Form Nyc-9.7b - Ubt Paid Credit Subchapter S Banking Corporations - 2017

ADVERTISEMENT

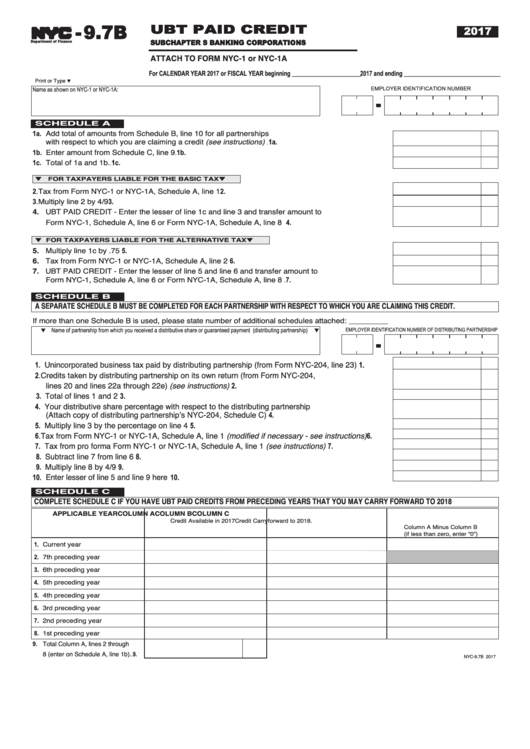

- 9.7B

U B T P A I D C R E D I T

2017

TM

S U B C H A P T E R S B A N K I N G C O R P O R A T I O N S

Department of Finance

ATTACH TO FORM NYC-1 or NYC-1A

For CALENDAR YEAR 2017 or FISCAL YEAR beginning ____________________ 2017 and ending ____________________________

Print or Type

t

Name as shown on NYC-1 or NYC-1A:

EMPLOYER IDENTIFICATION NUMBER

SCHEDULE A

1a. Add total of amounts from Schedule B, line 10 for all partnerships

with respect to which you are claiming a credit (see instructions)

1a.

....................................................................

1b. Enter amount from Schedule C, line 9

1b.

.................................................................................................................................

1c. Total of 1a and 1b.

1c.

............................................................................................................................................................................

FOR TAXPAYERS LIABLE FOR THE BASIC TAX t

t

2. Tax from Form NYC-1 or NYC-1A, Schedule A, line 1

2.

...............................................................................................

3. Multiply line 2 by 4/9

3.

.......................................................................................................................................................................

4. UBT PAID CREDIT - Enter the lesser of line 1c and line 3 and transfer amount to

Form NYC-1, Schedule A, line 6 or Form NYC-1A, Schedule A, line 8

4.

...........................................................

t FOR TAXPAYERS LIABLE FOR THE ALTERNATIVE TAX

t

5. Multiply line 1c by .75

5.

......................................................................................................................................................................

6. Tax from Form NYC-1 or NYC-1A, Schedule A, line 2

6.

...............................................................................................

7. UBT PAID CREDIT - Enter the lesser of line 5 and line 6 and transfer amount to

Form NYC-1, Schedule A, line 6 or Form NYC-1A, Schedule A, line 8

7.

...........................................................

SCHEDULE B

A SEPARATE SCHEDULE B MUST BE COMPLETED FOR EACH PARTNERSHIP WITH RESPECT TO WHICH YOU ARE CLAIMING THIS CREDIT.

If more than one Schedule B is used, please state number of additional schedules attached: _________

Name of partnership from which you received a distributive share or guaranteed payment (distributing partnership)

EMPLOYER IDENTIFICATION NUMBER OF DISTRIBUTING PARTNERSHIP

t

t

1. Unincorporated business tax paid by distributing partnership (from Form NYC-204, line 23)

1.

.............

2. Credits taken by distributing partnership on its own return (from Form NYC-204,

lines 20 and lines 22a through 22e) (see instructions)

2.

......................................................................................................

3. Total of lines 1 and 2

3.

...................................................................................................................................................................................

4. Your distributive share percentage with respect to the distributing partnership

(Attach copy of distributing partnership’s NYC-204, Schedule C)

4.

............................................................................

5. Multiply line 3 by the percentage on line 4

5.

..................................................................................................................................

6. Tax from Form NYC-1 or NYC-1A, Schedule A, line 1 (modified if necessary - see instructions)

6.

......

7. Tax from pro forma Form NYC-1 or NYC-1A, Schedule A, line 1 (see instructions)

7.

...................................

8. Subtract line 7 from line 6

8.

.......................................................................................................................................................................

9. Multiply line 8 by 4/9

9.

...................................................................................................................................................................................

10. Enter lesser of line 5 and line 9 here

10.

..............................................................................................................................................

SCHEDULE C

COMPLETE SCHEDULE C IF YOU HAVE UBT PAID CREDITS FROM PRECEDING YEARS THAT YOU MAY CARRY FORWARD TO 2018

APPLICABLE YEAR

COLUMN A

COLUMN B

COLUMN C

Credit Available in 2017

Credit Carryforward to 2018.

Column A Minus Column B

(if less than zero, enter “0”)

1. Current year

2. 7th preceding year

3. 6th preceding year

4. 5th preceding year

5. 4th preceding year

6. 3rd preceding year

7. 2nd preceding year

8. 1st preceding year

9. Total Column A, lines 2 through

8 (enter on Schedule A, line 1b) ..9.

NYC-9.7B 2017

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2