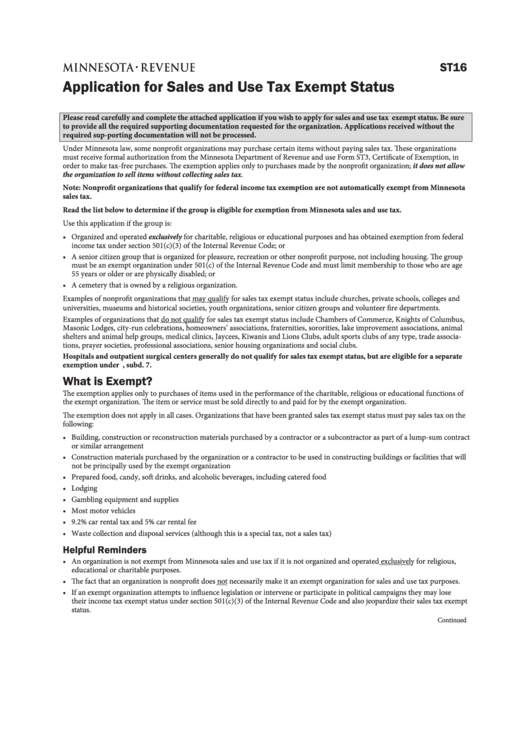

ST16

Application for Sales and Use Tax Exempt Status

Please read carefully and complete the attached application if you wish to apply for sales and use tax exempt status. Be sure

to provide all the required supporting documentation requested for the organization. Applications received without the

required sup-porting documentation will not be processed.

Under Minnesota law, some nonprofit organizations may purchase certain items without paying sales tax. These organizations

must receive formal authorization from the Minnesota Department of Revenue and use Form ST3, Certificate of Exemption, in

order to make tax-free purchases. The exemption applies only to purchases made by the nonprofit organization; it does not allow

the organization to sell items without collecting sales tax.

Note: Nonprofit organizations that qualify for federal income tax exemption are not automatically exempt from Minnesota

sales tax.

Read the list below to determine if the group is eligible for exemption from Minnesota sales and use tax.

Use this application if the group is:

• Organized and operated exclusively for charitable, religious or educational purposes and has obtained exemption from federal

income tax under section 501(c)(3) of the Internal Revenue Code; or

• A senior citizen group that is organized for pleasure, recreation or other nonprofit purpose, not including housing. The group

must be an exempt organization under 501(c) of the Internal Revenue Code and must limit membership to those who are age

55 years or older or are physically disabled; or

• A cemetery that is owned by a religious organization.

Examples of nonprofit organizations that may qualify for sales tax exempt status include churches, private schools, colleges and

universities, museums and historical societies, youth organizations, senior citizen groups and volunteer fire departments.

Examples of organizations that do not qualify for sales tax exempt status include Chambers of Commerce, Knights of Columbus,

Masonic Lodges, city-run celebrations, homeowners’ associations, fraternities, sororities, lake improvement associations, animal

shelters and animal help groups, medical clinics, Jaycees, Kiwanis and Lions Clubs, adult sports clubs of any type, trade associa-

tions, prayer societies, professional associations, senior housing organizations and social clubs.

Hospitals and outpatient surgical centers generally do not qualify for sales tax exempt status, but are eligible for a separate

exemption under M.S. 297A.70, subd. 7.

What is Exempt?

The exemption applies only to purchases of items used in the performance of the charitable, religious or educational functions of

the exempt organization. The item or service must be sold directly to and paid for by the exempt organization.

The exemption does not apply in all cases. Organizations that have been granted sales tax exempt status must pay sales tax on the

following:

• Building, construction or reconstruction materials purchased by a contractor or a subcontractor as part of a lump-sum contract

or similar arrangement

• Construction materials purchased by the organization or a contractor to be used in constructing buildings or facilities that will

not be principally used by the exempt organization

• Prepared food, candy, soft drinks, and alcoholic beverages, including catered food

• Lodging

• Gambling equipment and supplies

• Most motor vehicles

• 9.2% car rental tax and 5% car rental fee

• Waste collection and disposal services (although this is a special tax, not a sales tax)

Helpful Reminders

• An organization is not exempt from Minnesota sales and use tax if it is not organized and operated exclusively for religious,

educational or charitable purposes.

• The fact that an organization is nonprofit does not necessarily make it an exempt organization for sales and use tax purposes.

• If an exempt organization attempts to influence legislation or intervene or participate in political campaigns they may lose

their income tax exempt status under section 501(c)(3) of the Internal Revenue Code and also jeopardize their sales tax exempt

status.

Continued

1

1 2

2 3

3 4

4 5

5