Form Sc Sch.tc-26 - Venture Capital Investment Credit

ADVERTISEMENT

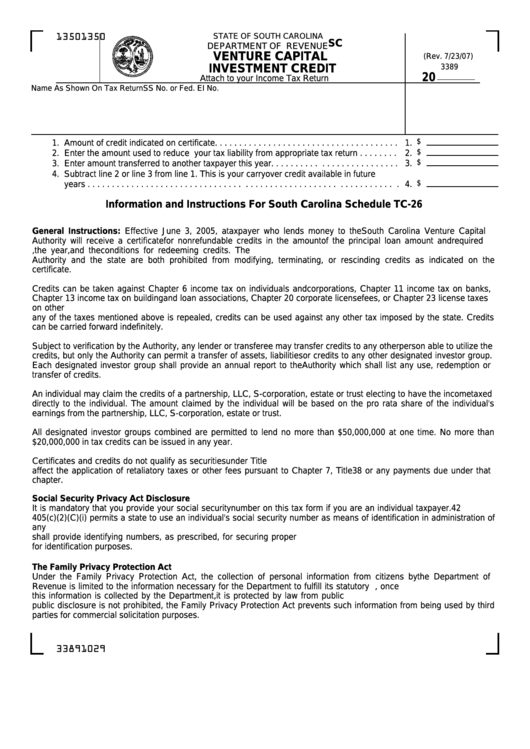

STATE OF SOUTH CAROLINA

1350

1350

SC SCH.TC-26

DEPARTMENT OF REVENUE

VENTURE CAPITAL

(Rev. 7/23/07)

INVESTMENT CREDIT

3389

20

Attach to your Income Tax Return

Name As Shown On Tax Return

SS No. or Fed. EI No.

$

1. Amount of credit indicated on certificate. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1.

$

2. Enter the amount used to reduce your tax liability from appropriate tax return . . . . . . . .

2.

$

3. Enter amount transferred to another taxpayer this year. . . . . . . . . . . . . . . . . . . . . . . . . .

3.

4. Subtract line 2 or line 3 from line 1. This is your carryover credit available in future

$

years . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4.

Information and Instructions For South Carolina Schedule TC-26

General Instructions: Effective June 3, 2005, a taxpayer who lends money to the South Carolina Venture Capital

Authority will receive a certificate for nonrefundable credits in the amount of the principal loan amount and required

interest. The certificate will state the amount of the loan, the year, and the conditions for redeeming credits. The

Authority and the state are both prohibited from modifying, terminating, or rescinding credits as indicated on the

certificate.

Credits can be taken against Chapter 6 income tax on individuals and corporations, Chapter 11 income tax on banks,

Chapter 13 income tax on building and loan associations, Chapter 20 corporate license fees, or Chapter 23 license taxes

on other businesses. Credits can also be taken against insurance premium tax or any other tax provided in Title 38. If

any of the taxes mentioned above is repealed, credits can be used against any other tax imposed by the state. Credits

can be carried forward indefinitely.

Subject to verification by the Authority, any lender or transferee may transfer credits to any other person able to utilize the

credits, but only the Authority can permit a transfer of assets, liabilities or credits to any other designated investor group.

Each designated investor group shall provide an annual report to the Authority which shall list any use, redemption or

transfer of credits.

An individual may claim the credits of a partnership, LLC, S-corporation, estate or trust electing to have the income taxed

directly to the individual. The amount claimed by the individual will be based on the pro rata share of the individual's

earnings from the partnership, LLC, S-corporation, estate or trust.

All designated investor groups combined are permitted to lend no more than $50,000,000 at one time. No more than

$20,000,000 in tax credits can be issued in any year.

Certificates and credits do not qualify as securities under Title 35. Use of tax credits by an insurance company does not

affect the application of retaliatory taxes or other fees pursuant to Chapter 7, Title 38 or any payments due under that

chapter.

Social Security Privacy Act Disclosure

It is mandatory that you provide your social security number on this tax form if you are an individual taxpayer. 42 U.S.C

405(c)(2)(C)(i) permits a state to use an individual's social security number as means of identification in administration of

any tax. SC Regulation 117-201 mandates that any person required to make a return to the SC Department of Revenue

shall provide identifying numbers, as prescribed, for securing proper identification. Your social security number is used

for identification purposes.

The Family Privacy Protection Act

Under the Family Privacy Protection Act, the collection of personal information from citizens by the Department of

Revenue is limited to the information necessary for the Department to fulfill its statutory duties. In most instances, once

this information is collected by the Department, it is protected by law from public disclosure. In those situations where

public disclosure is not prohibited, the Family Privacy Protection Act prevents such information from being used by third

parties for commercial solicitation purposes.

33891029

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1