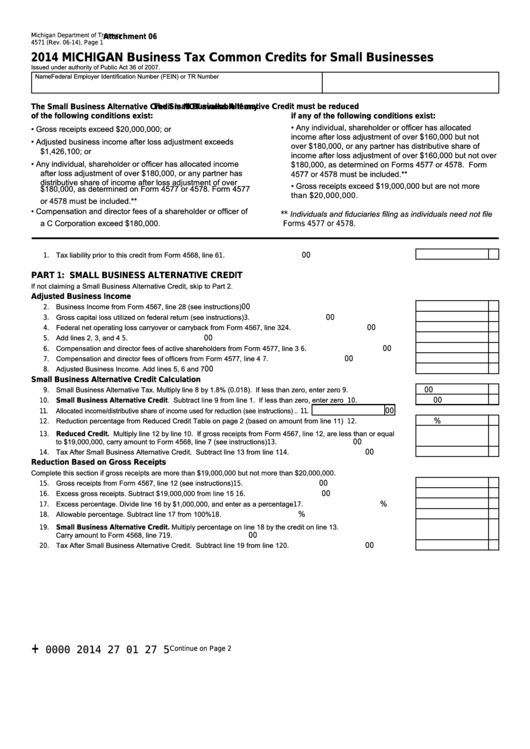

Form 4571 - Michigan Business Tax Common Credits For Small Businesses - 2014

ADVERTISEMENT

Michigan Department of Treasury

Attachment 06

4571 (Rev. 06-14), Page 1

2014 MICHIGAN Business Tax Common Credits for Small Businesses

Issued under authority of Public Act 36 of 2007.

Name

Federal Employer Identification Number (FEIN) or TR Number

The Small Business Alternative Credit is NOT available if any

The Small Business Alternative Credit must be reduced

of the following conditions exist:

if any of the following conditions exist:

• Any individual, shareholder or officer has allocated

• Gross receipts exceed $20,000,000; or

income after loss adjustment of over $160,000 but not

• Adjusted business income after loss adjustment exceeds

over $180,000, or any partner has distributive share of

$1,426,100; or

income after loss adjustment of over $160,000 but not over

• Any individual, shareholder or officer has allocated income

$180,000, as determined on Forms 4577 or 4578. Form

after loss adjustment of over $180,000, or any partner has

4577 or 4578 must be included.**

distributive share of income after loss adjustment of over

• Gross receipts exceed $19,000,000 but are not more

$180,000, as determined on Form 4577 or 4578. Form 4577

than $20,000,000.

or 4578 must be included.**

• Compensation and director fees of a shareholder or officer of

Individuals and fiduciaries filing as individuals need not file

**

a C Corporation exceed $180,000.

Forms 4577 or 4578.

1. Tax liability prior to this credit from Form 4568, line 6 ...........................................................................................

00

1.

PART 1: SMALL BUSINESS ALTERNATIVE CREDIT

If not claiming a Small Business Alternative Credit, skip to Part 2.

Adjusted Business Income

2. Business Income from Form 4567, line 28 (see instructions)................................................................................

00

2.

3. Gross capital loss utilized on federal return (see instructions) ..............................................................................

00

3.

4. Federal net operating loss carryover or carryback from Form 4567, line 32 .........................................................

00

4.

5. Add lines 2, 3, and 4 .............................................................................................................................................

00

5.

6. Compensation and director fees of active shareholders from Form 4577, line 3 .................................................

00

6.

7. Compensation and director fees of officers from Form 4577, line 4 .....................................................................

00

7.

8. Adjusted Business Income. Add lines 5, 6 and 7...................................................................................................

00

8.

Small Business Alternative Credit Calculation

9. Small Business Alternative Tax. Multiply line 8 by 1.8% (0.018). If less than zero, enter zero ............................

00

9.

10. Small Business Alternative Credit. Subtract line 9 from line 1. If less than zero, enter zero .........................

00

10.

11. Allocated income/distributive share of income used for reduction (see instructions) .. 11.

00

12. Reduction percentage from Reduced Credit Table on page 2 (based on amount from line 11) ..........................

%

12.

13. Reduced Credit. Multiply line 12 by line 10. If gross receipts from Form 4567, line 12, are less than or equal

to $19,000,000, carry amount to Form 4568, line 7 (see instructions) ..................................................................

00

13.

14. Tax After Small Business Alternative Credit. Subtract line 13 from line 1 .............................................................

00

14.

Reduction Based on Gross Receipts

Complete this section if gross receipts are more than $19,000,000 but not more than $20,000,000.

15. Gross receipts from Form 4567, line 12 (see instructions) ....................................................................................

00

15.

16. Excess gross receipts. Subtract $19,000,000 from line 15 ..................................................................................

00

16.

17. Excess percentage. Divide line 16 by $1,000,000, and enter as a percentage ....................................................

%

17.

18. Allowable percentage. Subtract line 17 from 100% ...............................................................................................

%

18.

19. Small Business Alternative Credit. Multiply percentage on line 18 by the credit on line 13.

Carry amount to Form 4568, line 7 ........................................................................................................................

00

19.

20. Tax After Small Business Alternative Credit. Subtract line 19 from line 1 .............................................................

00

20.

+

Continue on Page 2

0000 2014 27 01 27 5

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5