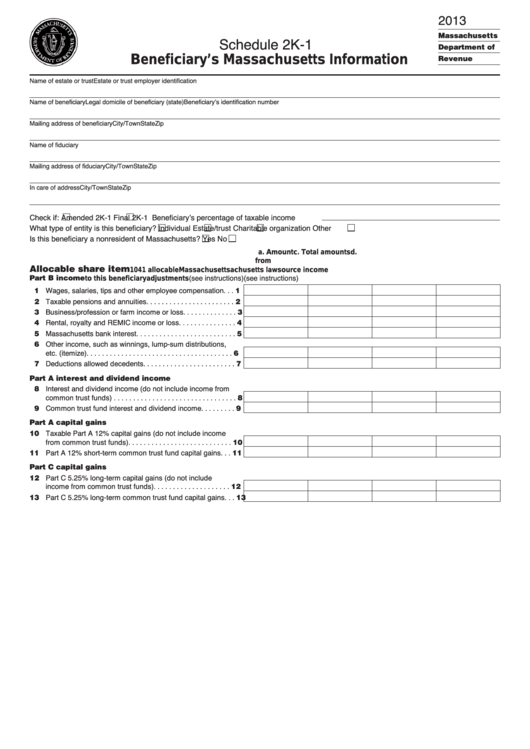

Schedule 2k-1 - Beneficiary'S Massachusetts Information - 2013

ADVERTISEMENT

2013

Schedule 2K-1

Massachusetts

Department of

Beneficiary’s Massachusetts Information

Revenue

Name of estate or trust

Estate or trust employer identification

Name of beneficiary

Legal domicile of beneficiary (state)

Beneficiary’s identification number

Mailing address of beneficiary

City/Town

State

Zip

Name of fiduciary

Mailing address of fiduciary

City/Town

State

Zip

In care of address

City/Town

State

Zip

Check if:

Amended 2K-1

Final 2K-1 Beneficiary’s percentage of taxable income

What type of entity is this beneficiary?

Individual

Estate/trust

Charitable organization

Other

Is this beneficiary a nonresident of Massachusetts?

Yes

No

a. Amount

c. Total amounts

d.

from federal

b.

using Mass-

Massachusetts

(see instructions)

(see instructions)

llocable share item

1041 allocable

Massachusetts

achusetts law

source income

Part B income

to this beneficiary

adjustments

11 Wages, salaries, tips and other employee compensation . . . 1

12 Taxable pensions and annuities . . . . . . . . . . . . . . . . . . . . . . . 2

13 Business/profession or farm income or loss. . . . . . . . . . . . . . 3

14 Rental, royalty and REMIC income or loss . . . . . . . . . . . . . . . 4

15 Massachusetts bank interest. . . . . . . . . . . . . . . . . . . . . . . . . . 5

16 Other income, such as winnings, lump-sum distributions,

etc. (itemize) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

17 Deductions allowed decedents . . . . . . . . . . . . . . . . . . . . . . . . 7

18 Interest and dividend income (do not include income from

Part

interest and dividend income

common trust funds) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

19 Common trust fund interest and dividend income . . . . . . . . . 9

10 Taxable Part A 12% capital gains (do not include income

Part

capital gains

from common trust funds). . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11 Part A 12% short-term common trust fund capital gains . . . 11

12 Part C 5.25% long-term capital gains (do not include

Part C capital gains

income from common trust funds) . . . . . . . . . . . . . . . . . . . . 12

13 Part C 5.25% long-term common trust fund capital gains. . . 13

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2