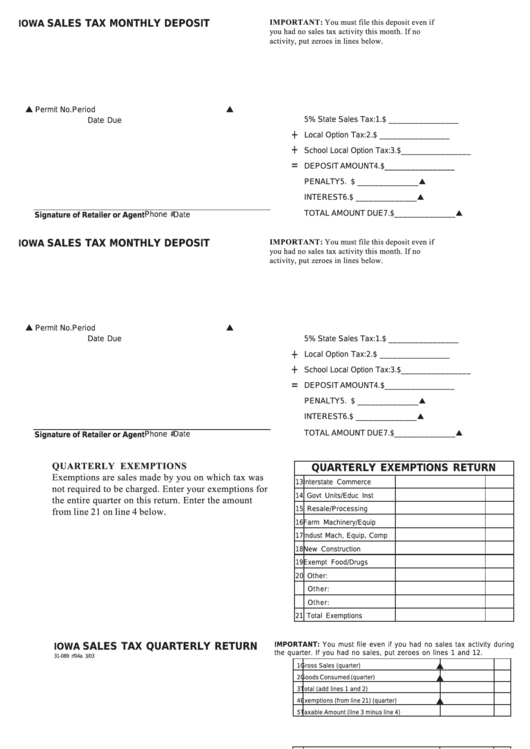

Form 31-089 - Iowa Sales Tax Monthly Deposit, Iowa Regular Local Option Tax And School Local Option Tax

ADVERTISEMENT

IMPORTANT: You must file this deposit even if

SALES TAX MONTHLY DEPOSIT

IOWA

you had no sales tax activity this month. If no

activity, put zeroes in lines below.

Permit No.

Period

5% State Sales Tax:

1. $ ________________

Date Due

+

Local Option Tax:

2. $ ________________

+

School Local Option Tax:

3. $ ________________

=

DEPOSIT AMOUNT

4. $ ________________

PENALTY

5. $ ______________

INTEREST

6. $ ______________

TOTAL AMOUNT DUE

7. $ ______________

Date

Phone #

Signature of Retailer or Agent

IMPORTANT: You must file this deposit even if

SALES TAX MONTHLY DEPOSIT

IOWA

you had no sales tax activity this month. If no

activity, put zeroes in lines below.

Permit No.

Period

Date Due

5% State Sales Tax:

1. $ ________________

+

Local Option Tax:

2. $ ________________

+

School Local Option Tax:

3. $ ________________

=

DEPOSIT AMOUNT

4. $ ________________

PENALTY

5. $ ______________

INTEREST

6. $ ______________

TOTAL AMOUNT DUE

7. $ ______________

Date

Phone #

Signature of Retailer or Agent

QUARTERLY EXEMPTIONS

QUARTERLY EXEMPTIONS RETURN

Exemptions are sales made by you on which tax was

13 Interstate Commerce

not required to be charged. Enter your exemptions for

14 Govt Units/Educ Inst

the entire quarter on this return. Enter the amount

from line 21 on line 4 below.

15 Resale/Processing

16 Farm Machinery/Equip

17 Indust Mach, Equip, Comp

18 New Construction

19 Exempt Food/Drugs

20 Other:

Other:

Other:

21 Total Exemptions

IMPORTANT: You must file even if you had no sales tax activity during

SALES TAX QUARTERLY RETURN

IOWA

the quarter. If you had no sales, put zeroes on lines 1 and 12.

31-089 rf04a 3/03

1 Gross Sales (quarter)

2 Goods Consumed (quarter)

3 Total (add lines 1 and 2)

4 Exemptions (from line 21) (quarter)

5 Taxable Amount (line 3 minus line 4)

Permit No.

Period

6a State Sales Tax (5% of line 5) (quarter)

Date Due

6b Total Local Option Sales Tax (quarter)

6c Total School Local Option Tax (quarter)

7 Total Tax (add lines 6a, 6b, and 6c)

8 Deposits and Overpayment Credits

9 Balance (line 7 minus line 8)

10 Penalty (if applicable)

Title

Signature of Retailer or Agent

Date

11 Interest (if applicable, see instructions)

Daytime Phone No.: ________________

12 Total Amount Due (add lines 9-11)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3