Your 2013 annual return is due March 17, 2014.

File electronically in e-Services starting January 21, 2014.

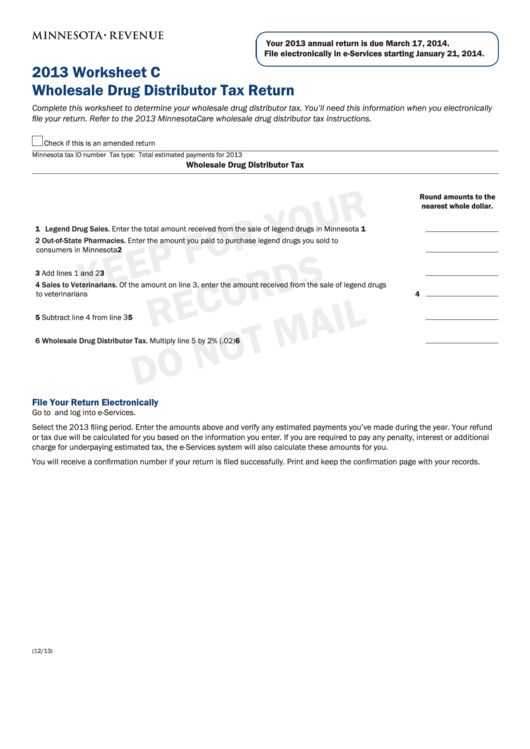

2013 Worksheet C

Wholesale Drug Distributor Tax Return

Complete this worksheet to determine your wholesale drug distributor tax. You’ll need this information when you electronically

file your return. Refer to the 2013 MinnesotaCare wholesale drug distributor tax instructions.

Check if this is an amended return

Minnesota tax ID number

Tax type:

Total estimated payments for 2013

Wholesale Drug Distributor Tax

Round amounts to the

nearest whole dollar.

1 Legend Drug Sales. Enter the total amount received from the sale of legend drugs in Minnesota . . . . . . . . . . . . . . 1

2 Out-of-State Pharmacies. Enter the amount you paid to purchase legend drugs you sold to

consumers in Minnesota . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Add lines 1 and 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Sales to Veterinarians. Of the amount on line 3, enter the amount received from the sale of legend drugs

to veterinarians . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5 Subtract line 4 from line 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6 Wholesale Drug Distributor Tax. Multiply line 5 by 2% ( .02) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

File Your Return Electronically

Go to and log into e-Services .

Select the 2013 filing period. Enter the amounts above and verify any estimated payments you’ve made during the year. Your refund

or tax due will be calculated for you based on the information you enter . If you are required to pay any penalty, interest or additional

charge for underpaying estimated tax, the e-Services system will also calculate these amounts for you .

You will receive a confirmation number if your return is filed successfully. Print and keep the confirmation page with your records.

(12/13)

1

1