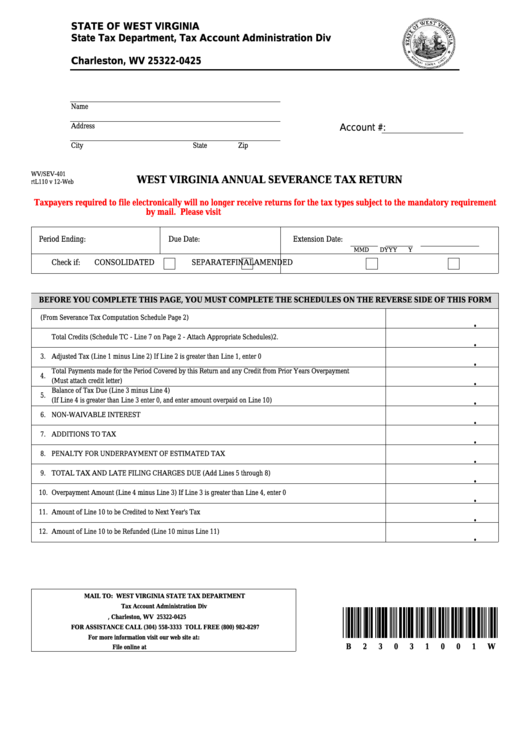

STATE OF WEST VIRGINIA

State Tax Department, Tax Account Administration Div

P.O. Box 425

Charleston, WV 25322-0425

Name

Address

Account #:

City

State

Zip

WV/SEV-401

WEST VIRGINIA ANNUAL SEVERANCE TAX RETURN

rtL110 v 12-Web

Taxpayers required to file electronically will no longer receive returns for the tax types subject to the mandatory requirement

by mail. Please visit for additional information.

Period Ending:

Due Date:

Extension Date:

M

M

D

D

Y

Y

Y

Y

Check if:

CONSOLIDATED

SEPARATE

FINAL

AMENDED

BEFORE YOU COMPLETE THIS PAGE, YOU MUST COMPLETE THE SCHEDULES ON THE REVERSE SIDE OF THIS FORM

1. Total Tax (From Severance Tax Computation Schedule Page 2)

.

2.

Total Credits (Schedule TC - Line 7 on Page 2 - Attach Appropriate Schedules)

.

3.

Adjusted Tax (Line 1 minus Line 2) If Line 2 is greater than Line 1, enter 0

.

Total Payments made for the Period Covered by this Return and any Credit from Prior Years Overpayment

4.

.

(Must attach credit letter)

Balance of Tax Due (Line 3 minus Line 4)

5.

.

(If Line 4 is greater than Line 3 enter 0, and enter amount overpaid on Line 10)

6.

NON-WAIVABLE INTEREST

.

7.

ADDITIONS TO TAX

.

8.

PENALTY FOR UNDERPAYMENT OF ESTIMATED TAX

.

9.

TOTAL TAX AND LATE FILING CHARGES DUE (Add Lines 5 through 8)

.

10.

Overpayment Amount (Line 4 minus Line 3) If Line 3 is greater than Line 4, enter 0

.

11.

Amount of Line 10 to be Credited to Next Year's Tax

.

12.

Amount of Line 10 to be Refunded (Line 10 minus Line 11)

.

MAIL TO: WEST VIRGINIA STATE TAX DEPARTMENT

Tax Account Administration Div

P.O. Box 425, Charleston, WV 25322-0425

FOR ASSISTANCE CALL (304) 558-3333 TOLL FREE (800) 982-8297

For more information visit our web site at:

B

2

3

0

3

1

0

0

1

W

File online at https://mytaxes.wvtax.gov

1

1 2

2