Form 04-544 - Claim For Refund Motor Fuel Tax - Alaska Department Of Revenue

ADVERTISEMENT

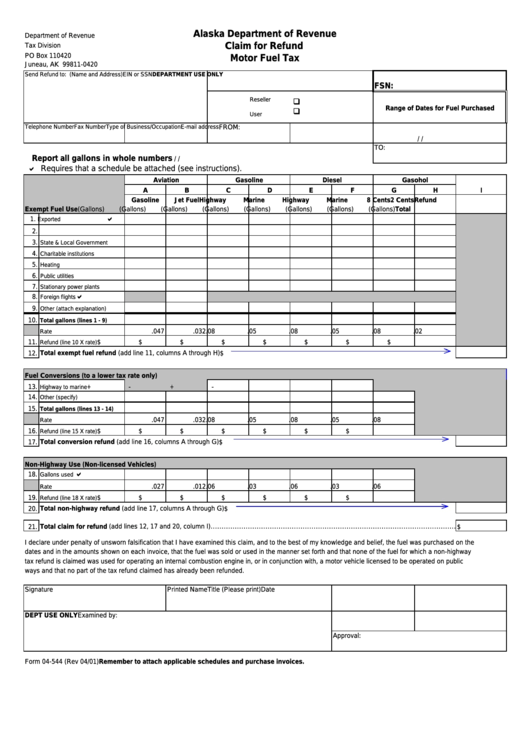

Alaska Department of Revenue

Department of Revenue

Claim for Refund

Tax Division

PO Box 110420

Motor Fuel Tax

Juneau, AK 99811-0420

Send Refund to: (Name and Address)

EIN or SSN

DEPARTMENT USE ONLY

FSN:

Reseller

q

Range of Dates for Fuel Purchased

q

User

Telephone Number

Fax Number

Type of Business/Occupation

E-mail address

FROM:

/

/

TO:

Report all gallons in whole numbers

/

/

a Requires that a schedule be attached (see instructions).

Aviation

Gasoline

Diesel

Gasohol

A

B

C

D

E

F

G

H

I

Gasoline

Jet Fuel

Highway

Marine

Highway

Marine

8 Cents

2 Cents

Refund

Exempt Fuel Use

(Gallons)

(Gallons)

(Gallons)

(Gallons)

(Gallons)

(Gallons)

(Gallons)

(Gallons)

Total

a

1.

Exported

2.

U.S. Government

3.

State & Local Government

4.

Charitable institutions

5.

Heating

6.

Public utilities

7.

Stationary power plants

a

8.

Foreign flights

9.

Other (attach explanation)

10.

Total gallons (lines 1 - 9)

.047

.032

.08

.05

.08

.05

.08

.02

Rate

11.

$

$

$

$

$

$

$

$

Refund (line 10 X rate)

12. Total exempt fuel refund (add line 11, columns A through H)

$

Fuel Conversions (to a lower tax rate only)

13.

+

-

+

-

Highway to marine

14.

Other (specify)

15.

Total gallons (lines 13 - 14)

.047

.032

.08

.05

.08

.05

.08

Rate

16.

$

$

$

$

$

$

$

Refund (line 15 X rate)

17. Total conversion refund (add line 16, columns A through G)

$

Non-Highway Use (Non-licensed Vehicles)

a

18.

Gallons used

.027

.012

.06

.03

.06

.03

.06

Rate

19.

$

$

$

$

$

$

$

Refund (line 18 X rate)

20. Total non-highway refund (add line 17, columns A through G)

$

21. Total claim for refund (add lines 12, 17 and 20, column I)……………………………………………………………………………………………………………..

$

I declare under penalty of unsworn falsification that I have examined this claim, and to the best of my knowledge and belief, the fuel was purchased on the

dates and in the amounts shown on each invoice, that the fuel was sold or used in the manner set forth and that none of the fuel for which a non-highway

tax refund is claimed was used for operating an internal combustion engine in, or in conjunction with, a motor vehicle licensed to be operated on public

ways and that no part of the tax refund claimed has already been refunded.

Signature

Printed Name

Title (Please print)

Date

Examined by:

DEPT USE ONLY

Approval:

Form 04-544 (Rev 04/01)

Remember to attach applicable schedules and purchase invoices.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4