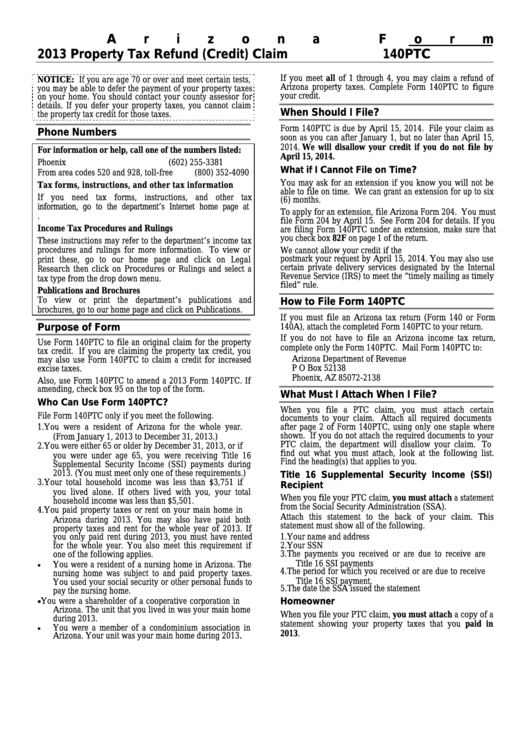

Instructions For Form 140ptc - Property Tax Refund (Credit) Claim - 2013

ADVERTISEMENT

Arizona Form

2013 Property Tax Refund (Credit) Claim

140PTC

If you meet all of 1 through 4, you may claim a refund of

NOTICE: If you are age 70 or over and meet certain tests,

Arizona property taxes. Complete Form 140PTC to figure

you may be able to defer the payment of your property taxes

your credit.

on your home. You should contact your county assessor for

details. If you defer your property taxes, you cannot claim

When Should I File?

the property tax credit for those taxes.

Form 140PTC is due by April 15, 2014. File your claim as

Phone Numbers

soon as you can after January 1, but no later than April 15,

2014. We will disallow your credit if you do not file by

For information or help, call one of the numbers listed:

April 15, 2014.

Phoenix

(602) 255-3381

What if I Cannot File on Time?

From area codes 520 and 928, toll-free

(800) 352-4090

You may ask for an extension if you know you will not be

Tax forms, instructions, and other tax information

able to file on time. We can grant an extension for up to six

If you need tax forms, instructions, and other tax

(6) months.

information, go to the department’s Internet home page at

To apply for an extension, file Arizona Form 204. You must

file Form 204 by April 15. See Form 204 for details. If you

Income Tax Procedures and Rulings

are filing Form 140PTC under an extension, make sure that

you check box 82F on page 1 of the return.

These instructions may refer to the department’s income tax

procedures and rulings for more information. To view or

We cannot allow your credit if the U.S. Post Office does not

postmark your request by April 15, 2014. You may also use

print these, go to our home page and click on Legal

certain private delivery services designated by the Internal

Research then click on Procedures or Rulings and select a

Revenue Service (IRS) to meet the “timely mailing as timely

tax type from the drop down menu.

filed” rule.

Publications and Brochures

To view or print the department’s publications and

How to File Form 140PTC

brochures, go to our home page and click on Publications.

If you must file an Arizona tax return (Form 140 or Form

Purpose of Form

140A), attach the completed Form 140PTC to your return.

If you do not have to file an Arizona income tax return,

Use Form 140PTC to file an original claim for the property

complete only the Form 140PTC. Mail Form 140PTC to:

tax credit. If you are claiming the property tax credit, you

Arizona Department of Revenue

may also use Form 140PTC to claim a credit for increased

P O Box 52138

excise taxes.

Phoenix, AZ 85072-2138

Also, use Form 140PTC to amend a 2013 Form 140PTC. If

amending, check box 95 on the top of the form.

What Must I Attach When I File?

Who Can Use Form 140PTC?

When you file a PTC claim, you must attach certain

File Form 140PTC only if you meet the following.

documents to your claim. Attach all required documents

after page 2 of Form 140PTC, using only one staple where

1. You were a resident of Arizona for the whole year.

shown. If you do not attach the required documents to your

(From January 1, 2013 to December 31, 2013.)

PTC claim, the department will disallow your claim. To

2. You were either 65 or older by December 31, 2013, or if

find out what you must attach, look at the following list.

you were under age 65, you were receiving Title 16

Find the heading(s) that applies to you.

Supplemental Security Income (SSI) payments during

2013. (You must meet only one of these requirements.)

Title 16 Supplemental Security Income (SSI)

3. Your total household income was less than $3,751 if

Recipient

you lived alone. If others lived with you, your total

When you file your PTC claim, you must attach a statement

household income was less than $5,501.

from the Social Security Administration (SSA).

4. You paid property taxes or rent on your main home in

Attach this statement to the back of your claim. This

Arizona during 2013. You may also have paid both

statement must show all of the following.

property taxes and rent for the whole year of 2013. If

you only paid rent during 2013, you must have rented

1. Your name and address

for the whole year. You also meet this requirement if

2. Your SSN

one of the following applies.

3. The payments you received or are due to receive are

Title 16 SSI payments

You were a resident of a nursing home in Arizona. The

4. The period for which you received or are due to receive

nursing home was subject to and paid property taxes.

Title 16 SSI payment.

You used your social security or other personal funds to

5. The date the SSA issued the statement

pay the nursing home.

Homeowner

You were a shareholder of a cooperative corporation in

Arizona. The unit that you lived in was your main home

When you file your PTC claim, you must attach a copy of a

during 2013.

statement showing your property taxes that you paid in

You were a member of a condominium association in

2013.

.

Arizona. Your unit was your main home during 2013

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6